Teradata Expands AI Solutions with Microsoft Partnership

Teradata Corporation TDC has announced that its AI Unlimited platform is now available for public preview through Microsoft’s MSFT Fabric Workload Hub.

This new serverless compute engine aims to boost the speed of AI innovations for businesses looking to integrate advanced analytics.

By utilizing Teradata’s ClearScape Analytics and AI capabilities, now part of Microsoft Fabric, the company positions itself well in the competitive AI and data analytics market.

This collaboration enhances Microsoft’s data analytics platform, helping users conduct AI projects more efficiently and at scale.

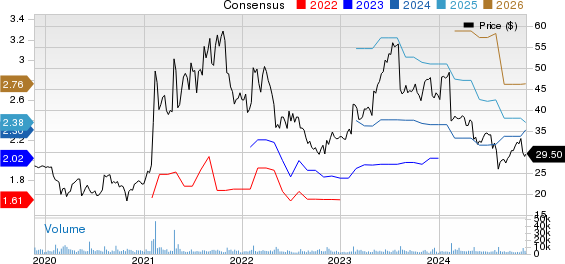

Current Financial Situation of Teradata Corporation

Teradata Corporation price-consensus-chart | Teradata Corporation Quote

Users can explore Teradata AI Unlimited via the Microsoft Fabric Workload Hub while safely operating within their existing Teradata systems.

The integration supports open data formats found in OneLake, ensuring better compatibility with other analytical tools.

Stock Performance Comparison

Year to date (YTD), TDC shares are down 32.2%. This contrasts sharply with the Zacks Computer & Technology Sector’s growth of 26.3% and the Zacks Computer-Storage Devices industry’s increase of 13.6%.

Key factors contributing to the decline include slower revenue growth and fierce competition from Oracle ORCL and Snowflake SNOW, both aggressively enhancing their cloud and analytics products.

While Teradata has not fully captured the growing market for cloud data analytics, its stock has still managed to outperform Snowflake, which is down 34.5% YTD, compared to Oracle’s strong 79.2% return.

Future Prospects in Cloud and AI Solutions

Teradata continues to offer strong analytical solutions through its Teradata Vantage platform, which includes VantageCloud and ClearScape Analytics. This powerful combination provides speed, scale, and security across various environments, whether on-premises, in public or private clouds, or hybrid setups.

The company is optimistic, particularly about its cloud business, which saw public cloud annual recurring revenues increase by 26% year over year to $570 million, largely due to high demand for its VantageCloud and ClearScape Analytics products.

Its enhancements in AI capabilities, spotlighting improvements to ClearScape Analytics, further solidify Teradata’s role as a significant player in AI.

Moreover, the partnership with NVIDIA’s AI platform enhances its offerings by providing scalable AI capabilities, enabling clients to process extensive datasets effectively.

These developments are part of Teradata’s broad strategy to become a trusted AI partner for its clientele as the demand for AI-driven analytics rises.

FY24 Earnings Estimates on the Rise

For the fiscal year 2024, Teradata projects non-GAAP earnings between $2.30 and $2.34 per share, with total revenues expected to decline by 2-4% from the previous year’s figures.

The Zacks Consensus Estimate for 2024 revenues is set at $1.75 billion, suggesting a 4.41% decrease from the prior year.

For earnings, the consensus stands at $2.30 per share, which represents a 2.68% increase over the last 30 days and an 11.11% jump year-over-year.

Current Market Sentiment of Teradata

Currently, TDC holds a Zacks Rank #2 (Buy).

You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Notable Stock Picks from Zacks

Our experts have identified five stocks with the potential to gain +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian highlights one company that stands out.

This top choice is recognized as one of the most innovative financial firms, boasting a fast-expanding customer base of over 50 million and a diverse range of cutting-edge solutions, positioning it well for significant growth. Although not every pick succeeds, this one has the potential to outperform earlier Zacks’ recommendations such as Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Teradata Corporation (TDC): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Snowflake Inc. (SNOW): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.