Bitcoin’s Future: Are Kiyosaki’s Predictions Worth Considering?

Rich Dad Poor Dad author Robert Kiyosaki often suggests that investors focus on solid assets like precious metals, real estate, and owning a business. Recently, however, he has turned his attention to Bitcoin (CRYPTO: BTC), making bold predictions about its future value. Just two weeks ago, Kiyosaki set a price target of $350,000 for Bitcoin by 2025. This Thursday, he reiterated this target, suggesting that Bitcoin could be worth between $175,000 and $350,000 by the end of this year.

Stay Informed Every Morning! Get market updates with Breakfast news straight to your inbox. Sign Up For Free »

In 2024, Bitcoin surged by 119%, increasing from $42,221 to $92,627 per coin. If Kiyosaki’s forecasts prove accurate, this implies that Bitcoin could gain an additional 89% to 278% by 2025.

But do these ambitious predictions hold up under scrutiny? Let’s explore the potential factors that could drive Bitcoin’s price higher in the coming years.

What Factors Could Boost Bitcoin Prices in 2025?

Several developments could positively impact Bitcoin’s value in the near future.

Impact of Bitcoin’s Fourth Halving

In April 2024, Bitcoin underwent its fourth halving, reducing the rewards miners receive for creating new coins. This pivotal change affects Bitcoin’s economic model. As the costs of mining remain constant while new Bitcoin becomes less available, the potential for price increases becomes significant.

Without rising prices, miners could struggle to cover their costs, which would jeopardize the entire network. Historically, Bitcoin’s value has increased following halvings, typically with a delay of 9 to 12 months. If this pattern continues, more price gains could be on the horizon.

The Rise of Spot Bitcoin ETFs

Recent approvals of 11 exchange-traded funds (ETFs) that track Bitcoin’s real-time price, announced in January 2024, have provided a new avenue for investor participation. These funds allow people with stock brokerage accounts to invest in Bitcoin without needing a crypto brokerage account. Funds like the iShares Bitcoin Trust (NASDAQ: IBIT) and the ARK 21Shares Bitcoin ETF (NYSEMKT: ARKB) offer easy options to gain exposure to Bitcoin.

These ETFs operate by managing actual Bitcoin holdings, often in partnership with Coinbase (NASDAQ: COIN). For example, on Thursday, the ARK 21Shares Bitcoin ETF closed at $97.27 per share, and the iShares alternative at $55.37.

Increased Institutional Investor Interest

If banks and capital management firms start investing in Bitcoin, the impact could be profound. The world’s top 500 money managers ended 2023 with $128 trillion in assets, according to data from WTW. Allocating even a small percentage of these funds to Bitcoin could significantly influence its market value.

As institutional interest in crypto grows, Bitcoin could quickly alter the supply-and-demand dynamics in the market.

Kiyosaki’s Role and Growing Public Interest in Bitcoin

Kiyosaki’s optimistic Bitcoin price targets may also reflect a broader uptick in public interest. Currently, there are around 106 million Bitcoin accounts globally, representing only a fraction of the 8 billion people and numerous businesses worldwide.

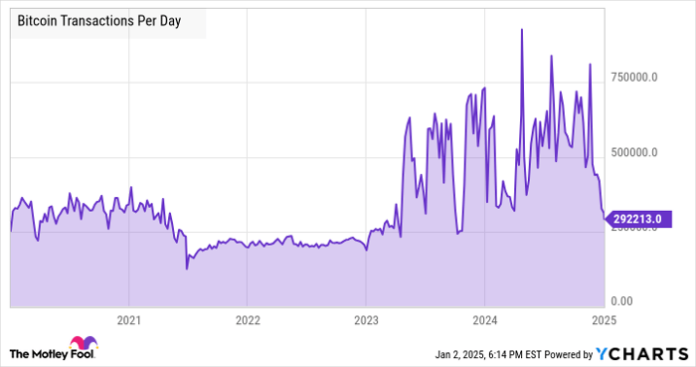

Notably, only about 400,000 Bitcoin transactions occur daily, indicating limited real-world usage. However, if Bitcoin becomes more integrated into daily life—used for significant purchases, for instance—its price could rise due to both its scarcity and increased utility.

Conversations about Bitcoin on popular social media platforms can further enhance public awareness and interest in the cryptocurrency, drawing in more potential users.

Should You Take Kiyosaki’s Bitcoin Predictions Seriously?

While Kiyosaki’s targets may seem ambitious, the increasing interest from influential figures like him suggests that Bitcoin is becoming a standard component of modern investment strategies, alongside traditional assets like stocks and real estate.

The current trends could herald a new era in personal finance and wealth management. Including Bitcoin in your investment portfolio might be prudent as these factors unfold.

Is Investing $1,000 in Bitcoin a Smart Move Right Now?

Before making any investments in Bitcoin, consider this:

The Motley Fool Stock Advisor team recently identified their picks for the 10 best stocks to consider—Bitcoin did not make the list. These selected stocks may offer significant returns in the years ahead.

For instance, had you invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would have $885,388 today!*

Stock Advisor provides a straightforward guide for success, with advice on building a portfolio, ongoing analyst insights, and two new stock suggestions each month. The service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Anders Bylund has investments in Bitcoin and Coinbase. The Motley Fool endorses Bitcoin and Coinbase. For more information, please refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein belong solely to the author and do not reflect those of Nasdaq, Inc.