Why Nvidia Drives 30% of the S&P 500’s Growth This Year

Tech Giants Surge, Led by Nvidia’s Remarkable Performance

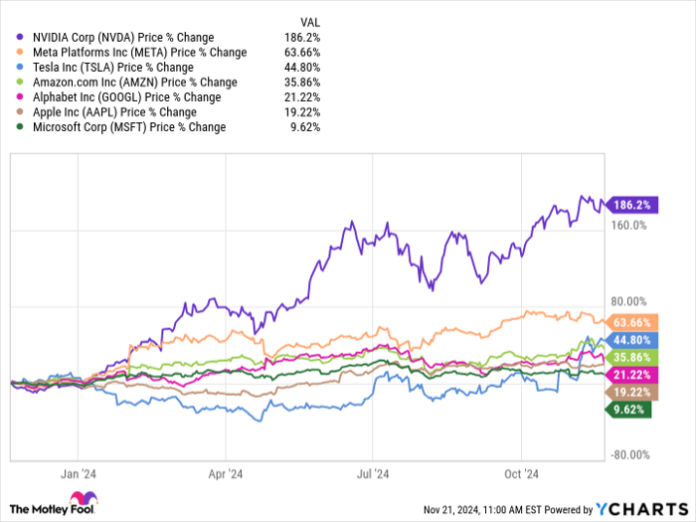

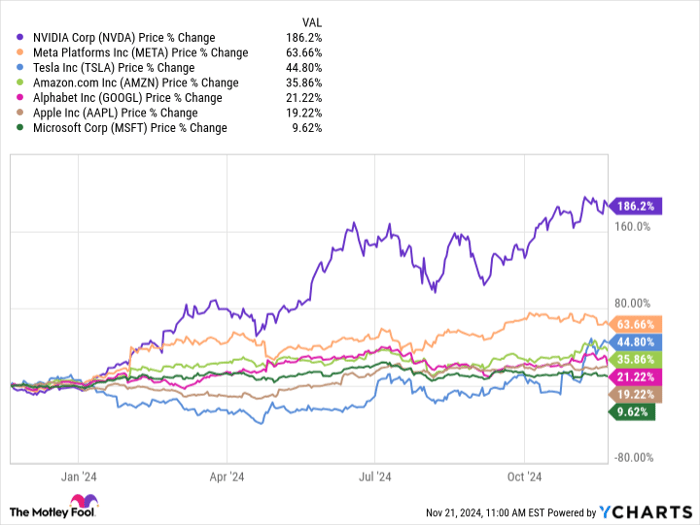

The S&P 500 (SNPINDEX: ^GSPC) has risen by 30% in the past year, with Nvidia (NASDAQ: NVDA) contributing significantly to that success. Nvidia’s stock has skyrocketed 186%, boasting a market cap of $3.6 trillion, which is 7% of the S&P 500’s total value.

Yet, Nvidia is not the only star. It is part of a group known as the “Magnificent Seven,” which includes several major technology companies that have delivered an average return of 56% over the same period. Together, these companies have a combined market capitalization of $16.9 trillion, making up 32.1% of the entire S&P 500.

NVDA data by YCharts.

Investors who haven’t invested in these technology stocks are likely missing out on market gains. Fortunately, there are easy ways to gain access to this booming sector through exchange-traded funds (ETFs).

Bullish on Big Tech: A Smart ETF Choice

The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) has about half of its investment concentrated in four of the nation’s largest tech companies. This ETF consistently outperforms the S&P 500 over both the short and long term, making it an appealing choice for investors at any level.

With only 71 stocks in its portfolio, the Vanguard Mega Cap Growth ETF is highly concentrated. The technology sector comprises a remarkable 61.4%, while consumer discretionary stocks follow at 20.3%.

Notably, its top four holdings account for 45.1% of the portfolio and include leading figures in artificial intelligence (AI). For example, Apple has launched its Apple Intelligence software with features that enhance user experience across its devices. With over 2.2 billion active devices, Apple could be a major player in consumer AI distribution.

Nvidia also plays a crucial role by providing the leading graphics processing units (GPUs) necessary for AI model development. The company has seen triple-digit growth in its data center revenue for six consecutive quarters, fueled by strong demand. Recently, CEO Jensen Huang mentioned that the demand for Nvidia’s new Blackwell GPUs is “staggering.”

In addition, Microsoft and Amazon, two of Nvidia’s primary customers, utilize these GPUs in their data centers to help businesses deploy AI models cost-effectively. Both companies have their own AI chatbots which may grow into significant revenue streams in the coming years.

All stocks within the Magnificent Seven are among the top positions in the Vanguard Mega Cap Growth ETF. Yet, the fund isn’t solely focused on tech; it also includes strong performers like Eli Lilly, Visa, Costco Wholesale, and McDonald’s.

Investors will find that the Vanguard Mega Cap Growth ETF is cost-effective to own, boasting an expense ratio of just 0.07%. This is significantly lower than the average expense ratio of 0.94% for comparable funds, ensuring that lower fees preserve more of the investor’s returns.

Image source: Getty Images.

Why This Fund Outshines the Competition

Since its inception in 2007, the Vanguard Mega Cap Growth ETF has achieved a compound annual return of 13%, surpassing the S&P 500’s average annual return of 10.2% during the same time frame.

Over the last decade, the ETF has even posted a higher compound annual return of 15.9%. This growth aligns with the swift adoption of key technologies such as cloud computing and AI, in contrast to the 13.2% return of the S&P 500 during these years.

While AI is not the only contributor to this ETF’s success, its significant investments in Nvidia, Apple, Microsoft, and Amazon suggest its impact will be profound. Estimates indicate that AI could contribute $7 trillion to the global economy over the next decade, according to Goldman Sachs, while PwC predicts a figure as high as $15.7 trillion by 2030.

However, there are risks. If AI doesn’t meet expectations, stocks in the Magnificent Seven may face considerable declines. Therefore, diversifying with the Vanguard Mega Cap Growth ETF could be wise for those with limited exposure to these leading tech companies.

Investing Considerations for Vanguard Mega Cap Growth ETF

Before making an investment in the Vanguard Mega Cap Growth ETF, here are some points to ponder:

The Motley Fool Stock Advisor has identified what they believe are the 10 best stocks for investors to purchase right now, and Vanguard Mega Cap Growth ETF is not included. The selected stocks could yield substantial returns in the coming years.

Reflect on the potential gains of Nvidia on April 15, 2005… if you invested $1,000 at that time, it could be worth $869,885 today!

The Stock Advisor service provides investors a straightforward plan for success, including building a diversified portfolio and monthly stock picks. Since 2002, Stock Advisor has achieved returns more than four times greater than the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of the board, alongside Randi Zuckerberg, a former spokesperson for Facebook and sister to Meta Platforms CEO Mark Zuckerberg. Anthony Di Pizio currently does not hold positions in the mentioned stocks. The Motley Fool maintains positions in and recommends stocks like Alphabet, Amazon, Apple, Costco Wholesale, Goldman Sachs Group, Meta Platforms, Microsoft, Nvidia, Tesla, and Visa, among others. They have also recommended specific trading options regarding Microsoft. The Motley Fool adheres to a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.