ServiceNow Expands AI Innovations for Future Growth

Company Boosts Portfolio with GenAI and Governance

ServiceNow (NOW) is enhancing its Now platform with new Generative AI (GenAI) innovations and governance tools aimed at promoting responsible AI use. With over 150 additions to its GenAI capabilities, the company is rolling out advanced Now Assist features, including a focus on secure and compliant AI practices.

Strong Partnerships Drive ServiceNow’s Growth

The growth of NOW is bolstered by a robust range of partnerships. Notable collaborators such as Five9 (FIVN), Visa, Microsoft (MSFT), NVIDIA (NVDA), Zoom, Siemens, Rimini Street, IBM, Genesys, Fujitsu, Equinix, Boomi, and Infosys enhance ServiceNow’s AI capabilities.

Recently, ServiceNow and Five9 expanded their partnership to create a comprehensive AI-powered solution designed to improve both employee and customer experiences by integrating ServiceNow Customer Service Management with the Five9 platform.

Stellar Stock Performance Highlights NOW’s Potential

ServiceNow’s outlook remains promising, with shares increasing by 48% year-to-date. This performance surpasses the Zacks Computer & Technology sector’s 30% and the Zacks Computers – IT Services industry’s 15.8% returns.

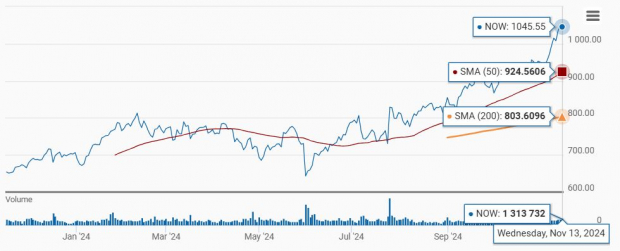

Currently, ServiceNow shares are trading above both the 50-day and 200-day moving averages, indicating positive market sentiment.

ServiceNow Trades Above Key Moving Averages

Image Source: Zacks Investment Research

Analyzing the Growth Drivers for ServiceNow

Let’s examine the key factors influencing NOW’s ongoing success.

Year-to-Date Performance

Image Source: Zacks Investment Research

ServiceNow Increases Subscription Revenue Forecast

For 2024, ServiceNow anticipates subscription revenues in the range of $10.655-$10.66 billion, an increase from the previous estimate of $10.575-$10.585 billion. This projection represents a substantial year-over-year increase of 23% on a GAAP basis or 22.5% on a non-GAAP basis.

The company also expects a non-GAAP subscription gross margin of 84.5% and a non-GAAP operating margin of 29.5%. Additionally, a free cash flow margin of 31% is anticipated.

For the fourth quarter of 2024, subscription revenues are projected to be between $2.875 billion and $2.88 billion, indicating a year-over-year growth of approximately 21.5-22% on a GAAP basis. Year-over-year growth at constant currency is expected to be around 20.5%.

The Current Remaining Performance Obligation is estimated to grow by 21.5% year-over-year on both non-GAAP and GAAP bases.

For the current quarter, a non-GAAP operating margin of 29% is expected.

The Zacks Consensus Estimate for 2024 earnings stands at $13.87 per share, reflecting a 0.4% increase over the past month, showing a robust 28.66% year-over-year growth.

ServiceNow, Inc. Price and Consensus

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

The revenue consensus for 2024 is set at $10.97 billion, suggesting a growth of 22.33% compared to the 2023 reported figures.

Robust Product Offerings Enhance ServiceNow’s Position

ServiceNow leverages AI and machine learning to enhance its solutions. The company’s growing GenAI portfolio aligns well with its projected total addressable market of $275 billion by 2026.

The latest update, known as Xanadu, delivers AI-driven tailored industry solutions across telecommunications, media, technology, financial services, and the public sector.

This update enhances customer agility, productivity, and overall employee experiences, while expanding the GenAI portfolio to critical business functions such as Security and Sourcing & Procurement Operations.

Beginning in November, ServiceNow plans to integrate Agentic AI into its platform to facilitate continuous 24/7 productivity, launching this for Customer Service Management and IT Service Management AI Agents to decrease issue resolution times and increase agent productivity.

Strong Liquidity Supports Future Opportunities for NOW

ServiceNow boasts a strong liquidity position, holding $5.295 billion in cash as of September 30, 2024. The company generated $471 million in free cash flow during the third quarter of 2024.

For 2024, the anticipated free cash flow margin is projected to remain at 31%. This strong cash position enables ServiceNow to explore growth avenues, including acquisitions and share repurchases.

In the third quarter, the company repurchased approximately 272,000 shares for $225 million and has $562 million remaining for future stock repurchases within its existing plan.

Valuation Reflects Strong Potential, Yet Lingers at Premium

Despite the positive outlook, ServiceNow shares may be considered pricey, indicated by a Value Score of F, suggesting an elevated valuation currently.

The forward 12-month Price/Sales ratio stands at 16.7X, significantly higher than its median of 13.72X and the sector’s average of 6.37X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Overall, the strong growth potential validates ServiceNow’s premium valuation.

Conclusion: Positive Outlook for ServiceNow Investors

With its strong GenAI offerings and extensive partnerships, ServiceNow is poised to attract more clients and enhance subscription revenues. The stock’s Growth Score of B presents an appealing opportunity for growth-focused investors.

ServiceNow currently holds a Zacks Rank #2 (Buy), suggesting it might be an opportune time for investors to consider acquiring shares. You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in federal funds are allocated for repairing and upgrading America’s infrastructure. This includes investments in AI data centers, renewable energy, and more.

In this report, you will discover five surprising stocks positioned to benefit significantly from this ongoing spending spree.

Download ‘How to Profit from the Trillion-Dollar Infrastructure Boom’ for free today.

Want the latest recommendations from Zacks Investment Research? Download ‘5 Stocks Set to Double’ for free now.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ServiceNow, Inc. (NOW): Free Stock Analysis Report

Five9, Inc. (FIVN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.