Wall Street Evaluates Tech Giants: Meta, Uber, and Amazon’s Q3 Performance

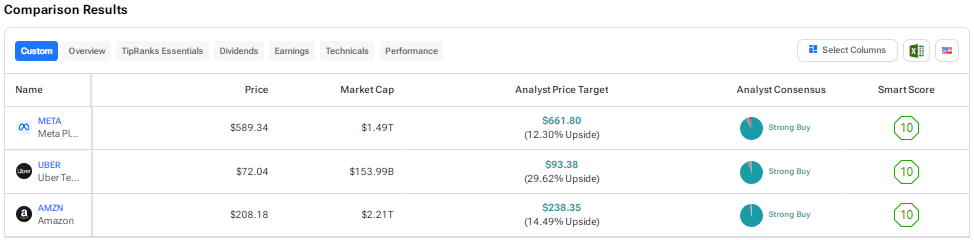

This earnings season brought a mix of results from major tech companies. While some impressed investors, others missed expectations. Optimism in the sector remains, largely due to advancements in generative AI. Using TipRanks’ Stock Comparison Tool, we analyze Meta Platforms (META), Uber Technologies (UBER), and Amazon (AMZN) to identify which “Strong Buy” stock boasts the highest upside potential according to analysts.

Meta Platforms (NASDAQ:META)

Meta Platforms reported Q3 earnings for 2024 that exceeded expectations. The company’s revenue grew 19% year-over-year to $40.5 billion, and earnings per share (EPS) surged 37% to $6.03.

Despite these strong results, shares dipped after the report due to disappointing user metrics. Daily active users (DAP) rose by 5% to 3.29 billion, which fell short of the anticipated 3.31 billion.

Additionally, Meta raised its capital expenditure forecast for 2024, with CEO Mark Zuckerberg warning of a significant increase in AI infrastructure spending projected for 2025.

Is META Stock a Good Buy?

Following the earnings announcement, Baird analyst Colin Sebastian maintained a Buy rating on META, raising his price target to $630 from $605. He believes Meta’s strong performance reflects healthy user growth and the impact of AI on advertising and content.

Overall, analysts remain positive on Meta Platform’s future. The stock holds a Strong Buy consensus rating, supported by 41 Buys, three Holds, and one Sell. The average target price of $654.23 suggests an 11% upside potential, with shares rising 66.5% year-to-date.

See more META analyst ratings

Uber Technologies (NYSE:UBER)

Uber Technologies experienced a stock decline of 9.3% on October 31, following slower bookings growth that raised concerns among investors about demand in the ride-hailing market. Gross bookings grew 16% year-over-year to $40.97 billion but fell short of the $41.25 billion estimate.

On a positive note, Uber’s Q3 revenue increased 20% to $9.29 billion, exceeding expectations. The EPS jumped to $1.20 from just $0.10 last year, partly due to a $1.7 billion boost from unrealized gains on equity investments.

Uber CEO Dara Khosrowshahi remains optimistic, citing the strength of its core business that supports investments in new products for long-term growth.

Is UBER a Buy or Sell Right Now?

Goldman Sachs analyst Eric Sheridan maintained a Buy rating on Uber with a price target of $96. He views UBER as a strong opportunity for growth following its stock retreat after earnings.

Sheridan noted that Uber’s equity outlook depends on expanding markets and rising profitability, encouraging investors to reassess the stock’s potential.

With 32 Buys and two Holds, UBER has a Strong Buy consensus rating. The average price target of $91.86 indicates a 27.5% upside from current prices, and shares have grown 17% year-to-date.

See more UBER analyst ratings

Amazon (NASDAQ:AMZN)

Amazon shares have risen 37% this year after the company released promising Q3 results. Sales increased 11% to $158.9 billion, fueled by strong retail, AWS (Amazon Web Services), and advertising sectors.

Moreover, Q3 EPS soared over 50% to $1.43, benefiting from solid revenue growth and improved margins. Amazon’s cost-cutting strategy is significantly contributing to these enhanced margins.

Similar to its peers, Amazon is heavily investing in AI, with capital expenditures reaching $51.9 billion in 2024 and an expected $75 billion by year’s end.

What Is the Price Target for Amazon Stock?

Citi analyst Ronald Josey raised Amazon’s price target to $252 from $245, maintaining a Buy rating. After the Q3 results, he is more confident in the company’s ability to grow while expanding margins.

He highlighted AWS’s AI segment, which is a rapidly growing revenue source, and anticipates that generative AI will enhance AWS’s business further. For Citi, Amazon remains a top choice in the Internet sector.

Amazon holds a Strong Buy consensus rating based on 44 Buys and one Hold. The average price target of $238.35 suggests a 14.5% upside potential.

See more AMZN analyst ratings

Conclusion

Wall Street is optimistic about the growth prospects of Meta Platforms, Uber Technologies, and Amazon. Analysts view the recent drop in UBER shares as a buying opportunity for long-term investment, noting higher potential returns in comparison to the other tech stocks discussed.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.