Flowers Foods: Navigating Growth and Challenges in the Bakery Sector

Flowers Foods, Inc. FLO has established itself as a significant player in the packaged bakery market, featuring well-known brands like Nature’s Own, Dave’s Killer Bread (“DKB”), and Wonder Bread. The company emphasizes brand innovation, operational efficiency, and strategic acquisitions to fuel its growth. However, Flowers Foods also faces a difficult consumer environment, alongside pressure on profit margins due to heightened promotional activities.

Key Elements Influencing FLO’s Growth

Staying true to its core priorities, Flowers Foods focuses on team development, brand enhancement, margin protection, and careful mergers and acquisitions. In recent years, FLO has aimed to shift towards a brand-oriented approach.

In the third quarter of 2024, flagship brands delivered solid results, with Nature’s Own and DKB achieving unit sales growth of 2% and 4%, respectively. Canyon Bakehouse also reported remarkable 11% unit growth, affirming its stronghold in the gluten-free market. These advancements highlight the company’s capacity to meet diverse consumer preferences, particularly those leaning towards healthier and higher-quality products.

Innovation is at the heart of Flowers Foods’ strategy. The introduction of keto-friendly products, such as Nature’s Own keto bread, has gained traction among consumers, significantly increasing market share in this segment. To build on this success, the company plans to roll out keto hamburger and hotdog buns in 2024 and 2025. Additionally, the upcoming national launch of Wonder-branded sweet baked goods and DKB snack bites reflects a strategic push into high-potential areas like indulgent snacks and healthier options.

Flowers Foods remains committed to its objectives, which include executing a portfolio strategy that phases out low-margin businesses in favor of more profitable opportunities, refining its cost structure, investing in brand growth to bolster volume and market share, enhancing product diversity, leveraging technology for improved data analysis, and investing in its workforce to optimize performance.

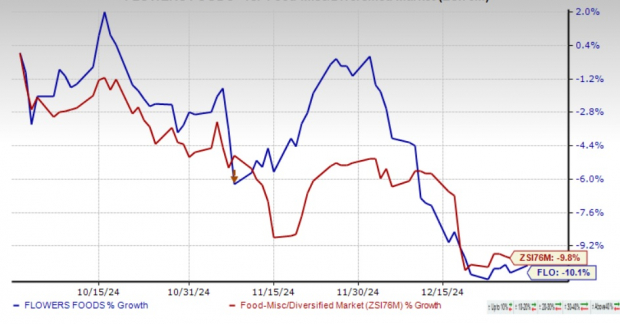

Image Source: Zacks Investment Research

Challenges Facing FLO

As Flowers Foods navigates a challenging consumer landscape characterized by shifting spending patterns and increased promotional efforts, these factors have adversely affected its performance in the third quarter of 2024. Although the broader food industry has benefited from a surge in at-home dining, Flowers Foods encounters specific hurdles within its core segments, notably packaged bread and cake.

The cake category has emerged as a continuous challenge, reflecting changing consumer tastes away from traditional products. With a focus on at-home dining, the foodservice sector is experiencing diminished demand, limiting Flowers Foods’ chances to leverage recovery in out-of-home dining sectors. In the realm of private labels, unit shares dropped by 40 basis points during the third quarter, in part due to shrinking price differences as promotional activities for branded goods intensified. These challenges emphasize the company’s reliance on underperforming segments, posing risks to consistent revenue growth.

The competitive landscape has further intensified, with greater promotional efforts squeezing profit margins. While Flowers Foods has successfully increased its adjusted EBITDA margin through pricing strategies and cost-saving measures, continued reliance on promotions may threaten its profitability. Additionally, inflationary trends affecting labor and raw materials remain significant challenges.

Final Thoughts on Flowers Foods

With a strategic focus on premium brands, innovation, and operational efficiency, Flowers Foods is well-positioned for long-term success. Nonetheless, the company must navigate weak segments and a competitive marketplace with precision. As FLO works to launch new products and refine its operations, its adaptability to evolving market preferences will be crucial to its future trajectory.

In recent months, FLO shares have declined by 10.1%, compared to a 9.8% drop in the broader industry.

Three Notable Consumer Staples Stocks

We spotlight three strong contenders from the Consumer Staples sector: Ingredion Incorporated INGR, Freshpet FRPT, and US Foods Holding Corp. USFD.

Ingredion Incorporated produces sweeteners, starches, and nutritional ingredients primarily from corn and other starches. The company currently holds a Zacks Rank #2 (Buy) and has recorded an average surprise of 9.5% over the last four quarters. Current earnings estimates suggest a growth of 12.4% from the previous year.

Freshpet, specializing in pet food, also carries a Zacks Rank #2. The company has a notable trailing surprise of 144.5% on average for its last four quarters, with projected sales and earnings growth of 27.2% and 228.6%, respectively.

US Foods engages in the distribution of food and non-food products to service customers across the U.S. Holding a Zacks Rank #2, it experienced a slight earnings surprise of 0.4% last quarter. However, estimates for current-year sales and earnings reflect growth of 6.4% and 18.6%, respectively.

Only $1 to Access All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering 30-day access to our entire list of picks for only $1. There’s no obligation to spend anything beyond that.

Thousands have taken advantage of this offer. Yet, others have hesitated, thinking there must be a catch. Indeed, we have our reasons. It allows you to explore our portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and others, which realized 228 positions with double- and triple-digit returns in 2023 alone.

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.