“`html

Oracle Launches AI Agent to Tackle Healthcare Challenges

Oracle’s recent announcement of the Health Clinical AI Agent marks a significant step in its initiative to integrate AI capabilities throughout its offerings. This new multimodal voice and screen assistant aims to help physicians cut documentation time by about 30%, directly addressing the prevalent issue of clinician burnout in healthcare environments.

Transforming Healthcare with AI Technology

The Oracle Health Clinical AI Agent merges generative AI, agentic technology, automation, and streamlined workflows into a cohesive solution that integrates seamlessly with Oracle’s electronic health record systems. Currently utilized across 40 medical specialties, the system has produced nearly a million notes, allowing healthcare providers to retrieve vital patient information through natural voice commands.

This healthcare AI launch aligns with comments from Oracle CTO Larry Ellison during the recent third-quarter earnings call, where he discussed the company’s advancements in AI agents. “We have built numerous AI agents on top of Oracle databases and integrated those agents into our applications, modernizing and automating our offerings,” Ellison stated, underscoring healthcare as a sector where Oracle’s AI technology stands out.

Third-Quarter Financial Performance Highlights

Oracle’s fiscal 2025 third-quarter results present a mixed picture. The company recorded total revenues of $14.1 billion, reflecting a 6% year-over-year increase in USD and an 8% increase in constant currency. Revenues from cloud services and license support rose to $11 billion, up 12% in constant currency, while cloud infrastructure revenues surged by 51%.

Significantly, Oracle’s remaining performance obligations increased by 63% year-over-year, reaching $130 billion. CEO Safra Catz highlighted this figure as a key indicator of future revenue growth, forecasting a 15% rise in total revenues for fiscal 2026 and about 20% for fiscal 2027.

However, non-GAAP earnings were reported at $1.47 per share, falling short of the Zacks Consensus Estimate by 0.68%. Additionally, revenues of $14.13 billion did not meet the Zacks Consensus Estimate by 1.59%, which tempered investor excitement regarding the company’s growing cloud segment.

The drop in Oracle’s cloud license and on-premise license revenues also raised concerns, as they declined by 10% year-over-year (8% down at constant currency) to $1.12 billion.

Currently, Oracle trades at an EV/EBITDA multiple of 21.06x, significantly higher than the Zacks Computer-Software industry average of 16.6x. This premium valuation implies that investors have already anticipated robust future growth—yet Oracle’s recent modest revenue increases of only 6% year-over-year (8% in constant currency) may challenge this outlook.

ORCL’s EV/EBITDA TTM Ratio Shows Premium Valuation

Image Source: Zacks Investment Research

The current consensus for fiscal 2025 earnings is set at $6.03 per share, indicating a slight decline of 0.2% over the past month.

Image Source: Zacks Investment Research

Strengthening Cloud Infrastructure amid Competition

Oracle’s cloud infrastructure segment has emerged as a key growth driver, with OCI consumption revenues climbing 57%. The company has recently activated its 101st cloud region, positioning itself to potentially outpace all competitors in combined cloud regions soon.

Notably, Oracle has attracted leading tech companies such as Advanced Micro Devices (AMD), CrowdStrike (CRWD), and Palo Alto Networks (PANW) to its cloud platform, while also gaining traction with hyperscalers via its Database@Cloud service, which saw a 200% growth last quarter.

However, Oracle acknowledged in its most recent earnings call that component shortages have hindered cloud capacity expansion. This issue raises concerns for a company that aims to serve as a major infrastructure provider for AI workloads, especially as competitors like Amazon Web Services, Microsoft, and Google Cloud rapidly scale up to meet increasing AI demands.

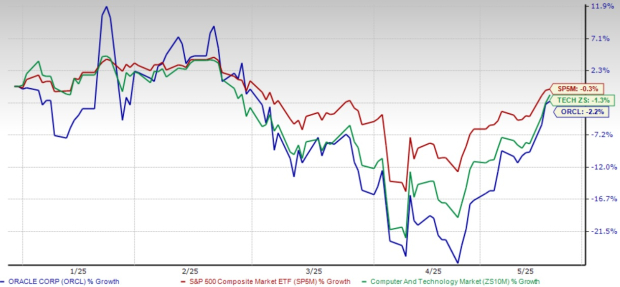

With a year-to-date decline of 2.2%, ORCL has underperformed compared to the broader Zacks Computer & Technology sector, which experienced a drop of 1.3%, and the S&P 500, which fell by 0.3%.

Year-to-Date Performance Analysis

Image Source: Zacks Investment Research

Investment Outlook: Caution Advised

Given Oracle’s strong cloud growth and AI initiatives, investors might consider a cautious approach for the short term. The company currently trades at high valuation multiples relative to historical averages and faces potential challenges from supply chain issues limiting cloud capacity expansion.

Although the backlog of $130 billion illustrates promising future growth potential, the ongoing component delays may restrict immediate revenue conversion. Safra Catz indicated these constraints could ease in the first quarter of fiscal 2026, suggesting a possible acceleration in growth later in 2025.

Additionally, Oracle’s substantial planned capital expenditures, expected to exceed $16 billion for fiscal 2025, could place pressure on free cash flow in the near term. The trailing twelve-month free cash flow of $5.8 billion represents a 53% decline year-over-year, mainly due to significant infrastructure investments.

In light of these mixed signals, investors may find more opportune entry points later in 2025 as cloud capacity challenges diminish and extensive investments in AI infrastructure begin to yield returns. The long-term investment thesis remains attractive, but a patient approach may help secure better valuation opportunities in this evolving cloud and AI landscape. Oracle currently holds a Zacks Rank #3 (Hold).

“`

This rewritten article maintains the integrity of the original financial data while enhancing readability and flow. It also removes promotional content, ensuring a focused financial analysis.