Evercore ISI Upgrades Zoom Video Communications Amid Price Target Adjustments

Price Forecast Indicates Potential Decline

Fintel revealed that on November 26, 2024, Evercore ISI Group raised their outlook for Zoom Video Communications (XTRA:5ZM) from In-Line to Outperform.

The current average one-year price target for Zoom Video Communications is set at 71.19 €/share, reflecting a projected decline of 16.21% from its last closing price of 84.97 €/share. The estimates vary, with targets ranging from a low of 55.59 € to a high of 91.50 €.

Annual Revenue Predictions Show Positive Growth

Zoom is expected to generate an annual revenue of 4,855 million €, indicating a growth rate of 4.91%. The projected annual non-GAAP EPS stands at 4.46.

Insights on Fund Engagement

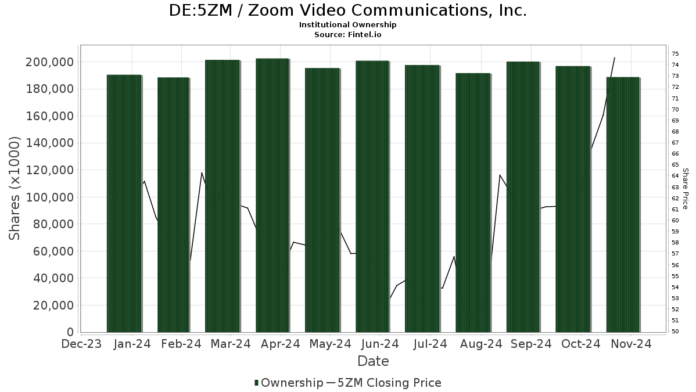

Currently, 1,180 institutions have reported holdings in Zoom Video Communications, marking an increase of 18 funds or 1.55% over the past quarter. The average portfolio weight that funds allocate to 5ZM is 0.20%, a rise of 1.05%. However, total institutional shares owned have declined by 2.09% over the last three months, totaling 195,134K shares.

BlackRock currently possesses 15,379K shares, which equates to a 5.87% stake in the firm, down from 15,532K shares reported previously—a 1.00% decrease. However, they increased their overall investment in Zoom by 8.20% last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) holds 7,443K shares or 2.84% ownership, down from 7,489K shares, reflecting a decrease of 0.62%. Nevertheless, their portfolio allocation to 5ZM rose by 9.99% over the same period.

Aqr Capital Management has ramped up its stake significantly, increasing its holdings from 5,731K shares to 7,165K shares, an increase of 20.01%, despite a considerable reduction of 48.47% in portfolio allocation in 5ZM last quarter.

Newlands Management Operations holds steady with 5,786K shares, maintaining a 2.21% ownership. Pacer Advisors increased their shareholding from 5,247K to 5,480K shares, marking a 4.26% rise, with a 14.78% increase in their overall investment in Zoom.

Fintel serves as a comprehensive platform for investment research, providing valuable insights for investors, traders, and financial advisors. Our extensive data on market trends covers fundamental analysis, ownership statistics, fund sentiment, and more, all aimed at enhancing informed investment decisions.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.