Shares of GE Aerospace (NYSE: GE) have seen an impressive increase of over 63% in 2024, following the spinoff of GE Vernova in April, according to data provided by S&P Global Market Intelligence. This surge occurs amidst industry concerns about potential declines in original equipment (OE) sales, particularly as both Boeing and Airbus faced production challenges and supply chain disruptions impacting companies like GE.

Overview of GE Aerospace’s Performance in 2024

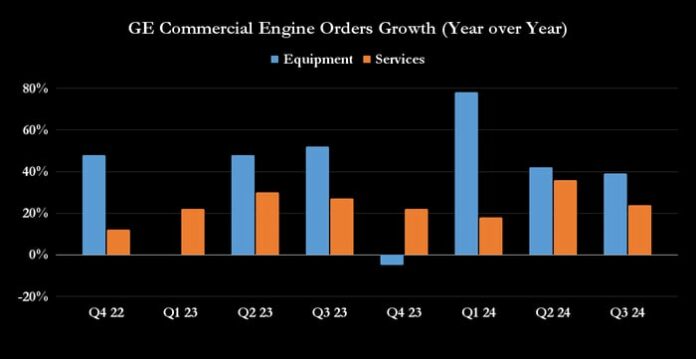

Despite pressures on OE production and sales, GE Aerospace found strength in its commercial aftermarket. Growth in flight departures and robust orders for engine equipment and services countered the earlier production shortfalls. Below are key data points highlighting these market dynamics.

Where should you invest $1,000 today? Analyst teams have identified the 10 best stocks to invest in now. See the 10 stocks »

GE’s commercial engine orders demonstrated exceptional resilience throughout the year, bouncing back despite previous delivery challenges. This is a point worth revisiting shortly.

Data source: GE Aerospace presentations. Chart by author.

Impressive service order performance, which generally has higher margins compared to OE, encouraged GE’s management to raise its earnings guidance multiple times throughout the year. Initially set at a midpoint of $6.25 billion in operating profit, expectations were later revised upward to $6.8 billion.

|

Segment Profit |

January Guidance |

April Guidance |

July Guidance |

October Guidance |

|---|---|---|---|---|

|

Commercial Engines & Services (CES) |

$6 billion to $6.3 billion |

$6.1 billion to $6.4 billion |

$6.3 billion to $6.5 billion |

$6.6 billion to $6.8 billion |

|

Defense & Propulsion Technologies (DPT) |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

$1 billion to $1.3 billion |

|

Total GE Aerospace operating profit |

$6 billion to $6.5 billion |

$6.2 billion to $6.6 billion |

$6.5 billion to $6.8 billion |

$6.7 billion to $6.9 billion |

Data source: GE presentations.

Looking Ahead: What to Expect for GE in 2025

While 2024 presented challenges, GE’s joint venture, CFM International, is actively engaged in producing the LEAP engine for the Boeing 737 MAX and Airbus A320 neo. Unfortunately, LEAP engine deliveries fell far below anticipated estimates for 2024. New engines often involve initial losses, but GE places value on expanding its installed engine base to promote future service growth.

|

Metric |

January Guidance |

April Guidance |

July Guidance |

October Guidance |

|---|---|---|---|---|

|

LEAP delivery growth |

20%-25% |

10%-15% |

0-5% |

Down 10% |

Data source: GE Aerospace presentations.

GE Aerospace’s Outlook for 2025

Word is that GE is well-positioned in service offerings for 2025. Nonetheless, margins could feel pressure due to the necessity of increasing LEAP deliveries. Furthermore, recent earnings calls indicated cautious guidance in the defense segment, hinting at possible margin challenges. Investors may look for mixed signals in guidance for the upcoming year.

Is Now the Right Time to Invest $1,000 in GE Aerospace?

Considering an investment in GE Aerospace? Here are some points to ponder:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks available right now, and GE Aerospace is notably not on that list. The chosen stocks have the potential for significant returns in the next few years.

Reflect on Nvidia’s past performance; when it made the advisory list on April 15, 2005, investing $1,000 at that time could have returned an extraordinary $858,852!*

Stock Advisor offers investors a clear path to success, with strategies for portfolio building, timely updates from analysts, and two new stock recommendations each month. The service has reportedly more than quadrupled the return of the S&P 500 since its inception in 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends GE Aerospace. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.