Investing in the Future: The Rise of Nuclear Energy

Zacks Thematic Screens allows you to explore 30 exciting investment themes that are shaping the future. Whether you’re keen on technology, renewable energy, or healthcare innovations, these themes are designed to align your investments with your interests.

If you’re interested in viewing the thematic lists, please click here >>> Thematic Screens – Zacks Investment Research.

Let’s examine the ‘Nuclear’ theme, highlighting stocks like Constellation Energy (CEG) and Vistra Corp (VST).

Nuclear Energy’s Growing Influence

Nuclear energy is crucial for the global shift towards a low-carbon and sustainable energy future. This investment theme consists of companies involved in uranium mining, constructing and maintaining nuclear reactors, and generating electricity from nuclear sources. It also includes businesses that provide essential technology and services to the nuclear sector.

CEG and Microsoft Partnership

Constellation Energy gained attention earlier this year when it announced plans to restart one of its nuclear plants in partnership with tech giant Microsoft. Microsoft will use the plant’s electricity to support its data centers, a necessary demand as AI technology proliferates.

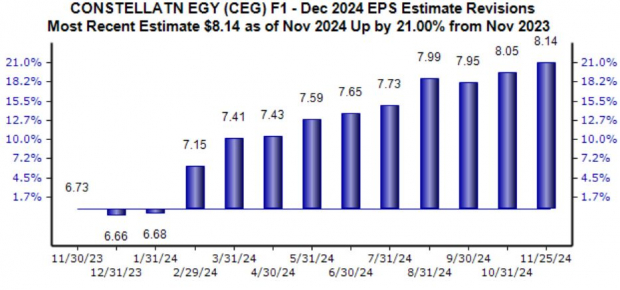

With a 130% increase in share price year-to-date, CEG significantly outperformed the S&P 500, which has risen 27% during the same period. The company’s outlook for the current fiscal year appears positive, with the Zacks Consensus EPS estimate of $8.14 indicating a 21% increase compared to last year and projecting a 60% growth rate year-over-year.

Image Source: Zacks Investment Research

Vistra Enhances Nuclear Operations

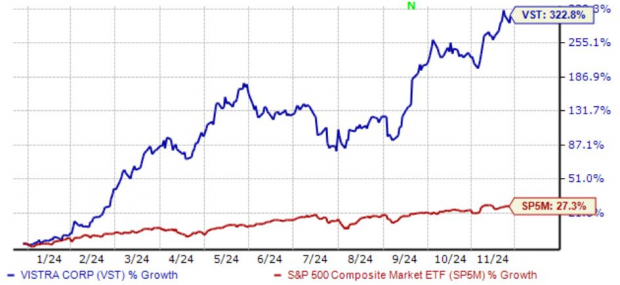

Vistra operates a diverse and efficient fleet, including natural gas, nuclear, coal, solar, and battery facilities. In 2024, the company’s stock has surged nearly 320%, significantly exceeding market averages.

Image Source: Zacks Investment Research

Earlier this year, Vistra completed the acquisition of Energy Harbor, adding over 4,000 MW of nuclear generation capacity and approximately one million retail customers. The company also secured two new power purchase agreements with Amazon and Microsoft, highlighting its strategic position.

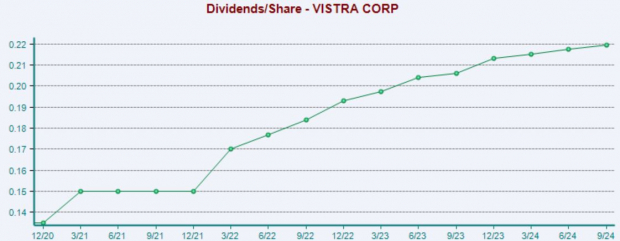

For income-seeking investors, Vistra’s impressive 14% annualized growth rate in dividends over the past five years is noteworthy and indicative of its commitment to shareholders. Below is a chart showing the company’s quarterly dividends.

Image Source: Zacks Investment Research

Final Thoughts

Thematic investing is an effective way to align portfolios with new trends. Both long-term and short-term themes influence which companies thrive as economies evolve.

While stocks in these themes may not be direct recommendations, they serve as a useful starting point. Investors can utilize the Zacks Rank and other metrics to select stocks that align with their strategies. Each featured stock comes with a Zacks report, providing tools to analyze performance and potential.

5 Stocks Set to Double

These stocks have been selected by a Zacks expert as the top picks expected to gain +100% or more in 2024. Previous recommendations have experienced impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks mentioned in this report remain under the radar of Wall Street, presenting a unique opportunity for investors.

To see these 5 potential home runs >>

Looking for the latest recommendations from Zacks Investment Research? Download the report: 5 Stocks Set to Double.

Constellation Energy Corporation (CEG): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.