Evaluating Analyst Ratings: What Do They Suggest for Owens Corning?

Investors often look to analyst recommendations when deciding on stock transactions. Changes in ratings from sell-side analysts can sway stock prices, but how reliable are these insights?

Before delving into the credibility of brokerage recommendations, let’s examine what analysts are currently saying about Owens Corning (OC).

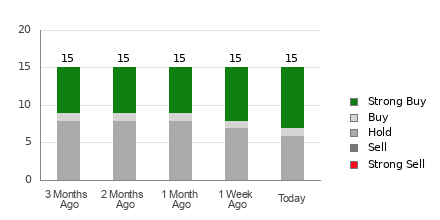

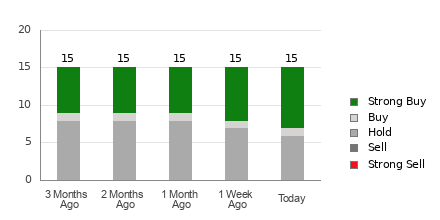

Owens Corning holds an average brokerage recommendation (ABR) of 1.87, which is based on the collective views of 15 brokerage firms. This rating falls between Strong Buy and Buy on a scale from 1 to 5, where 1 indicates Strong Buy and 5 indicates Strong Sell.

Among the 15 recommendations that contribute to this ABR, eight are Strong Buy and one is a Buy, which represent 53.3% and 6.7% of the total recommendations, respectively.

Current Trends in Brokerage Recommendations for OC

Discover the price target and stock forecast for Owens Corning here>>>

While the ABR leans toward buying Owens Corning, making investment decisions based solely on this recommendation may not be wise. Research suggests that brokerage ratings do not consistently lead investors to stocks with the highest potential for appreciation.

Why is that the case? Brokerage firms may hold stakes in the stocks they cover, resulting in a bias among their analysts. Studies reveal that for each “Strong Sell,” there are approximately five “Strong Buy” recommendations.

This indicates that the interests of brokerage houses often diverge from those of retail investors, suggesting analysts might not accurately predict where a stock’s price is headed. Consequently, these recommendations might serve better as a supplementary tool to confirm your own analysis rather than as the sole basis for decision-making.

Zacks Rank, a proprietary stock rating system with a solid track record, categorizes stocks into five groups—from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It can effectively indicate a stock’s potential short-term performance. Therefore, comparing the ABR with the Zacks Rank may aid in formulating a more sound investment strategy.

Distinguishing Between Zacks Rank and ABR

Despite both metrics being presented in a range from 1-5, they represent different concepts altogether.

The ABR is derived solely from analyst recommendations and is typically shown as a decimal (e.g., 1.28). In contrast, the Zacks Rank is a quantitative model that focuses on earnings estimate revisions and is presented as whole numbers from 1 to 5.

Historically, brokerage analysts have been overly optimistic in their recommendations, often skewing results in favor of their employers’ interests. This can mislead investors rather than provide helpful guidance.

The Zacks Rank, however, revolves around earnings estimate revisions, which have shown a reliable correlation with short-term stock price movements.

Furthermore, Zacks Rank maintains a balanced approach in applying grades to all stocks with current-year earnings estimates. This ensures a proportional distribution across the five ranks it assigns.

Another key distinction lies in the currency of these ratings. The ABR can lag behind current market conditions, while earnings estimates by brokerage analysts are frequently updated, allowing the Zacks Rank to provide timely insights into potential price shifts.

Is Investing in Owens Corning a Good Move?

Looking at earnings estimate revisions for Owens Corning, the Zacks Consensus Estimate for the current year has remained stable at $15.46 over the past month.

This stability suggests analysts may have consistent views on the company’s earnings, indicating that OC might perform similarly to the broader market in the near term.

The lack of consensus changes, along with other earnings estimate factors, has resulted in a Zacks Rank of #3 (Hold) for Owens Corning. You can explore today’s complete list of Zacks Rank #1 (Strong Buy) stocks here >>>>

Given this context, it might be wise to approach the Buy-equivalent ABR for Owens Corning with a degree of caution.

Zacks Selection of the Top 10 Stocks for 2025

Are you interested in early access to our top ten stock picks for 2025?

Historical performance indicates significant potential gains.

From 2012, when our Director of Research Sheraz Mian began managing the portfolio, the Zacks Top 10 Stocks group has surged +2,112.6%, vastly outperforming the S&P 500’s +475.6%. Sheraz is currently sifting through 4,400 companies to select the strongest 10 stocks for 2025. Don’t miss your chance to invest in these selections when they’re revealed on January 2.

Be the First to Know About Our Top 10 Stocks >>

Free Analysis Report on Owens Corning Inc (OC)

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.