Brokerage Insights: What Analysts Are Saying About Amazon (AMZN)

Before making investment decisions, many investors seek guidance from Wall Street analysts. But how effective are their stock recommendations? Let’s take a closer look at what these analysts think about Amazon (AMZN).

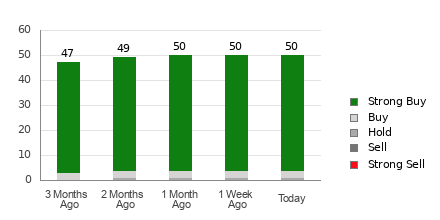

Currently, Amazon has an average brokerage recommendation (ABR) of 1.10 on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 indicates a Strong Sell. This rating comes from recommendations made by 50 different brokerage firms. The ABR of 1.10 suggests a strong leaning towards Buy.

Out of the 50 recommendations that contribute to this ABR, 46 are rated as Strong Buy, and three are rated Buy. This means that 92% of the recommendations are Strong Buy, with Buy making up 6% of the total.

Understanding the Trends for AMZN

For a detailed price target and stock forecast for Amazon, click here>>>

While the ABR suggests buying Amazon, it is unwise to base your investment solely on this number. Research shows that brokerage recommendations may often fail to identify stocks that will rise the most.

Why does this happen? Often, brokerage firms may have a vested interest in the stocks they analyze, leading to biased ratings. Studies reveal that for every “Strong Sell,” a brokerage typically issues five “Strong Buy” recommendations.

This disconnect means brokerage recommendations may not accurately reflect the future price movements of stocks. Instead, these insights should serve to confirm your own research or to support indicators known for success in predicting price changes.

The Zacks Rank system, a proprietary tool with a solid track record, assigns stocks ratings from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This system effectively signals a stock’s potential performance.

Clarifying Zacks Rank vs. ABR

While both Zacks Rank and ABR use a similar scale, they measure different things.

The ABR is based solely on analyst recommendations and typically includes decimals (e.g., 1.28). On the other hand, Zacks Rank is a quantitative model, presenting data as whole numbers from 1 to 5, focused on earnings estimate revisions.

Brokerage analysts have a history of being overly optimistic in their ratings, often giving more positive assessments than justified. As a result, they may mislead investors more often than they help them.

In contrast, Zacks Rank is grounded in the changes of earnings estimates, and past research shows a strong connection between these estimates and stock price movements.

The Zacks Rank grades are consistently applied across all stocks with analyst earnings estimates for the year, ensuring balance among the rankings, while also being more timely compared to the ABR.

Is Investing in Amazon a Good Choice?

The Zacks Consensus Estimate for Amazon’s earnings has remained steady at $5.19 over the past month. Analysts are optimistic about the company’s earnings potential, as indicated by the consistent upward revisions in earnings per share (EPS) estimates.

This strong analyst agreement, along with other factors, has earned Amazon a Zacks Rank of #2 (Buy). You can find a full list of today’s Zacks Rank #1 (Strong Buy) stocks here>>>>

Thus, the Buy-equivalent ABR for Amazon can assist investors in making informed decisions.

Zacks Announces Top 10 Stocks for 2025

Curious about Zacks’ top picks for 2025?

Historical data shows that these selections can perform exceptionally well. Since 2012, Zacks’ Top 10 Stocks have increased by +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Zacks’ Director of Research, Sheraz Mian, is currently reviewing over 4,400 firms to select the top 10 stocks for 2025. Make sure to catch them when they’re released on January 2.

Want to receive the latest recommendations from Zacks Investment Research? Today, you can download the report titled “5 Stocks Set to Double” for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

To access this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.