Tesla’s Resurgence Challenges Analyst Skepticism Amid Stock Surges

Electric vehicle leader Tesla TSLA recently grabbed attention with a strong third-quarter earnings report that propelled its stock up nearly 23%. This marked one of the company’s largest one-day gains in the last decade, attributed mainly to margin improvements and a positive future outlook (read: Tesla Records its Best Day in 11 Years: 5 ETF Winners).

Although Tesla’s stock has risen, opinions on its inclusion in the “Magnificent Seven” — a group that includes NVIDIA NVDA, Apple AAPL, Alphabet (GOOG, GOOGL), Amazon AMZN, Meta META, and Microsoft MSFT — remain mixed on Wall Street (read: Is Tesla’s Stock Pop Sustainable? TSLA ETFs in Focus).

As the earnings season unfolds, the Magnificent Seven is expected to achieve a year-over-year earnings growth of 18.1%. Companies like NVIDIA, Alphabet, Amazon, and Meta are predicted to be significant contributors to S&P 500 earnings growth, according to FactSet, as reported by Yahoo Finance.

Tesla’s Earnings Show Promise but Analysts Remain Wary

Tesla’s third-quarter earnings reflected a 17% increase, indicating a rebound following two quarters of declines. Yet, analysts express caution regarding Tesla’s long-term status among leading tech companies, pointing out that some of its growth indicators might be overstated.

In recent months, Tesla has missed delivery projections and is experiencing market share losses to competitors in both China and the U.S. Additionally, a recent robotaxi event did not meet expectations, raising alarms for investors focused on ridesharing.

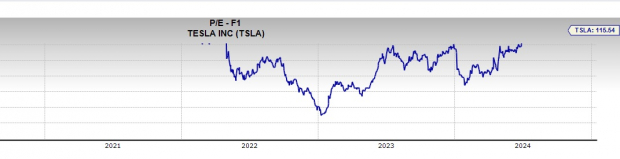

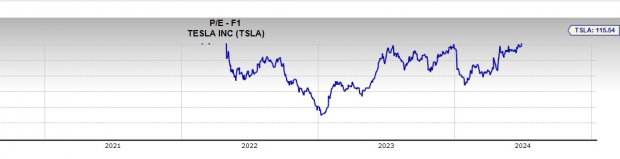

Valuation Issues Weigh Heavily on Tesla’s Position

Tesla’s high valuation adds to the uncertainty surrounding its rank within the Magnificent Seven. The company currently boasts a forward price-to-earnings ratio of approximately 115.54, significantly higher than that of its tech peers.

Image Source: Zacks Investment Research

Reflecting the cautious sentiment, Tesla holds an average brokerage recommendation (ABR) of 2.96, on a scale from 1 (Strong Buy) to 5 (Strong Sell). This is determined from 39 brokerage firms, compared to an ABR of 2.89 a month earlier, based on 38 recommendations.

Of the 39 recommendations, 23.08% are categorized as Strong Buy, with an additional 5.13% as Buy, representing the lowest approval rating among the Magnificent Seven.

Outlook for Tesla’s Stock Price

Looking ahead, 35 analysts have issued short-term price targets for Tesla, averaging at $206.22. The estimates range from a low of $24.86 to a high of $310.00, suggesting a potential decline of 23.4% from Tesla’s last closing price of $269.19 as of October 25.

Is Netflix a Better Choice in the Tech Space?

As Tesla faces challenges, Netflix NFLX stands out as a strong contender for inclusion in the tech elite. The company has shown impressive earnings, subscriber growth, and positive cash flows, increasing its stock price by 55% year-to-date, following only NVIDIA and Meta within the Magnificent Seven.

Image Source: Zacks Investment Research

Ayako Yoshioka from Wealth Enhancement Group identifies Netflix as an attractive option due to its strong performance and positive forecasts. Similarly, analysts from Bank of America praise its free cash flow sustainability, with signals echoed by Jesus Alvarado-Martinez of Portfolio Wealth Advisors.

Netflix reported a free cash flow of $2.19 billion in Q3, an increase from $1.89 billion the previous year. Forecasts from Bank of America suggest this could rise to $8.9 billion in 2025 and $11.16 billion in 2026.

Analyst Recommendations for Netflix

Out of 40 current recommendations for Netflix shares, 23 are Strong Buy and 2 are Buy, making up 57.5% and 5%, respectively. Netflix boasts an impressive Zacks Rank of #2 (Buy) and a favorable VGM Score of B. It currently trades at a forward P/E of 37.88X, much lower than the 105.6X average for its Broadcast Radio and Television peers.

Image Source: Zacks Investment Research

Exploring Netflix-Oriented ETFs

For those considering Netflix as a worthy tech investment, several exchange-traded funds (ETFs) focus on Netflix stocks. Options include single-stock ETFs like T-Rex 2X Long NFLX Daily Target ETF NFLU and Direxion Daily NFLX Bull 2X Shares NFXL.

Additional Netflix-heavy ETFs are the MicroSectors FANG+ ETN FNGS (with a 9.18% weight in Netflix), Invesco Next Gen Media and Gaming ETF GGME (8.35% weight), and the First Trust Dow Jones Internet Index Fund FDN (8.32% weight).

Stay Updated on Key ETF Insights

Zacks’ free Fund Newsletter will keep you informed with top news and analysis about high-performing ETFs each week.

For expert recommendations, you can download our free report on 5 Stocks Set to Double today.

Alphabet Inc. (GOOG): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

Meta Platforms, Inc. (META): Free Stock Analysis Report

Invesco Next Gen Media and Gaming ETF (GGME): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.