Tesla’s Global Deliveries Face Challenges Amid Mixed Sales Reports

Tesla Inc TSLA analyst Troy Teslike reported on Tuesday that while the electric vehicle (EV) manufacturer’s sales in China are projected to rise this year, declines in the U.S. and Europe are likely to negatively impact Tesla’s overall global deliveries.

Sales Trends: Mixed Signals “There is no need for celebrations over the China figures when sales are down in the U.S. and Europe,” said Teslike.

Specifically, Tesla’s sales in China are expected to grow by over 48,000 units, while sales in the U.S. and Europe are likely to decrease by over 30,000 units each, according to Teslike’s analysis.

Furthermore, the much-anticipated Cybertruck is not expected to significantly boost U.S. sales. This is in part due to a planned three-day production halt this month intended to manage excess inventory.

2023 Delivery Goals: A High Bar For the full year 2023, Tesla aims to deliver 1,808,581 vehicles globally. To achieve a year-over-year increase, the company needs to sell at least 514,926 vehicles by the end of December.

This target is particularly ambitious, as Tesla has never previously delivered over 500,000 vehicles in a single quarter.

In the third quarter of this year, Tesla reported deliveries of 462,890 vehicles, reflecting a 6.4% increase compared to the same period last year and a 4.3% increase from the previous quarter.

In contrast, the company experienced a drop in deliveries during the first quarter, falling 8.5% year-over-year, followed by a 4.8% decline in the second quarter.

According to Teslike, low sales figures in Europe are expected to drag down overall global delivery numbers, despite potential growth in China.

Current Stock Performance Tesla stock closed at $351.42 on Tuesday, down 1.6% for the day. Year-to-date, shares have increased by 41.5%, according to Benzinga Pro data.

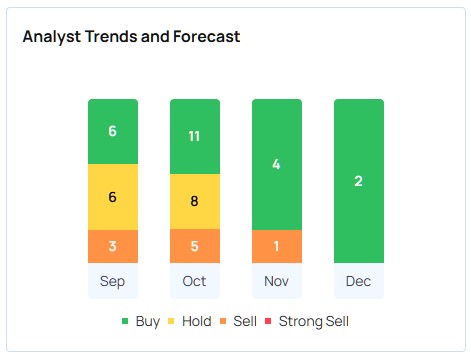

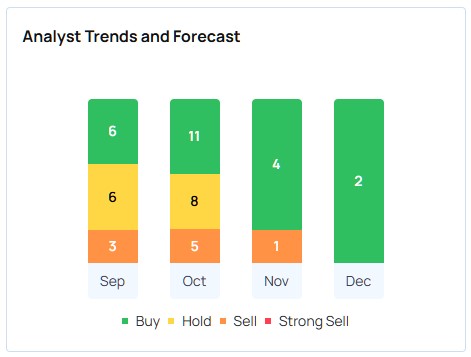

Analysts currently have a consensus rating of “Buy” on Tesla stock, with the highest price target set at $411. Recent ratings from Roth MKM, Stifel, and UBS average a price target of $339, indicating a potential downside of 3.5%.

Explore more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs