Exploring International Stocks for Stronger Income: A 9.2% Yield Strategy

Income investors might be missing out by overlooking international stocks. Utilizing these investments can significantly boost income and enhance investment stability.

One intriguing method involves high-yield closed-end funds (CEFs), allowing us to strategically balance between U.S. and international stocks for an impressive 9.2% yield that we can grow. This approach hinges on occasional “rebalancing” between our U.S. and overseas CEFs.

The journey begins with China, where recent developments may signal opportunities for our overseas income strategy.

Chinese Stocks: Potential for 13% Annual Gains?

Amid ongoing discussions about tariffs, China has unveiled a new stimulus package, a move that has positively influenced Chinese stocks. While the finer details remain to be seen, this package may resemble the quantitative easing initiatives in the U.S. seen during the 2010s (after the financial crisis) and 2020 (during the pandemic).

Following the first U.S. stimulus package, the S&P 500 achieved a remarkable 13.0% annualized gain over five years, and stocks soared an astonishing 84% in the two years following the pandemic. However, due to the unique circumstances surrounding 2020, it is wise to focus on the potential for a more stable 13% annualized return from Chinese stocks, akin to the 2010s style.

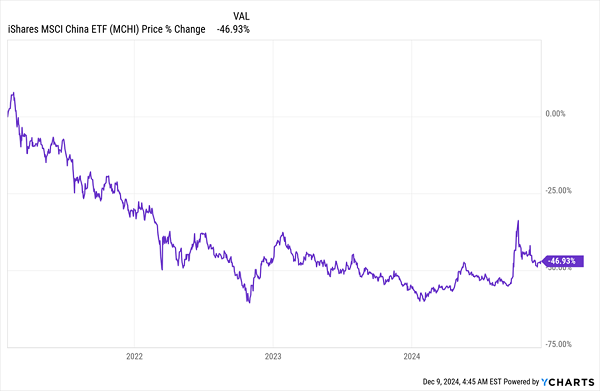

Notably, Chinese stocks have tumbled nearly 50% from their 2021 peak, suggesting this could be a timely entry point for contrarian investors.

Chinese Stocks in Decline

Encouragingly, there are signs of a rebound as China recognizes the need to support its economy, further enhancing the appeal of this potential entry point.

For CEF investors, the China Fund (CHN) stands out. It is currently trading at a 16.3% discount to its net asset value (NAV), making Chinese assets even more attractive.

Chinese Assets Seeing Increased Discounts

However, the persistent drop in CHN’s price raises caution: despite a rise in Chinese stocks, the fund’s value has continued to decrease. History shows that previous government attempts to stimulate the Chinese economy have often fallen short.

In 2016, after a stock market crash, China attempted to stabilize its market, resulting in a 21.7% increase in the following year. Unfortunately, the long-term view shows that the Chinese market has posted only a 3.5% average annual return since then, hindered by the limitations of an economy under heavy state control. Although CHN managed to outperform the index with a 5% annualized return, this remains modest compared to safer investment options.

Seeking Global Diversification

While it’s essential to consider international exposure, we should avoid overcommitting to China. A more balanced approach would be to invest in the BlackRock Enhanced International Dividend Trust (BGY), a key holding in my CEF Insider service.

Comparing Performance: BGY vs. Chinese Funds

This chart illustrates the contrasting performance. While CHN (orange) and the Chinese stock benchmark MCHI (purple) have declined over the last five years, BGY has achieved a notable annualized gain of 7.4%. Recently, BGY announced an increase in its monthly dividend, resulting in an attractive 9.2% yield based on the new payout, indicating that investors may derive their returns primarily through dividends.

In this context, we can adjust our holdings between U.S. and international stocks, which helps to elevate safety, returns, and income. For example, pairing BGY with the U.S.-focused Liberty All-Star Equity Fund (USA) allows for strategic moves. If U.S. assets decline, investors can reinvest BGY’s income by purchasing USA shares. Conversely, when overseas stocks fall, the high dividend rate from USA (currently at 9.9%) could be redirected into international stocks.

This strategy enhances diversification and can create a robust income stream, contrasting sharply with the typical approach of buying low-yielding international ETFs and domestic funds. Such an approach may lead to price volatility and hampers frequent rebalancing without needing to sell shares.

Embracing AI with Our CEF Strategy (Delivering 9.8% Yields)

International stocks are not the only opportunities beyond the S&P 500 we can exploit through CEFs.

Investors can also access high-performing AI stocks via these dynamic funds. Investing in four recommended AI-focused CEFs can yield you a substantial 9.8% dividend payout while providing exposure to leading AI companies like Microsoft (MSFT) and NVIDIA (NVDA), available at appealing discounts.

These AI funds may not stay affordable for long. Click here for more information and to access a free Special Report detailing their names and tickers.

Also see:

• Warren Buffett Dividend Stocks

• Dividend Growth Stocks: 25 Aristocrats

• Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.