Cerence’s CRNC shares have surged 151.1% in the past month. The Zacks Computer & Technology sector has risen 5.7%, while the Zacks Computers – IT Services sector has declined 1.7% in the same timeframe.

The recent rise can be attributed to Cerence’s robust AI portfolio, an increasing number of clients, and a growing presence in the global automotive market, backed by a strong network of partnerships.

Significant collaborations with automakers such as Volkswagen, Renault RNLSY, Skoda, and Audi, alongside the launch of six Generative AI (GenAI) programs in fiscal 2024, underscore the rising demand for its AI-driven solutions in the automotive industry.

Cerence’s emphasis on GenAI solutions has also resulted in successful product launches and heightened customer engagement. The introduction of CaLLM Edge, the industry’s first large language model for automotive edge systems, bolstered its standing as a leader in AI automotive technologies.

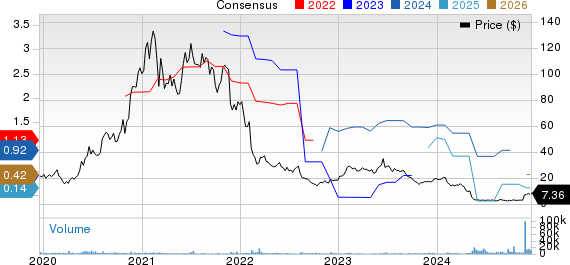

Cerence Inc. Price and Consensus

Cerence Inc. price-consensus-chart | Cerence Inc. Quote

However, can CRNC stock continue to rise, powered by its solid portfolio and expanding customer base? Let’s take a closer look.

Strong Client Base Enhances Cerence’s Future

Cerence’s portfolio strength is a crucial factor in expanding its clientele. Key partnerships with industry leaders like Smart, Audi, Microsoft MSFT, Tuya TUYA, and Renault are vital drivers of growth.

In September, Cerence teamed up with Tuya Smart to incorporate multilingual text-to-speech capabilities into Tuya’s cloud platform, improving voice interactions for two-wheeler riders. This collaboration strengthens CRNC’s position as a leader in voice technology across multiple transport sectors.

By November, Cerence launched CaLLM Edge, an embedded small language model developed with Microsoft, aimed at providing enhanced, AI-driven user experiences in vehicles, focusing on performance, privacy, and cost efficiency.

Furthermore, Cerence has broadened its partnership with Renault, enhancing the Reno in-car companion with generative AI capabilities that enable more interactive and intelligent voice-driven assistance.

CRNC Stock Valuation Appears Attractive

Currently, Cerence’s shares are trading at a notable discount compared to the industry average, making the stock appealing based on valuation metrics. The Value Score of B indicates that CRNC is trading at a discount.

Its forward 12-month P/S ratio is 1.29X, significantly lower than the Zacks Computers – IT Services industry average of 10.77X and Cerence’s historical median of 2.89X over the past five years.

Automotive Industry Challenges for Cerence

Despite its successes, Cerence faces considerable competition within the automotive voice assistance market, which has impacted overall revenue growth.

In the fiscal fourth quarter of 2024, Cerence reported revenues of $55 million, reflecting a 32.1% year-over-year decline. This drop is chiefly due to a one-time fixed license revenue of $12.8 million recorded last year and the $9.2 million decline from the legacy Connected Services contract with Toyota that ended in the fiscal first quarter of 2024.

Additionally, Cerence’s share of global auto production dipped slightly to 52% in the fiscal fourth quarter from 53% in the previous quarter, primarily attributed to lower production rates from key customers.

Cautious 1Q25 Forecast from Cerence

Looking ahead to the first quarter of fiscal 2025, Cerence projects revenues to fall between $47 million and $50 million. This forecast includes a $1 million headwind due to the scaling back of specific professional service projects.

The expected non-GAAP loss for the first quarter is between 32 and 25 cents per share.

The Zacks Consensus Estimate for revenues stands at $49.12 million, reflecting a 64.49% drop from last year. The consensus loss estimate is set at 30 cents per share, an increase of 11 cents over the last month. Comparatively, CRNC reported earnings of $1.12 per share in the same quarter last year.

Conclusion

Currently holding a Zacks Rank #3 (Hold), it may be prudent to await a more opportune moment to invest in Cerence stock. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Top Stocks to Watch Over the Next Month

Experts have unveiled 7 top stocks from a pool of 220 Zacks Rank #1 Strong Buys, labeling them “Most Likely for Early Price Increases.”

Historically, this list has outperformed the market, achieving an average annual gain of +24.1% since 1988. Be sure to check these carefully selected stocks.

Would you like the latest stock recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

RENAULT (RNLSY): Free Stock Analysis Report

Cerence Inc. (CRNC): Free Stock Analysis Report

Tuya Inc. Sponsored ADR (TUYA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.