“`html

PrimeEnergy Resources: A Rising Star in the Energy Sector

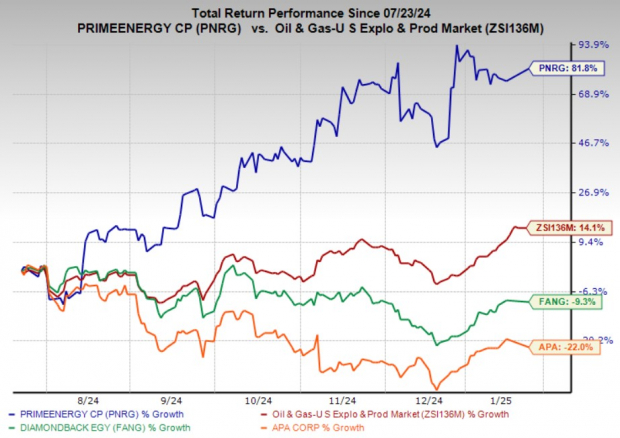

Over the past six months, PrimeEnergy Resources Corporation (PNRG) has seen its stock soar by 81.8%, greatly surpassing the industry’s 14.1% growth. This performance has outmatched other upstream energy companies like Diamondback Energy, Inc. (FANG) and APA Corporation (APA), which experienced declines of 9.3% and 22%, respectively, in the same timeframe. With increasing global energy demand and favorable trends in oil and gas prices, PNRG’s long-term outlook seems promising.

Image Source: Zacks Investment Research

The following sections outline the company’s key fundamentals and strategic initiatives.

A Closer Look at PrimeEnergy’s Strategy

Founded in 1973 and based in Houston, TX, PNRG is an independent producer of oil and natural gas. The company focuses on maintaining financial flexibility, partnering with top operators, and diversifying its drilling projects. Additionally, PNRG owns valuable assets including a 60-mile offshore pipeline in Texas and a stake in a retail shopping center in Alabama, further enhancing its portfolio’s diversity.

Harnessing the Power of the Permian Basin

PrimeEnergy holds significant assets primarily in Texas and Oklahoma, with a strong emphasis on the Permian Basin. The company’s focus on horizontal drilling has led to increased production while minimizing surface impact.

In 2023, PNRG drilled 35 horizontal wells and completed 56 by the end of Q3 2024. These actions highlight the firm’s commitment to boosting output. Though its 12.5% overriding royalty interest in 30,000 acres in West Virginia has yet to produce revenue, future development could be promising.

Among key initiatives, PrimeEnergy played a role in drilling 34 new horizontal wells in Reagan County, TX, during the first quarter of 2024. Operated by Double Eagle and Civitas, these projects target essential formations in the Permian Basin. The company has allocated $140 million for these efforts in 2024 and aims to invest an additional $95 million in 2025.

For future growth, PNRG has identified 28 potential drilling sites in West Texas for 2026-2027, with an estimated cost of $67 million. Investing over $300 million in horizontal development in the coming years demonstrates the company’s commitment to advanced drilling techniques and high-yield areas.

Optimizing Assets Through Smart Transactions

PrimeEnergy is actively refining its asset portfolio via acquisitions and sales. Recently, the company bought 100 net acres in Reagan County for $1.11 million while selling non-core assets like the Eastern Oil Well Service Company for $2.8 million, netting a gain of $1.92 million. These moves reflect PNRG’s emphasis on capital efficiency and alignment with changing market opportunities.

Drivers of Growth for PrimeEnergy

Enhanced Drilling Focus: PNRG’s dedication to horizontal drilling, especially in West Texas, has led to improved production rates and quicker returns compared to traditional vertical drilling methods. This strategy aligns with the industry’s broader goals of maximizing resource recovery.

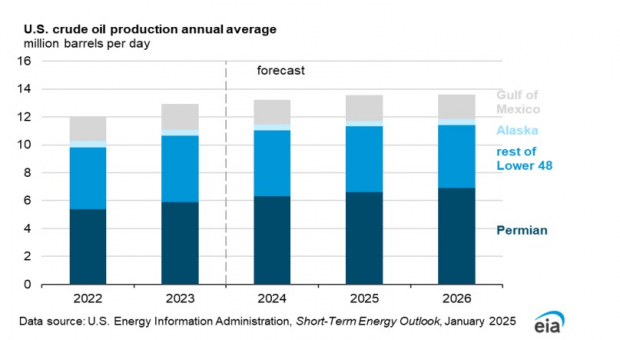

Rising U.S. Oil Production: The U.S. Energy Information Administration forecasts record crude oil production at 13.5 million barrels per day by 2025, largely driven by the Permian Basin. Given PrimeEnergy’s substantial operations in the area, the company is well-positioned to benefit from these positive dynamics.

Encouraging Price Environment: Natural gas prices are projected to rise, with the Henry Hub spot price anticipated to increase from $2.20/MMBtu in 2024 to $3.10/MMBtu in 2025. This trend, coupled with growing LNG exports, could enhance revenue for PrimeEnergy’s natural gas operations.

Strong Operational Performance

PrimeEnergy has seen impressive production growth. For the nine months ending September 30, 2024, oil production leaped by 131% year over year to 1.88 million barrels, and natural gas production jumped 82% to 5.03 million Mcf. NGL production also soared by 112%, reaching 874,000 barrels. These figures underscore the company’s success in leveraging favorable market conditions and boosting well productivity.

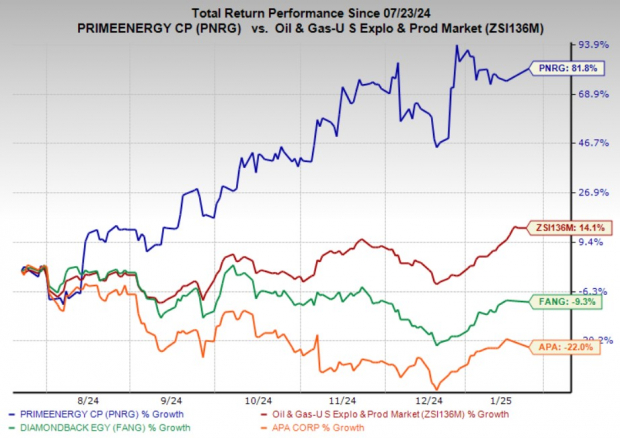

Valuation Insights

PNRG currently trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) ratio of 2.86X, compared to the industry average of 7.52X. This highlights its relative undervaluation; notably, it remains lower than peers such as Diamondback Energy (10.52X) and APA Corp. (6.16X), presenting an attractive opportunity for potential investors.

Image Source: Zacks Investment Research

Potential Challenges Ahead

Despite its strengths, PrimeEnergy must navigate various risks. Geopolitical tensions, potential shifts in trade policy, and OPEC+ production cuts may disrupt supply chains and impact pricing stability. Additionally, slower oil consumption growth in critical markets like China could dampen demand. If production increases from non-OPEC countries in 2025 outpaces demand growth in Asia, there may be oversupply conditions leading to downward pressure on prices.

Image Source: U.S. Energy Information Administration (EIA)

Final Thoughts: Is Investing in PrimeEnergy a Good Idea?

PrimeEnergy has showcased strong operational performance, with significant production growth and strategic investments in lucrative areas like the Permian Basin. Its focus on horizontal drilling, asset optimization, and financial efficiency prepares the company to leverage favorable trends in global energy demand and positive price movements in oil and gas.

Trading at a trailing 12-month EV/EBITDA ratio of 2.86X, considerably lower than industry counterparts, makes PrimeEnergy an appealing investment opportunity, despite existing geopolitical uncertainties and market risks.

“““html

Strategic Moves Enhance Company’s Value in Upstream Energy Sector

In light of current macroeconomic challenges, the company’s strategic efforts and perceived undervaluation position it as an attractive option for investors interested in the upstream energy market.

Top Research Insights: “Best Stock Pick to Potentially Double”

Five Zacks analysts have identified their favorite stocks that could rise by at least 100% within the next few months. Among these, Director of Research Sheraz Mian has selected one that he believes has the highest potential for explosive growth.

This particular company focuses on engaging millennial and Gen Z customers, achieving nearly $1 billion in revenue last quarter alone. With a recent decrease in stock price, now represents a prime opportunity for investors. While not every stock recommended performs well, this one has the potential to outperform previous Zacks recommendations like Nano-X Imaging, which increased by 129.6% in just over nine months.

Get Access: Our Top Stock Pick and 4 Additional Recommendations

APA Corporation (APA): Access Free Stock Analysis Report

Diamondback Energy, Inc. (FANG): Access Free Stock Analysis Report

PrimeEnergy Corporation (PNRG): Access Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`