Wall Street Analysts Shine a Light on Camtek: A Closer Look at Brokerage Ratings

Investors normally consider recommendations from Wall Street analysts before deciding to Buy, Sell, or Hold a stock. Often, reports about changes in ratings from brokerage firms affect stock prices, but how much should investors really depend on these recommendations?

This article will examine the insights that analysts have on Camtek (CAMT) before exploring how reliable these brokerage recommendations can be for investors.

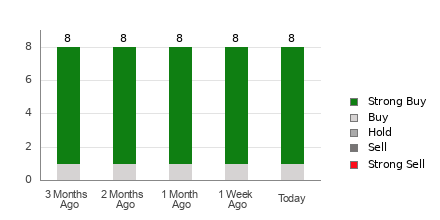

Understanding Camtek’s Analyst Ratings

Camtek currently boasts an average brokerage recommendation (ABR) of 1.13 on a scale of 1 to 5, which denotes a spectrum from Strong Buy to Strong Sell. This figure is based on recommendations from eight brokerage firms. An ABR of 1.13 suggests a leaning towards Strong Buy.

Of these eight opinions, seven analysts rate it as Strong Buy, while one rates it as Buy, translating to 87.5% in favor of Strong Buy and 12.5% for Buy.

Current Trends in Brokerage Recommendations for CAMT

Check price target & stock forecast for Camtek here>>>

While the ABR indicates a Buy for Camtek, caution is warranted before making any decisions based on this alone. Research indicates that brokerage recommendations often fail to guide investors toward stocks that will yield significant price increases.

Why might this be the case? Analysts employed by brokerage firms may favorably bias their ratings due to vested interests. Our research highlights that for every “Strong Sell,” there are five “Strong Buy” recommendations issued.

This discrepancy suggests that brokerage firms may not always align with retail investors’ interests, rendering their insights less useful for predicting a stock’s price trajectory. Therefore, it is advisable to use this data to supplement your own analysis or to use a tool known for predicting stock price movements effectively.

Comparing Zacks Rank to Average Brokerage Recommendations

Zacks Rank, a proprietary stock rating tool, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool has a history of successfully indicating stock price movements. Thus, validating the ABR against the Zacks Rank can enhance investment decision-making.

However, it is crucial not to confuse Zacks Rank and ABR. Despite both systems rating on a 1 to 5 scale, they measure different things. ABR is based solely on broker recommendations, typically shown in decimals (like 1.28), while the Zacks Rank uses whole numbers and is driven by earnings estimate revisions.

Brokerage analysts often exhibit overly optimistic tendencies. Their ratings can mislead, given their firms’ interests. In contrast, the Zacks Rank reacts promptly to earnings estimates, reflecting company performance trends more accurately and timely.

Is Investing in CAMT a Smart Move?

Reviewing the earnings estimates for Camtek, the Zacks Consensus Estimate remains steady at $2.79 for the current year. This consistent outlook from analysts might suggest the stock will perform similarly to the overall market in the short term.

The unchanged consensus estimate, along with the size of changes in estimates, has assigned Camtek a Zacks Rank of #3 (Hold). Additionally, you can view today’s Zacks Rank #1 (Strong Buy) stocks here>>>>.

Given these insights, it may be wise to proceed cautiously with the Buy-equivalent ABR for Camtek.

Research Chief Highlights “Best Pick” for Growth

Among thousands of stocks, five Zacks experts have identified their favorites expected to rise by over 100% in the coming months. From these, Director of Research Sheraz Mian has selected one with the highest potential for substantial gains.

This company, focused on millennial and Gen Z markets, reported nearly $1 billion in revenue last quarter alone. With a recent pullback creating a favorable buying opportunity, the potential for growth is significant. While not all of our top picks succeed, this one aims to outshine previous Zacks stocks—such as Nano-X Imaging, which gained +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Camtek Ltd. (CAMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.