“`html

Nvidia vs. Alphabet: Which Stock Should You Buy Today?

The artificial intelligence (AI) boom has been driving Nvidia‘s (NASDAQ: NVDA) stock higher for two years. Now, investors are questioning whether Nvidia’s shares can keep rising or if it might be better to invest in a lower-priced technology stock like Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Let’s explore the options.

Nvidia’s Strong Performance

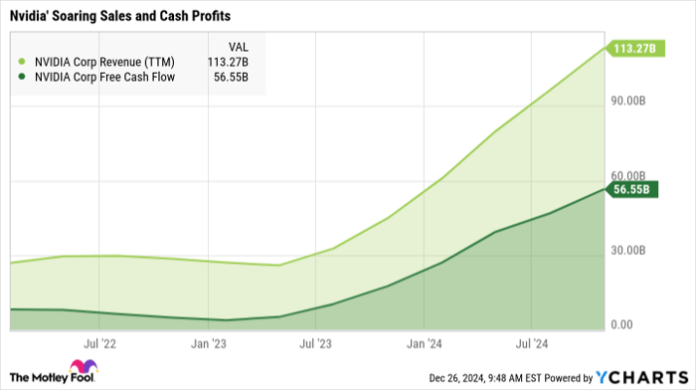

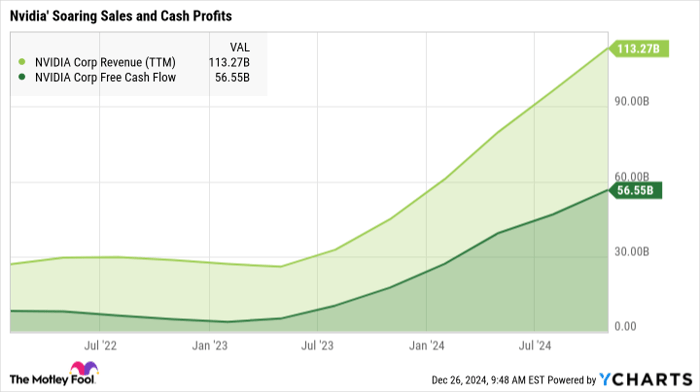

Nvidia’s annual sales reached $27.0 billion in fiscal year 2023, which concluded on January 29, 2023. Just under two years later, the company generated a remarkable $113.3 billion in free cash flow.

NVDA Revenue (TTM) data by YCharts. TTM = trailing 12 months.

This is an incredible time for Nvidia and its stakeholders. The company is among the most valuable globally due to its high profitability. As the key hardware supplier for OpenAI’s cutting-edge ChatGPT platform, Nvidia’s demand is surging as companies rush to develop their own AI technologies.

Currently, the stock is valued at 54 times adjusted earnings and 30 times sales, down from peaks of 247 times and 46 times during the summer of 2023. For those who bought Nvidia at that peak, the stock could yield a 139% return by December 26, 2024. This could indicate that Nvidia shares may be more attractively priced for long-term investment.

Alphabet’s Resilience

Alphabet’s financial results are equally impressive. The parent company of Google achieved revenues of $340 billion over the past year, translating into free cash flows of $55.8 billion. Although Nvidia recently surpassed Alphabet in cash flow, it did so at the tail end of a two-year downturn in the online advertising sector.

Alphabet has invested $49 billion in upgrading data centers and other infrastructure, positioning itself for future growth. Currently, Alphabet’s Class A shares are priced at just 26 times earnings and 7.1 times sales, making them potentially undervalued.

There are numerous reasons to consider investing in Alphabet stock for 2024. The company is designed for durability in a fast-evolving economy, is heavily engaged in the AI boom through software and services, and offers a reasonable stock price. It’s hard to find a downside.

The Case for Investing in Alphabet

Although Nvidia is experiencing strong growth, its stock price reflects that growth adequately. While it may see further increases in 2025 and beyond, the valuation could become lower. Additionally, Nvidia faces increasing competition as rivals introduce their own AI chips. While it’s wise to hold onto Nvidia shares, I would recommend keeping that as a “hold” for now.

In contrast, Alphabet combines a solid business model with an attractive stock price. The digital advertising sector is recovering, which could substantially boost Google’s revenues in the forthcoming years. The market seems to overlook this potential growth in Alphabet’s valuation.

Thus, while Nvidia remains a valid choice for long-term holding, I’m more inclined to invest further in Alphabet, which offers strong potential for future growth. If your investment portfolio lacks exposure to this remarkable stock, now is an opportune time to consider purchasing Alphabet shares.

Is It Time to Invest $1,000 in Alphabet?

Before you make any investment in Alphabet, take this into account:

The Motley Fool Stock Advisor analyst team has identified what they consider to be the 10 best stocks for investors to buy currently… and Alphabet was not included in that list. However, those 10 stocks have the potential to generate significant returns in the years ahead.

Reflect on this: when Nvidia was featured on this list on April 15, 2005, an investment of $1,000 would now be worth $839,670!

Stock Advisor provides users with a straightforward roadmap to success, which includes tips on portfolio building, ongoing analyst updates, and two fresh stock picks each month. The Stock Advisor service has outperformed the S&P 500 by over four times since its inception in 2002*.

Discover the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`