Oklo’s Surge: A New Player in the Nuclear Energy Market

(NYSE: OKLO)

Oklo, a lesser-known name in the finance world, captured the attention of investors last month thanks to a surge in the nuclear sector. As the company’s stock price climbed, many started to take notice of its potential.

Currently in the development stage and supported by OpenAI’s CEO Sam Altman, Oklo does not yet generate revenue. Despite this, nuclear energy is gaining traction among major tech firms and wealthy investors. As a result, demand for Oklo increased significantly last month.

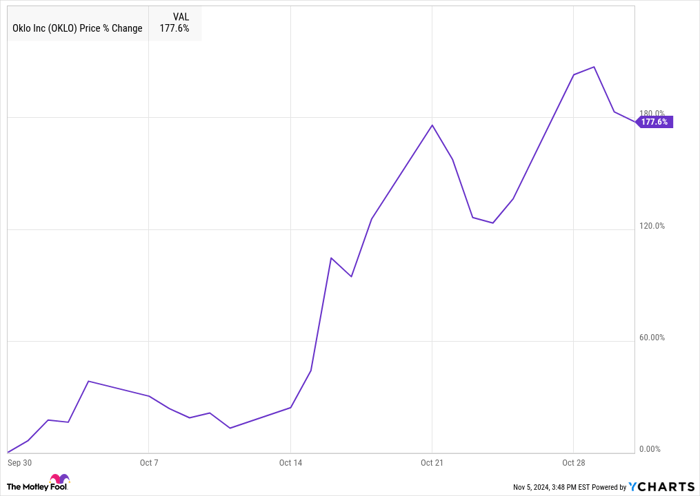

Data from S&P Global Market Intelligence shows that Oklo’s stock finished the month up 177.6%, nearly tripling its value. The chart below illustrates the two distinct phases of this surge.

OKLO data by YCharts

Nuclear Energy: The Future of Power?

Identifying itself as a fission technology company, Oklo specializes in small modular reactors. It started October strong, likely influenced by Microsoft’s recent agreement with Constellation Energy to rehabilitate the nuclear facility at Three Mile Island in Pennsylvania.

Even though Oklo experienced a slight decline thereafter, it rose again on October 14, following the Department of Energy’s approval of its conceptual safety design report for the Aurora Fuel Fabrication Facility—crucial for launching its first operational plant.

Investors also reacted positively when Alphabet announced its collaboration with Kairos Power to utilize small modular reactors for its AI data centers, indicating a growing acceptance of nuclear power in data infrastructure. The stock further climbed when Amazon revealed multiple partnerships for nuclear energy projects, including small modular reactor agreements.

The price continued to rise even amid a lack of significant news, reflecting strong interest in nuclear energy, particularly given Oklo’s backing by Altman and billionaire investor Peter Thiel.

Image source: Getty Images.

Looking Ahead: The Future for Oklo

In November, Oklo shares faced a setback following a regulatory decision that prevented Amazon from securing nuclear power from Talen Energy’s Susquehanna plant, which was intended for its data center.

This was a response to protests by utility companies American Electric Power and Exelon, culminating in a ruling by the Federal Energy Regulatory Commission that barred PJM Interconnection, the grid operator, from enhancing the power supply at Susquehanna.

This situation highlights the uncertainties in the nuclear sector and the importance of grid reliability in meeting growing power demands.

Investors should brace for ongoing volatility in Oklo’s stock as the nuclear narrative unfolds.

Could This Be Your Second Chance to Invest?

Have you ever felt you missed out on investing in once-in-a-lifetime stocks? This could be your moment.

In rare instances, our team of analysts issues a “Double Down” stock recommendation for companies on the brink of significant growth. If you’re concerned about missing your chance, now might be the time to act. The following figures illustrate past successes:

- Amazon: A $1,000 investment when we doubled down in 2010 would now be worth $22,050!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be valued at $41,999!*

- Netflix: A $1,000 investment made with our recommendation in 2004 would boast a remarkable $407,440!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, which could be a rare opportunity.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Constellation Energy, and Microsoft. Furthermore, The Motley Fool recommends options related to Microsoft. The Motley Fool adheres to a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.