Understanding High Yield Stocks

High dividend-yielding stocks above 10% may seem attractive for income-seeking investors initially. However, the complexity arises as yields fluctuate with share price movements. Investors must beware of ‘dividend traps’ where high yields result from poor share performance, posing a risk to initial investments.

Special Dividends, occasional substantial payouts by firms during profitable periods, add another layer of complexity to dividend analysis.

The Appeal of Dividend Aristocrats

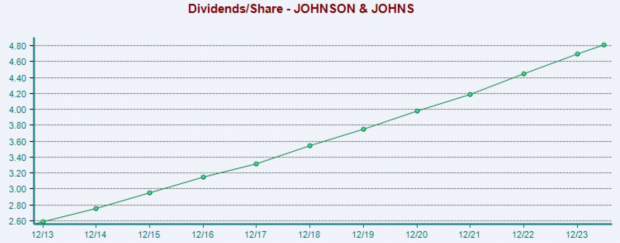

Investors valuing reliability often turn to Dividend Aristocrats, companies that have raised dividends for 25+ consecutive years. Members like Johnson & Johnson (JNJ), Coca-Cola (KO), and Procter & Gamble (PG) provide stability.

Annual yields for these companies are as follows:

Johnson & Johnson (JNJ): 3.2%

Coca-Cola (KO): 2.8%

Procter & Gamble (PG): 2.4%

Considering Investment Strategies

Though high yield stocks offer tempting returns, prudent investors must balance yield with stability and growth potential. Special caution is advised when high yields result from price declines, as they may not be sustainable in the long term.

Expert Insights

For tailored investment advice, consider consulting financial experts and reputable research sources like Zacks Investment Research.