Grab Holdings Limited: Insights from Wall Street Analysts

Investors often seek guidance from Wall Street analysts before deciding to Buy, Sell, or Hold a stock. While news about rating changes can sway stock prices, is this information actually useful?

Let’s explore the insights regarding Grab Holdings Limited (GRAB) and assess how reliable brokerage recommendations can be for investors.

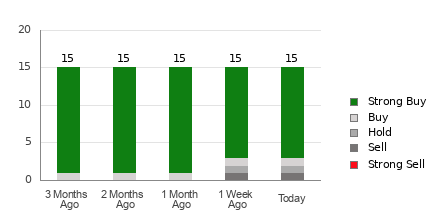

As of now, Grab has an average brokerage recommendation (ABR) of 1.37 on a scale of 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Strong Sell. This ABR is based on recommendations from 15 brokerage firms, suggesting the stock is between Strong Buy and Buy. Of these recommendations, 12 are categorized as Strong Buy, and one as Buy, creating a distribution where 80% are Strong Buy and 6.7% are Buy.

Understanding GRAB’s Brokerage Recommendations

Explore Grab’s price target & stock forecast here>>>

While the ABR hints at a potential buying opportunity for Grab, relying exclusively on this metric may lead to poor investment choices. Research indicates that brokerage recommendations often fall short when helping investors pick stocks likely to appreciate in value.

Why is this the case? Brokerage firms have vested interests in the stocks they analyze, which can skew their analysts’ ratings positively. Evidence suggests that for every “Strong Sell” recommendation, there are typically five “Strong Buy” recommendations. Thus, brokerage analysts’ opinions may not align with the actual price trends of the stocks they cover.

Instead, a more effective approach would be to verify your own research with these insights, or use them in conjunction with reliable indicators like the Zacks Rank.

Zacks Rank is a proprietary tool that categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell) based on earnings estimate revisions, making it a valuable predictor of a stock’s future price movement. Combining the ABR with the Zacks Rank can enhance your investment decision-making process.

Clarifying ABR vs. Zacks Rank

Though both metrics range from 1 to 5, ABR and Zacks Rank measure different aspects. The ABR is derived from analyst recommendations, displayed as decimals (e.g., 1.28), whereas Zacks Rank is based on earnings estimates and is expressed in whole numbers (1 to 5).

Brokerage analysts tend to be overly positive in their recommendations. The favorable ratings they give often do not align with their research findings due to conflicts of interest. This can mislead investors more often than it assists them.

On the other hand, Zacks Rank is based on actual earnings revisions, which have a proven correlation with stock price movements, providing a more reliable indicator for short-term investment decisions.

Moreover, unlike the ABR, which may not reflect current data, Zacks Rank updates promptly in response to revisions, offering timely insights into possible price changes.

Is GRAB a Smart Investment Choice?

Recent earnings estimate revisions for Grab show a Zacks Consensus Estimate that has risen by 25% over the past month to -$0.03. This growing optimism suggests that analysts foresee a positive trend developing for Grab’s earnings, potentially boosting the stock price.

The significant shift in the consensus estimate, combined with other favorable earnings factors, has earned Grab a Zacks Rank of #1 (Strong Buy). You can view the full list of current Zacks Rank #1 stocks here>>>>

Thus, the Buy-equivalent ABR may be a useful tool for investors considering Grab.

Zacks Announces Top 10 Stock Picks for 2025

Interested in discovering our top 10 stock recommendations for 2025?

Historical performance suggests these picks could yield impressive returns. From 2012 through November 2024, the Zacks Top 10 Stocks portfolio gained +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Zacks Director of Research Sheraz Mian is currently selecting the top 10 stocks to buy and hold for 2025. Ensure you check back on January 2 for these recommendations.

Be the first to access our new Top 10 Stocks >>

Get your free analysis report on Grab Holdings Limited (GRAB).

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.