“`html

Market Movements Amidst Tariff Turbulence

In a striking moment at the 2008 Beijing Olympics, Kobe Bryant charged straight into teammate Pau Gasol during a match between Team USA and Spain. Despite their camaraderie on the Los Angeles Lakers, Bryant wanted to assert dominance from the outset, declaring to his team that he’d go hard on Gasol right from the first play. This aggressive gesture set the tone for Team USA, which went on to win decisively. It underscored Bryant’s fierce competitive spirit, willing to tackle a friend head-on for the sake of victory.

This past weekend, President Trump signed executive orders imposing a 25% tariff on goods from Canada and Mexico, along with an additional 10% on imports from China. While many anticipated a tough approach toward China and Mexico, the move against Canada seemed particularly aggressive, reminiscent of Bryant’s notable on-court maneuver. Just as Bryant’s charge caught Gasol off guard, Trump’s tariff strategy raised eyebrows among investors and allies alike.

The market responded sharply, with Bitcoin dropping to $91,000 at one point on Sunday night. Cryptocurrencies like Ethereum and Solana, increasingly viewed as indicators of investor sentiment, also saw significant declines. Over the last two weekends, there has been a clear selloff in all crypto markets. When traditional markets reopened on Monday, major indices faced broad declines, reflecting growing fears about macroeconomic instability and pressure from rising prices.

Despite the turmoil, Trump remained seemingly unshaken, posting on Truth Social: “Will there be some pain? Yes, maybe (and maybe not!).” His mention of “maybe not” suggests a willingness to negotiate, indicating that he might seek a more diplomatic approach. Following calls with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum, the implementation of the tariffs was postponed by a month. The outcome of these diplomatic efforts remains uncertain, but Trump continues to exert his influence, using this time to reshape trade agreements, mindful of his limited four-year term. For now, it seems avocados and Coronas are safe for Super Bowl gatherings.

Strong Themes Shine Through Market Volatility

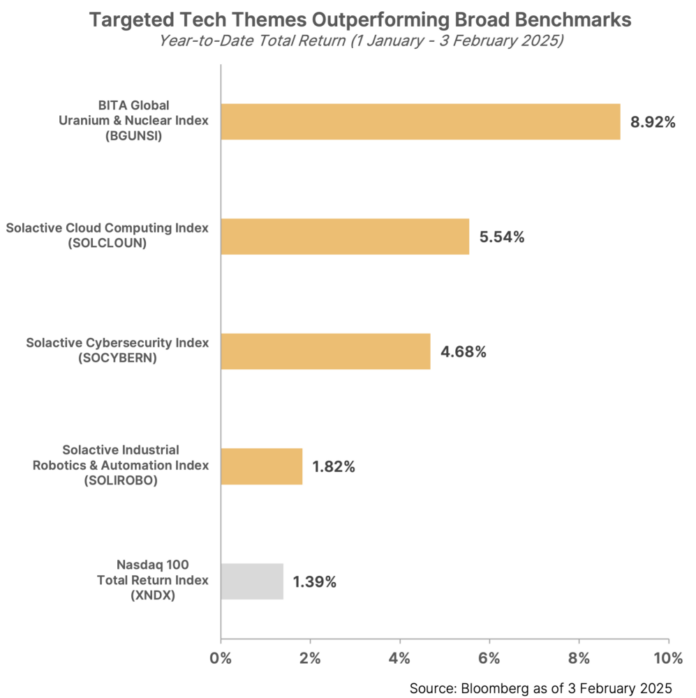

Despite the current market fluctuations, specific thematic and quality-focused strategies are outperforming broader indices this year. Sectors such as cloud computing, cybersecurity, robotics, and uranium/nuclear infrastructure have shown better returns than the Nasdaq 100 Index so far in 2023.

Furthermore, indices tracking global banks, European luxury brands, aerospace, defense, and US infrastructure have performed well against the S&P 500 Index this year. The resilience of these sectors hints at strong investor confidence in federal funding, particularly in light of potential spending cuts.

Indices that emphasize quality factors, such as free cash flow yield and pricing power, are also outperforming their benchmarks. In a scenario where trade tensions escalate and costs increase, firms with robust cash flow and pricing authority might weather challenges better than others.

Additionally, concerns about the economy have prompted a rise in precious metals, with gold surpassing $2,800 per ounce recently. Indices for gold and silver miners have outperformed the price movements of the metals themselves, indicating strong sector performance.

Highlighted Investment Opportunities

ARM Holdings (ARM): ARM is set to release its earnings on Wednesday, and the anticipation is high. Following the Stargate investment announcement, ARM’s focus on power-efficient designs is critical for technology reliant sectors. Although ARM does not manufacture chips, it licenses technology that enhances chip performance and efficiency. Their technology is widely used across various applications, from smartphones to robotics. Strong partnerships with companies like Nvidia and Apple further indicate their importance in the industry.

Advanced Micro Devices (AMD): AMD continues to gain recognition in the GPU chip market. With ongoing capital expenditures in AI and data centers, focus on software has renewed interest in AMD. Investors are keen to see if the company has gained market share and whether revenue growth can stimulate confidence despite recent stock price declines.

MicroStrategy (MSTR): With a strategy focused on Bitcoin, MicroStrategy, under Michael Saylor’s leadership, aims to enhance shareholder value through cryptocurrency investments. Currently, MSTR holds 471,107 BTC, acquired at an average price of $62,473. According to Bitcoin Treasuries by BiTBO, investors await updates on Saylor’s plans for the Bitcoin market, including potential institutional interest and strategies for leveraging their holdings.

Palantir (PLTR): In recent years, some analysts have criticized Palantir as being overvalued. However, current developments and market trends may present new narratives for investment.

“““html

Palantir Surges on Strong Earnings Amid AI Boom

Investors flocked to Palantir’s stock following its earnings call, drawn in by what CEO Alex Karp labeled as “untamed organic demand.” The company reported outstanding revenue and earnings, leading its share price to soar to over $100 per share in pre-market trading on Tuesday morning. Once viewed mainly as a provider of national security services for the government, Palantir is rapidly broadening its enterprise revenue streams. With ongoing advancements in AI and a steady demand for security worldwide, Palantir is well-positioned to boost its market presence.

Alphabet (Google): Although Alphabet entered the AI market later than some competitors, it has quickly made significant progress. AI features in Google Search are starting to show their value, with a key focus on ad revenue—expected to grow by 9.5% in the upcoming fourth-quarter report. While the company’s cloud division is gaining attention, search remains its most valuable asset. To maintain growth, Alphabet needs to keep its lead in search while effectively incorporating AI. Notably, Alphabet’s cloud business experienced a 35% increase last quarter, outpacing Amazon and Microsoft, though it’s important to note that it started from a smaller base. Future investments are anticipated, but efficient operations so far have bolstered strong profits. Balancing growth with cost control will be essential in upcoming quarters.

Amazon (AMZN): Amazon finished the third quarter with promising results last November, setting a favorable stage for its forthcoming fourth-quarter earnings. The performance of AWS will heavily influence market sentiment; any growth exceeding 19% will likely be favorably received. Investors are also eager to hear about AWS’s AI projects and the significant investments Amazon has made in AI technology. Additionally, Amazon’s e-commerce branch—often overshadowed by AWS—shows signs of revival. Initiatives like the ‘Amazon Haul’ discount storefront are expanding its reach. Should Amazon enhance its automation efforts further, the potential for significant profit margins may increase.

Major US Economic Reports & Federal Reserve System Speakers (Times in EST)

TUESDAY, FEB. 4

- 10:00 am Job openings

- 10:00 am Factory orders

- 11:00 am Atlanta Fed President Raphael Bostic discusses housing

- 2:00 pm San Francisco Fed President Daly speaks

- 7:30 pm Federal Reserve Vice Chairman Philip Jefferson speaks

WEDNESDAY, FEB. 5

- 8:15 am ADP employment

- 8:30 am U.S. trade deficit

- 9:00 am Richmond Fed President Tom Barkin speaks

- 9:45 am S&P final U.S. services PMI

- 10:00 am ISM services

- 1:00 pm Chicago Fed President Goolsbee speaks

- 3:00 pm Fed Governor Michelle Bowman speaks

- 7:30 pm Fed Vice Chairman Philip Jefferson speaks

THURSDAY, FEB. 6

- 8:30 am Initial jobless claims

- 8:30 am U.S. productivity

- 2:30 pm Fed Governor Christopher Waller speaks

- 5:10 pm Dallas Fed President Lorie Logan speaks

FRIDAY, FEB. 7

- 8:30 am U.S. employment report

- 8:30 am U.S. unemployment rate

- 8:30 am U.S. hourly wages

- 8:30 am Year-over-year hourly wages

- 9:25 am Fed Governor Michelle Bowman speaks

- 10:00 am Wholesale inventories

- 10:00 am Consumer sentiment (prelim)

- 3:00 pm Consumer credit

Source: MarketWatch.com, US Economic Calendar

Disclosures:

*Source: Bloomberg as of 3 February 2025

Themes Management Company LLC serves as an adviser to the Themes ETFs Trust. The funds are distributed by ALPS Distributors, Inc (1290 Broadway, Suite 1000, Denver, Colorado 80203). Themes ETFs are not sponsored, endorsed, issued, sold, or promoted by these entities, nor do these entities make any representations regarding the advisability of investing in the Themes ETFs. Neither ALPS Distributors, Inc, Themes Management Company LLC nor Themes ETFs are affiliated with these entities.

This report is for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation, or recommendation regarding any transaction, nor should it be regarded as legal, investment, or tax advice. Recipients should not use this information as a substitute for obtaining specific legal or tax advice from their advisors. References to specific securities and their issuers are purely illustrative and should not be seen as endorsements to buy or sell such securities. Indices and trademarks belong to their respective owners. Information is subject to change based on market conditions.

Some information here comes from third-party sources that have not been independently verified by Themes. While believed to be reliable, Themes does not guarantee the accuracy or completeness of this information. Themes is not obligated to update the information in the future.

Some content here includes “forward-looking statements,” identifiable by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or variations thereof. Due to various risks and uncertainties, actual outcomes may differ significantly from those indicated in forward-looking statements. This information should not be viewed as a promise or guarantee regarding future performance.

“`