Smart Dividend Stocks to Consider for Steady Income

Dividends provide a solid avenue for passive income, and investors often look for reliable companies that can offer both dividend payouts and capital growth. While some investors favor stable giants like Coca-Cola (NYSE: KO) or Air Products and Chemicals (NYSE: APD), others might be drawn to riskier stocks like Diamondback Energy (NASDAQ: FANG), which offer variable dividends depending on performance. Let’s explore why these three stocks are currently attractive options.

Image source: Getty Images.

Coca-Cola’s Sales Struggles Present a Buying Opportunity

Daniel Foelber (Coca-Cola): Despite recent gains in broader market indexes, Coca-Cola’s stock price has declined by over 12% in the past month—an unusual drop for this long-reliable company. Two main factors contribute to this situation. First, Coca-Cola’s latest earnings report fell short of expectations. Second, the consumer staples sector is under pressure, with many leading companies reporting disappointing results.

The earnings report revealed declining sales volumes, indicating a potential slowdown in demand—which could spell challenges for Coca-Cola into 2025 if consumer spending continues to be weak. Nevertheless, the company remains optimistic, projecting a 10% increase in non-GAAP organic revenue and 5% to 6% non-GAAP earnings growth for 2024, thanks to its solid operational strategies.

Coca-Cola has also enjoyed successful marketing initiatives in 2024, particularly around seasonal drinks. The company is recognized for effectively building brands to solidify their market presence. A notable example is Topo Chico, a sparkling water brand purchased for $220 million in 2017, which has now seen volumes increase tenfold since 2016.

By leveraging its expertise, Coca-Cola has transformed this regional brand into a major player in the industry. While the company has had missteps, such as perceived overpayments for brands like Bodyarmor and Costa Coffee, it continues to focus on its strengths in the beverage sector.

With a current price-to-earnings ratio of 26.4—below its 10-year median of 27.4—Coca-Cola appears to be a bargain. Additionally, it offers a dividend yield of 3.1%, supported by 62 consecutive years of dividend increases, making it a dependable investment choice for income-focused investors.

Air Products and Chemicals: A Steady Dividend Performer

Scott Levine (Air Products & Chemicals): Diversification is key to successful investing, and including reliable dividend payers like Air Products enhances any portfolio. The company offers a 2.3% forward-yielding dividend and has increased its payouts for over 40 years, showing its commitment to shareholder rewards.

Air Products serves clients across more than 30 industries, including energy, food, and biotechnology. This broad customer base reduces the risks associated with downturns in any single sector and helps ensure consistent cash flow for dividend payments.

The company has maintained a payout ratio of 62.3% over the past decade, demonstrating effective financial management. A significant backlog of around $19.5 billion further supports the company’s ability to sustain and grow dividends.

Diamondback Energy: Capitalizing on the Thriving Permian Basin

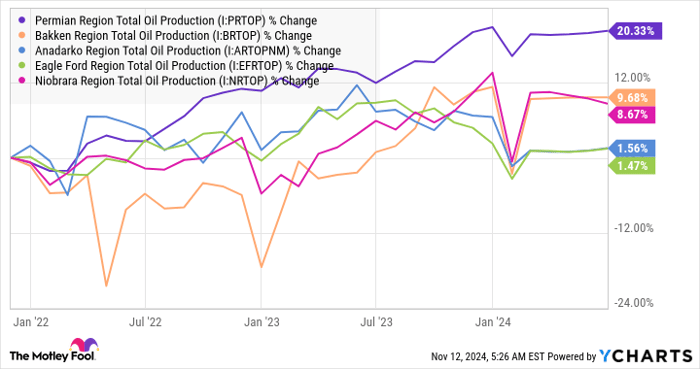

Lee Samaha (Diamondback Energy): Diamondback Energy touts itself as a premier player in the Permian Basin, the largest and fastest-growing oil-producing region in the U.S. Recently, the company completed a merger with Endeavor Energy, expanding its presence in the Permian and creating opportunities for synergy.

Permian Region Total Oil Production data by YCharts

Diamondback aims to return 50% of its quarterly free cash flow to investors, currently maintaining an annual dividend of $3.60, reflecting a yield of about 2% based on current prices. Additionally, with oil prices well above the necessary threshold of $37 per barrel, investors can anticipate increased dividend payouts in the future.

A Second Chance at Investment Opportunities

If you ever thought you missed out on investing in high-performing stocks, now may be your moment to seize the opportunity.

On select occasions, analysts recommend “Double Down” stocks—companies expected to experience significant growth. Here’s how past recommendations have performed:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d now have $381,173!*

- Apple: An initial $1,000 investment from 2008 would now be worth $43,232!*

- Netflix: A $1,000 investment from 2004 would have grown to $469,895!*

This is the ideal moment to explore three new “Double Down” stock alerts, as opportunities like this may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.