Rigetti Computing Faces High Valuations Despite Share Surge

Rigetti Computing’s (RGTI) shares are currently marked as overvalued, earning a Value Score of F. In terms of forward 12-month price/sales (P/S), RGTI is trading at 116.46X, significantly above its median of 94.39X and the Zacks Computer and Technology sector’s 6.53X.

Examining Price/Sales (F12M)

Image Source: Zacks Investment Research

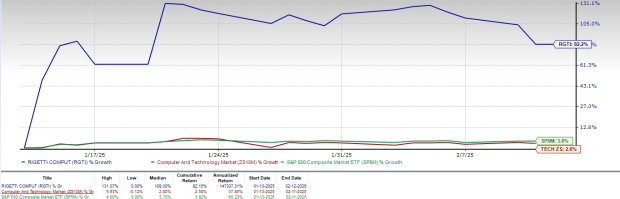

RGTI shares have soared 82.2% over the last month, in stark contrast to the Zacks Internet – Software industry’s return of 3.8% and the broader Zacks Computer & Technology sector’s growth of 2.6%.

RGTI Outshines Sector and Industry Peers

Image Source: Zacks Investment Research

In comparison, RGTI’s performance outstrips competitor D-WAVE QUANTUM (QBTS), which has rebounded by 392% in the same period. This strong performance can be linked to RGTI’s growing customer base and its emerging role in the quantum computing field.

Given the rise in share price yet high valuation, how should investors contemplate RGTI stock? Let’s delve deeper.

Quantum Innovations Position RGTI for Future Success

Rigetti’s developments in quantum computing are noteworthy. In Q3 2024, the company demonstrated 9-qubit chips with a remarkable 99.4% median 2-qubit gate fidelity and announced plans for a 36-qubit system by mid-2025. These key advancements in quantum hardware are crucial for RGTI’s growth trajectory.

Moreover, in December 2024, RGTI launched the 84-qubit Ankaa-3 quantum computer, featuring significant hardware redesigns that enhance performance and scalability. It boasts a median of 99% iSWAP gate fidelity and 99.5% fSim fidelity, supporting complex algorithms and is now accessible on Rigetti QCS.

This system will connect to platforms like Amazon (AMZN) Braket and Microsoft (MSFT) Azure in early 2025, facilitating quantum computing innovations via these major tech platforms.

RGTI continues to make strides in quantum computing by developing multi-chip architecture for scaling qubit systems, which positions the company at the industry’s forefront.

The evolving quantum computing market presents opportunities for RGTI, with a Grand View Research report anticipating a CAGR of 20.1% from 2024 to 2030.

Partnerships Fuel RGTI’s Quantum Growth

RGTI’s strategic alliances with Riverlane, NVIDIA, and Quantum Machines are significant contributors to its success, positioning the company as a crucial player in the advancing quantum computing landscape.

In December 2024, Rigetti announced the successful use of artificial intelligence, in collaboration with Quantum Machines, to automate the calibration of its 9-qubit Novera QPU. This was made possible by leveraging NVIDIA DGX Quantum, which enabled high gate fidelities, reflecting a significant leap in quantum computing operations.

Another important partnership involves Riverlane, focusing on quantum error correction technology. In October, Rigetti and Riverlane showcased real-time and low-latency quantum error correction with Rigetti’s 84-qubit Ankaa-2 system, improving decoding speeds and ensuring fault tolerance in quantum computing.

Collaborations with academic institutions like the UK’s National Quantum Computing Centre and the Israeli Quantum Computing Center enrich Rigetti’s technological capabilities and enhance its position in the global quantum computing ecosystem.

Earnings Estimates Show Positive Trajectory for RGTI

The Zacks Consensus Estimate for Rigetti’s 2025 revenues stands at $15.32 million, reflecting an anticipated 40.29% year-over-year increase. The consensus for 2025 loss per share remains at 28 cents, consistent over the past month, indicating a yearly rise of 17.65%.

Price and Consensus for Rigetti Computing, Inc.

Rigetti Computing, Inc. price-consensus-chart | Rigetti Computing, Inc. Quote

For the latest EPS estimates and surprises, check Zacks Earnings Calendar.

RGTI Faces Uphill Battle in Quantum Market

Although Rigetti’s advancements have bolstered its revenue growth, it grapples with macroeconomic challenges and fierce competition in the fast-moving quantum computing sector.

Further complicating the situation, influential figures in the tech sector have raised concerns about the practicality of quantum computing. Meta CEO Mark Zuckerberg and NVIDIA CEO Jensen Huang have both indicated that it may take decades for quantum computing to become commercially feasible, contributing to a downturn in the market affecting Rigetti.

Final Thoughts

With stretched valuations and a competitive landscape, RGTI shares are likely to experience pressure in the near term.

At present, Rigetti holds a Zacks Rank #3 (Hold), suggesting that investors might consider waiting for a more favorable opportunity to invest in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Reveals #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has skyrocketed over +800% since our recommendation. NVIDIA remains strong, but our new top chip stock has considerable growth potential.

Strong earnings growth and an expanding customer base position it well to meet the rapidly increasing demands for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to surge from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.