Fidelity MSCI Industrials ETF: Analysts Predict Upside Potential

In our latest analysis at ETF Channel, we evaluated the Fidelity MSCI Industrials Index ETF (Symbol: FIDU) by comparing the trading prices of its underlying assets to the analysts’ average 12-month price targets. Our findings reveal an implied target price of $81.94 for the ETF.

Current Trading Position and Analyst Outlook

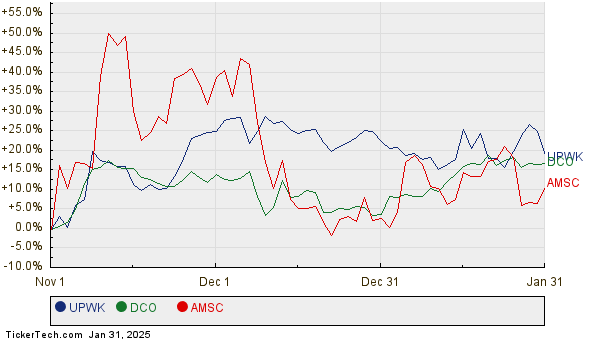

Currently, FIDU is trading at approximately $73.98 per unit. This suggests a promising upside of 10.76% based on analysts’ expectations for its components. Notably, three of its underlying assets, including Upwork Inc. (Symbol: UPWK), Ducommun Inc. (Symbol: DCO), and American Superconductor Corp. (Symbol: AMSC), show significant potential to exceed their projected target prices. Upwork’s recent trading price is $16.03, yet analysts forecast a rise to $18.73, indicating a 16.82% upside. For Ducommun, the stock is trading at $68.65, which is poised for an increase to $79.80, a potential gain of 16.24%. As for AMSC, analysts predict a climb from $27.31 to a target of $31.67, suggesting a 15.95% upside.

Below is a twelve-month price history chart showcasing the performance of UPWK, DCO, and AMSC:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Industrials Index ETF | FIDU | $73.98 | $81.94 | 10.76% |

| Upwork Inc | UPWK | $16.03 | $18.73 | 16.82% |

| Ducommun Inc. | DCO | $68.65 | $79.80 | 16.24% |

| American Superconductor Corp. | AMSC | $27.31 | $31.67 | 15.95% |

Analysts’ Targets: Optimism or Realism?

Considering these insights, one may wonder if analysts’ targets are realistic or overly optimistic. A higher target might reflect confidence in future performance, yet it could also lead to potential downgrades if current trends shift. Investors should perform additional research to determine the validity of these targets and how they align with recent developments in the respective companies and industries.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• URS Insider Buying

• IBCA Insider Buying

• Institutional Holders of UBER

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.