AGNC Investment Corp. Sees Strong Returns and High Dividend Yield

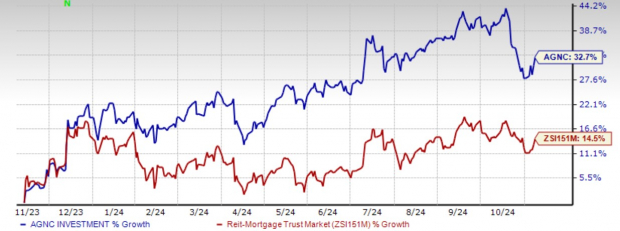

AGNC Investment Corp. boasts a current dividend yield of 14.9%, outpacing the industry’s average of 10.6%. Over the past year, AGNC’s shares have risen by 32.7%, while the industry has seen only a 14.5% increase. This impressive performance makes AGNC an attractive option for income-focused investors.

Overview of Recent Stock Performance

As a publicly traded mortgage real estate investment trust (mREIT), AGNC offers promising returns for stockholders and a substantial dividend yield. Under U.S. law, REITs must distribute 90% of their taxable income as dividends, which drives demand for AGNC shares. The company’s third-quarter 2024 results indicate that this trend is likely to continue.

Is this the right moment to invest? To determine that, we need to examine AGNC’s recent performance and various other factors.

Analysis of AGNC’s Q3 Performance

In the third quarter, AGNC reported a comprehensive net income of 64 cents per share, a turnaround from last quarter’s loss of 13 cents per share. As of September 30, 2024, the tangible net book value per share (BVPS) was $8.82, reflecting a 5% increase sequentially. Combined with its quarterly dividend payment of 36 cents per share, AGNC achieved an economic return on tangible common equity of 9.3%, compared to a negative 0.9% in the previous quarter.

This return, paired with the upward trend in profitability, indicates AGNC’s ability to maintain its attractive dividends. The company’s average asset yield rose to 4.73%, up from 4.69% in the prior quarter. Additionally, AGNC maintained strong liquidity, ending the quarter with $5.1 billion, ensuring it can uphold dividends moving forward.

AGNC’s Dividend Strategy

AGNC is well-known for its monthly dividends, currently exhibiting a payout ratio of 67%.

Other companies in the REIT and Equity Trust sector, such as Annaly Capital Management (NLY) and Ellington Credit Company (EARN), also offer appealing dividends. NLY’s annual yield stands at 13.1%, while EARN offers 14.5%.

AGNC benefits from varied funding sources and financing conditions, giving it the flexibility to optimize its portfolio. Furthermore, the board of directors recently replaced a $1 billion stock repurchase plan set to expire on December 31, 2024, with a new plan allowing for the repurchase of up to $1 billion of common stock until December 31, 2026. These buybacks will only occur if the repurchase price is below the estimated tangible BVPS.

Impact of Interest Rate Changes on AGNC

AGNC has faced challenges due to rising interest rates since early 2022 when the Federal Reserve began its rate hikes. This environment has negatively affected the company’s profitability and capacity to maintain its dividends, causing an increase in borrowing costs and leading to a net interest loss through September 30, 2024. The company’s book value per share declined 5.9% from September 30, 2022, to September 30, 2024.

Recently, the Federal Reserve announced a second rate cut this year, reducing rates by 25 basis points, bringing the federal funds rate to a range of 4.5% to 4.75%. As interest rates decrease, mortgage rates follow suit. The average rate on a 30-year fixed-rate mortgage fell to 6.79% on November 7, 2024, down from 7.50% a year prior. With potential future rate cuts in 2025, AGNC’s net interest spread and portfolio book value may improve significantly.

Sales Forecast for 2024 & 2025

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Long-Term Projections for AGNC

AGNC Investment focuses on leveraged investments in Agency residential mortgage-backed securities (RMBS) backed by U.S. government guarantees. The most favorable conditions for AGNC arise when spreads between Agency RMBS and benchmark rates are wide and stable, accompanied by less volatility in interest rates and monetary policy.

The long-term outlook for Agency RMBS remains positive, with current spreads supporting attractive risk-adjusted returns for leveraged investors like AGNC. Given the demand for Agency RMBS and a favorable monetary policy environment, AGNC’s returning performance is optimistic.

Should You Consider AGNC Stock Now?

AGNC’s high dividend yield and regular payments make it appealing for those seeking income. The declining interest rates should lessen some financial pressure, enabling AGNC to potentially increase its dividends.

However, investors must remain cautious about volatility in the mortgage market and potential adverse shifts in yield curves and overall financial conditions, as these factors could impact AGNC’s performance negatively. The company has a history of reducing dividends during challenging times.

From a valuation perspective, AGNC currently trades at a forward 12-month price-to-tangible book (P/TB) multiple of 1.04X, which exceeds the industry average of 0.91X, suggesting that the stock may be comparatively expensive at this time.

Current Price-to-Tangible Book Analysis

AGNC Investment Corp Faces Downward Earnings Revision Amid Market Concerns

Analysts Weigh In on AGNC’s Future

Currently, analysts have a negative outlook on AGNC stock, with earnings projections for both 2024 and 2025 seeing a downward revision over the past month.

Market Sentiment and Estimates

Image Source: Zacks Investment Research

Given the current state of AGNC, investors may want to exercise caution before purchasing shares. Simply focusing on its attractive dividend yield isn’t sufficient; it’s important to analyze potential interest rate shifts and the mortgage market dynamics for a more strategic investment approach. The stock’s premium valuation adds another layer of risk, warranting careful consideration.

As it stands, AGNC holds a Zacks Rank #4 (Sell). For those interested, you can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Discover Growth: 5 Clean Energy Stocks with Strong Potential

Energy is foundational to our economy, representing a multi-trillion dollar industry that includes some of the largest and most successful companies globally.

Recent advancements in technology are facilitating the rise of clean energy, driving a shift away from traditional fossil fuels. Significant investments are flowing into innovative energy solutions, such as solar and hydrogen fuel cells.

Investors should consider that leading companies in the clean energy sector could emerge as some of the most promising additions to their portfolios.

Download our report, Nuclear to Solar: 5 Stocks Powering the Future, to see Zacks’ top selections at no cost.

Interested in more investment insights from Zacks Investment Research? Today, you can download our report on 5 Stocks Set to Double for free.

AGNC Investment Corp. (AGNC): Free Stock Analysis Report

Annaly Capital Management Inc (NLY): Free Stock Analysis Report

Ellington Credit Company (EARN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.