Trump Media & Technology Stock Climbs Amid Election Anticipation

Shares of Trump Media & Technology(NASDAQ: DJT) surged last month as investors speculated on a potential Trump victory in Tuesday’s election. The former president’s improving poll numbers heightened expectations, with betting markets reflecting an increasing chance of his win.

The parent company of the Truth Social app expanded its reach by launching the Truth+ streaming service on various platforms, including iOS, Android, and the web, indicating a diversification strategy beyond social media.

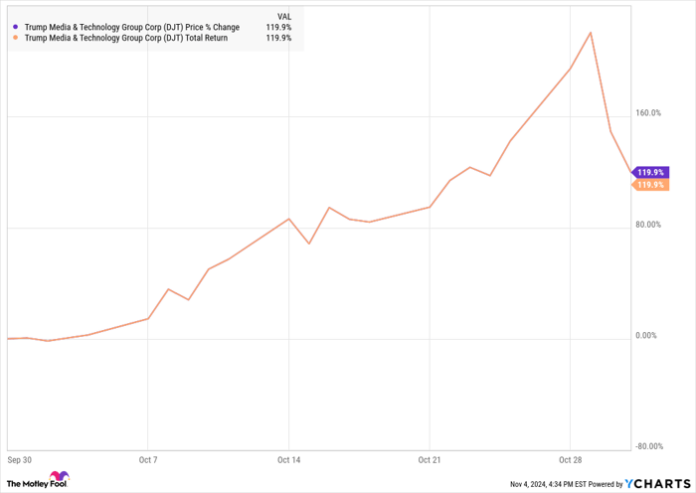

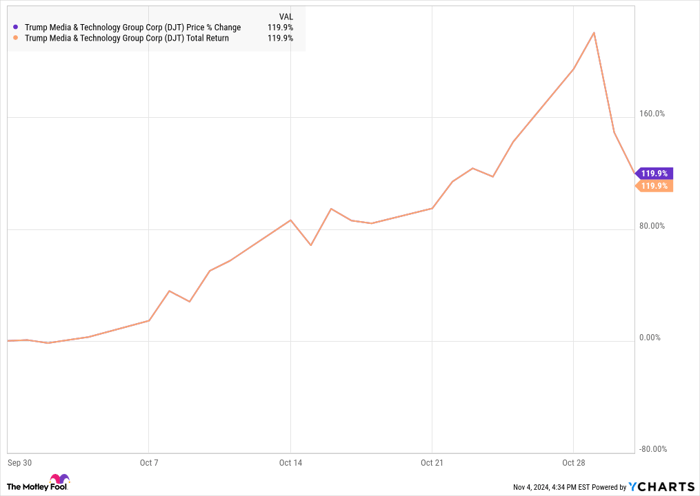

The primary driver of the stock’s 120% gain for the month, according to S&P Global Market Intelligence, was speculative betting on Trump’s electoral success. As illustrated in the accompanying chart, while the stock experienced a significant rise through much of the month, it did lose some value towards the end.

DJT data by YCharts

Connection Between Trump’s Candidacy and Stock Performance

The stock’s performance has become closely linked to Trump’s prospects in the presidential race. Currently, Trump Media & Technology has limited offerings for investors, as its quarterly revenue remains under $1 million. The recent vice presidential debate showcased Trump’s running mate, JD Vance, performing well, which may have contributed to bolstering support for Trump’s campaign.

In an intriguing display of confidence, a trader from France placed a bet exceeding $30 million on Trump’s victory after analyzing polling data on the betting site Polymarket.

A recent article from the New York Post suggested that part of Trump Media’s stock surge was fueled by speculation that Elon Musk might consider acquiring the company. Although Musk currently owns X (formerly Twitter) and spending billions on a struggling social media venture may seem unusual, his robust support for the Trump campaign could have prompted optimism among investors.

Image source: Getty Images.

Will Trump Media Maintain Its Market Gains?

Since reaching its recent peak, the stock has pulled back slightly. The well-regarded Selzer poll indicated that Vice President Harris was gaining ground in Iowa, a state previously considered secure for Trump, hinting at shifts in voter sentiment.

Anticipate substantial fluctuations in the stock on Wednesday, particularly in reaction to the election results. Even if the outcome remains undecided, movements on Tuesday may give insight into investor expectations based on exit polls.

Should Trump lose, the stock could decline significantly. Conversely, even with a win, the path to profitability for Trump Media remains uncertain amid a complex media landscape.

Considering an Investment in Trump Media & Technology Group?

Before making any investment in Trump Media & Technology Group, weigh this important information:

The Motley Fool Stock Advisor analyst team recently identified their selection of the 10 best stocks for investors, which notably did not include Trump Media. Their recommended stocks have the potential for substantial future returns.

For perspective, when Nvidia was listed on April 15, 2005, an investment of $1,000 then would now amount to $829,746!

The Stock Advisor program offers a straightforward plan for success, providing portfolio-building advice, regular updates from analysts, and two new stock recommendations every month. Since 2002, the service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.