Even though Wall Street is unpredictable, speculating about the upcoming year can be insightful. Here are five predictions for 2025:

Prediction #1: Small-Cap Stocks Will Shine

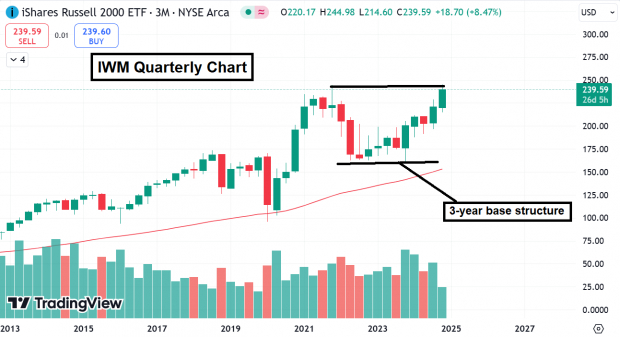

Large-cap technology stocks, particularly the mega-cap tech-heavy Nasdaq 100 Index ETF (QQQ) have soared about 155% in the last five years. In contrast, the small-cap Russell 2000 Index ETF (IWM) has only risen 47%. Here are two reasons I anticipate small caps will outperform large caps in 2025.

1. Impact of Tariffs: President-elect Donald Trump has hinted at imposing tariffs on various countries like China and Mexico. These tariffs could make foreign goods costlier, prompting consumers to consider domestic products more seriously.

2. Long-Term Growth Potential: An age-old Wall Street saying states, “The longer the base, the higher in space.” Currently, the IWM seems poised to break free from a three-year stagnation, suggesting potential catch-up growth.

Image Source: TradingView

Prediction #2: Anticipate a 10% Market Pullback Early in the Year

In all bull markets, stocks typically experience profit-taking phases, requiring some digestion of gains before advancing further. While the S&P 500 Index has witnessed a strong upward trend, it is not immune to normal corrections.

The S&P 500 has gained over six of the past seven months, with only a minor dip in one month. Historically, stocks tend to see at least one correction of 10% or more every year, regardless of market conditions.

Prediction #3: Increased Mergers & Acquisitions Ahead

Lina Khan, chair of the Federal Trade Commission (FTC), has been strict on mergers. Notably, she tried to block the Microsoft (MSFT) acquisition of Activision Blizzard but was less successful. In contrast, she successfully halted a merger between Kroger (KR) and Albertsons (ACI).

However, with changes in administration comes a shift in the M&A landscape. With Andrew Ferguson expected to be named FTC chair, a more lenient approach may emerge, especially for mid to small-cap firms. Yet, how the new administration addresses existing antitrust probes against Amazon (AMZN) and Alphabet (GOOGL) remains uncertain. Although they endorse free markets, many believe that the influence of major tech firms must be curtailed.

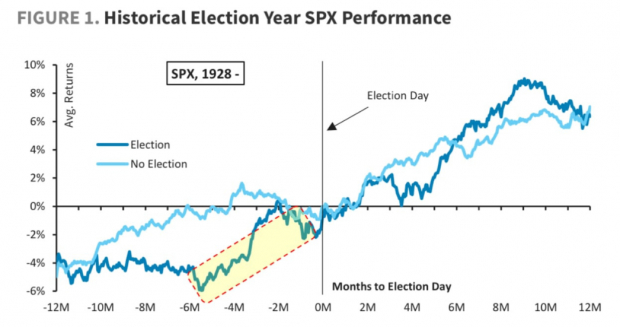

Prediction #4: Bull Market Expected to Continue with Over 10% S&P Gains

In financial markets, one trend often feeds another. With the S&P 500 having gained more than 20% for two consecutive years, historical data indicates that bull markets typically last around four years. It’s also historically observed that stock prices tend to rise after presidential elections.

Image Source: Barclays

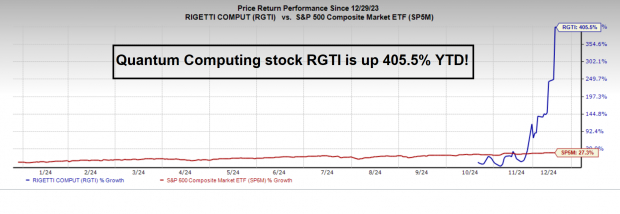

Prediction #5: A Surge in IPO Activity

Following a downturn in 2023, the IPO market rebounded in 2024. With a supportive Federal Reserve, a bullish market atmosphere, and new political conditions, a wave of IPOs is anticipated, especially in hot sectors like quantum computing and artificial intelligence. Currently, only a few pure players such as Rigetti Computing (RGTI) and C3.ai (AI).

Image Source: Zacks Investment Research

Access Zacks’ Insights for Only $1

No catch here.

A few years back, we amazed our members by offering them 30-day access to all our stock picks for just $1. No future obligations required.

Many jumped on this offer, while others were skeptical. Our motivation? We want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which achieved 228 positions with significant gains in 2023 alone.

Explore Stocks Now >>

Want insight on our top stock recommendations? Download our report on 5 Stocks Set to Double.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

Albertsons Companies, Inc. (ACI): Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

C3.ai, Inc. (AI): Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.