Why Amazon Outshines Costco for Future Investments

The late Charlie Munger, a renowned investor and Warren Buffett’s trusted partner, once had a strong appreciation for Costco Wholesale. Their straightforward business model—the collection of membership fees from satisfied shoppers—has made many investors wealthy.

Costco’s stock performance reflects this success, with shares returning over 570% in the last decade, significantly outperforming the S&P 500.

Nonetheless, I respectfully contend that there are better options available.

Consider Amazon (NASDAQ: AMZN), an e-commerce powerhouse. It has not only delivered an impressive 1,200% stock return in the past ten years, but since its launch in 1997, the company has increased its stock price by an eye-catching 193,000%. Looking ahead, it appears poised to continue outperforming Costco over the next decade.

Potential Slowdown for Costco

While Costco stands as a top-tier business, it faces challenges. With 76.2 million paying members and $254 billion in annual revenue, its model relies on low prices that yield very thin profit margins. A major portion of Costco’s profits stems from the membership fees charged to its customers.

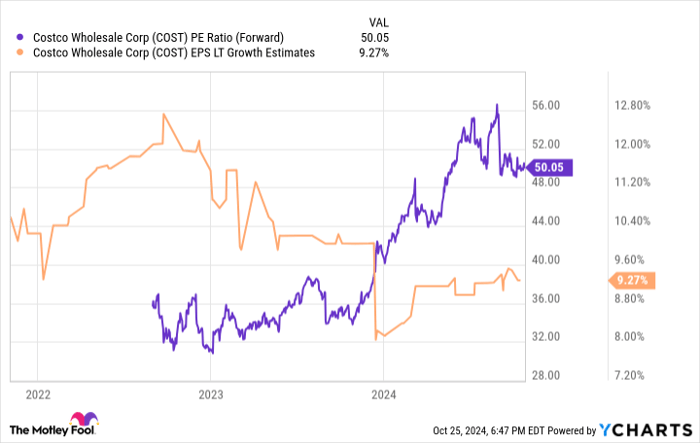

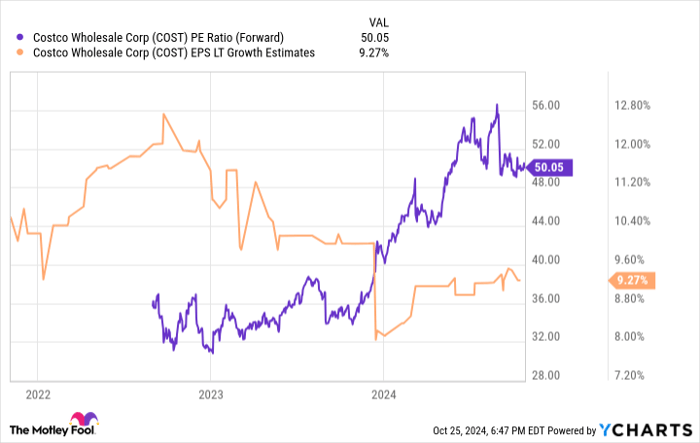

Consequently, Costco’s earnings growth largely hinges on expanding its member base. The company is not eager to hike membership fees, having just raised them for the first time in seven years this past September. In the latest quarter, membership numbers increased by 7.3% year-over-year. Long-term forecasts suggest Costco’s earnings could grow at an average of 9.3% annually:

COST PE ratio (forward) data by YCharts; EPS = earnings per share.

This growth estimate seems modest, particularly with Costco’s current price-to-earnings (P/E) ratio sitting at 50. Despite its quality, I question whether Costco’s stock can sustain this valuation. Typically, a healthy price/earnings-to-growth ratio (PEG) for a solid stock ranges from 2 to 2.5; however, Costco’s is currently at an alarming 5.4. As a result, the stock could face a sharp drop or could stagnate while the business catches up to its valuation.

Why Amazon Is Set to Thrive

Amazon mirrors Costco’s retail business by monetizing through low margins and paid memberships. While a Prime membership is not necessary to shop on Amazon, the benefits have attracted over 200 million subscribers.

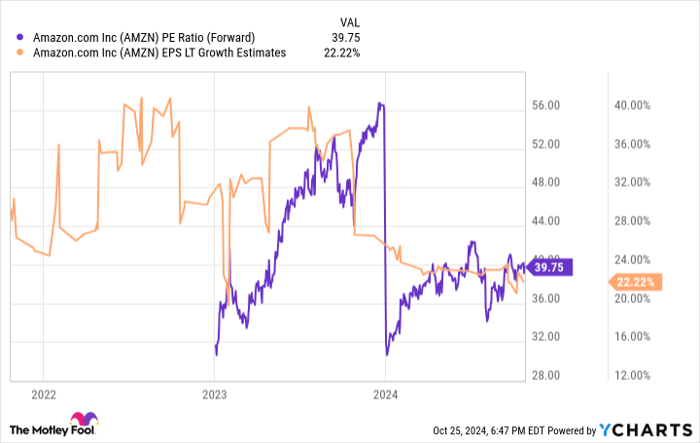

A crucial difference lies in Amazon’s stock performance. Currently, it trades at a forward P/E ratio of just under 40, with analysts projecting more than 22% annual earnings growth in the long term. This results in a PEG of 1.8, confidently within a reasonable range.

Even with a more cautious estimate of 16% earnings growth, the PEG ratio would stand at a manageable 2.5, which is not concerning for a company in growth mode.

AMZN PE ratio (forward); data by YCharts.

Costco, while notable for its efficiency, is growing at a slower pace compared to Amazon. This discrepancy likely cannot persist, which reinforces the case for Amazon as a superior investment moving forward.

Promising Long-Term Prospects for Amazon

It is relevant to explore why Amazon’s growth outpaces Costco’s. Two main factors illustrate this phenomenon.

First, Amazon dominates the online retail landscape, controlling approximately 40% of the U.S. e-commerce market. As shopping continues to shift online—propelled by an increase from 4.2% of total retail sales in 2010 to about 16% today—Amazon is well-positioned to capitalize on this ongoing trend.

Second, Amazon’s business extends beyond retail. Its cloud platform, Amazon Web Services, leads in global cloud computing, positioning it to benefit from the industry’s long-term growth. As more organizations transition to the cloud and artificial intelligence becomes increasingly prevalent, Amazon stands to gain immensely. Additionally, Amazon’s media and advertising segments are gaining momentum as well.

Over the past 30 years, few stocks have created more millionaires than Amazon, and it still presents a promising outlook. While Costco remains a strong contender, the numbers indicate that Amazon is the more attractive investment choice.

A New Chance for Wealthy Investments

Have you ever felt you missed out on buying some of the best stocks? If so, there is encouraging news.

Sometimes, our expert analysts put forth a recommendation known as a “Double Down” stock for companies poised for significant growth. If you’re concerned about missing the investment boat yet again, now might be the perfect moment to consider this opportunity. The following figures illustrate potential benefits:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,217!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,153!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $403,994!*

Currently, we are issuing “Double Down” alerts for three noteworthy companies, and this might be a rare chance to invest.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon and Costco Wholesale. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.