Wall Street Analysts Weigh In: Understanding Uber’s Investment Potential

When deciding whether to Buy, Sell, or Hold a stock, many investors rely on recommendations from Wall Street analysts. These ratings from brokerage firms can sway a stock’s price; however, do they really hold weight? Let’s delve into what the analysts say about Uber Technologies (UBER) and evaluate how to interpret these recommendations effectively.

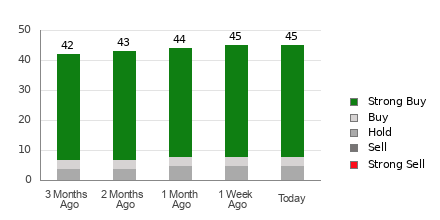

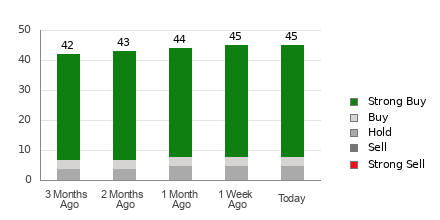

Currently, Uber boasts an average brokerage recommendation (ABR) of 1.29 on a scale from 1 to 5 (where 1 is Strong Buy and 5 is Strong Sell). This figure results from the evaluations of 45 different brokerage firms. An ABR of 1.29 is positioned between a Strong Buy and a Buy. Out of the total 45 recommendations, 37 are classified as Strong Buy, while three are categorized as Buy, indicating that Strong Buy and Buy make up 82.2% and 6.7% of the total recommendations, respectively.

Exploring Current Trends in Uber’s Brokerage Recommendations

Find out Uber’s price target and stock forecast here>>>

Despite a favorable ABR for Uber, it’s crucial to not rely solely on this information for investment decisions. Studies indicate that brokerage recommendations frequently do not help investors identify stocks with the highest potential for price increases.

So, why is this the case? Analysts often have vested interests in the stocks they cover, which leads to a noticeable positive bias in their recommendations. Our research reveals that brokerage firms often issue five “Strong Buy” recommendations for every single “Strong Sell” recommendation.

This discrepancy can misguide investors, as recommendations may not accurately reflect where a stock’s price is heading. Rather than using this information in isolation, consider it as a tool to validate your own analyses or support indicators that have historically proven effective in predicting price movements.

For instance, our proprietary stock rating tool, the Zacks Rank, is recognized for its accuracy. It categorizes stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), making it a trusted indicator for short-term price performance. Aligning the Zacks Rank with the ABR can significantly aid in making informed investment choices.

Distinguishing Between ABR and Zacks Rank

Although both the ABR and Zacks Rank are rated on a 1 to 5 scale, they serve distinct purposes. The ABR is based purely on brokerage recommendations and may feature decimal values, such as 1.28. The Zacks Rank, on the other hand, is a quantitative model focused on earnings estimate revisions, represented in whole numbers from 1 to 5.

It’s important to note that brokerage analysts often exhibit excessive optimism due to the conflict of interest inherent in their positions, tending to issue ratings that are more favorable than warranted by their research.

In contrast, the Zacks Rank is influenced by real earnings estimate revisions. Empirical studies show that changes in earnings estimates are closely linked to stock price movements.

Additionally, the Zacks Rank ensures balance by proportionally applying grades across all stocks with available earnings estimates for the current year, while constantly adjusting to current conditions based on analyst insights.

Another key difference lies in the timeliness of these ratings. The ABR may not always reflect the latest market changes, while the Zacks Rank rapidly incorporates analysts’ revisions, ensuring it accurately signals future price trends.

Assessing Uber as an Investment Opportunity

Looking at recent earnings estimate revisions for Uber, the Zacks Consensus Estimate for the current year has risen by 68.5% in just the last month to $1.83.

The shifting sentiment among analysts, indicated by their collective consensus to raise earnings per share (EPS) estimates, suggests positive momentum for Uber’s stock in the near future.

This considerable change in the consensus estimate, along with other related factors, has resulted in a Zacks Rank #2 (Buy) for Uber. For more details on top-rated stocks, click here to view today’s Zacks Rank #1 (Strong Buy) stocks>>>>

Thus, while the Buy-equivalent ABR for Uber is a positive indicator, it should be used in conjunction with additional research before making any investment decisions.

Access Zacks’ Recommendations for Just $1

Enter the world of investing with confidence.

Years ago, we surprised our members by offering 30-day access to all our stock picks for only $1, with no further obligations.

Many investors have taken advantage of this unique offer, while others hesitated, suspecting a catch. Here’s the reason behind it: we aim to introduce you to our services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which achieved 228 positions with double- and triple-digit gains in 2023 alone.

Want to receive the latest from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Get your free stock analysis report for Uber Technologies, Inc. (UBER).

To view the full article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.