Meta Platforms Seizes AI Opportunities as Advertising Growth Soars

With the rise of artificial intelligence, many companies are accelerating their growth. Notably, Meta Platforms (NASDAQ: META) is making significant strides by integrating AI into its advertising strategies, positioning itself for a brighter future.

Meta Platforms Reaps Benefits from AI Investments

On October 30, Meta Platforms reported its third-quarter 2024 earnings, showing a revenue increase of 10% year-over-year to $40.6 billion. The non-GAAP earnings per share surged by 37% to reach $6.03, exceeding Wall Street expectations of $5.25 per share on revenue of $40.3 billion.

The company’s growth can be attributed to a rise in ad impressions and an increase in ad prices. Specifically, ad impressions rose by 7%, while the average price per ad jumped by 11%. This strong earnings report also reflects Meta’s prudent cost management, which saw expenses rise by only 14% year-over-year to $23.2 billion.

Interestingly, despite these robust results, Meta’s stock fell by 4% post-earnings. The decline was attributed to management’s announcement of increased capital spending, raising the budget for 2024 from $37 billion – $40 billion to $38 billion – $40 billion.

During the earnings call, management noted that investors should anticipate significant growth in capital expenditures for 2025. With a planned increase of 39% in 2024 from last year’s $28 billion spend, this raised some concerns among investors regarding the potential impact on profitability.

Long-Term Vision: Building an AI Infrastructure

Looking beyond immediate spending figures, it’s important to focus on the long-term benefits of these investments. Mark Zuckerberg, CEO of Meta, emphasized the need for substantial infrastructure to support AI. He expressed confidence that these investments would lead to new opportunities that could significantly enhance earnings over the coming years.

Already, AI is positively influencing the advertising sector, Meta’s core business. AI-driven content has resulted in an 8% increase in user engagement on Facebook and a 6% increase on Instagram. This uptick positions Meta to capture a larger share of advertising budgets, driving up both ad impressions and prices.

Moreover, advertisers are increasingly utilizing Meta’s generative AI tools; over 1 million advertisers created more than 15 million ads in October alone. Notably, businesses leveraging AI for image generation have seen a 7% rise in conversions.

Meta’s user base also continues to grow, boasting 3.29 billion daily active users in September 2024—up 5% from the previous year. This expanding audience makes the platform increasingly attractive to advertisers aiming to efficiently reach their target demographics.

For instance, advertisers using Meta’s Advantage+ shopping campaigns reported a 32% increase in return on ad spending. This platform automates aspects of ad campaigns, including targeting and placements, further enhancing advertising effectiveness.

Potential for Massive Growth Towards a $2 Trillion Valuation

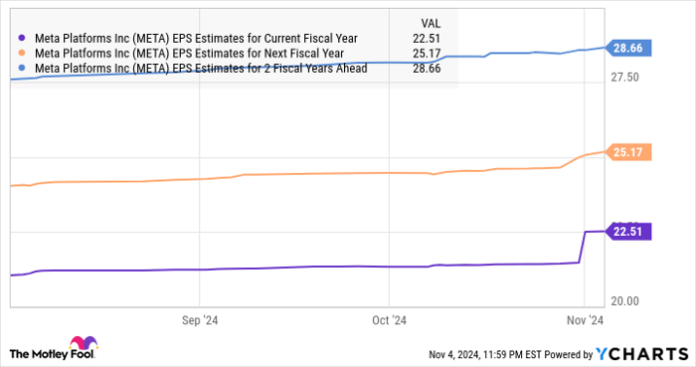

While Meta anticipates rising capital expenditures for 2025, analysts have adjusted their earnings forecasts positively. As shown in the chart below, expectations for Meta’s profitability have been upgraded significantly.

META EPS Estimates for Current Fiscal Year data by YCharts.

Analysts predict double-digit earnings growth for Meta in the next few years, with the possibility of even larger gains as AI tools offer enhanced returns to advertisers.

If Meta achieves earnings of $28.66 per share by 2026 and trades at 30 times forward earnings, similar to the Nasdaq-100 index average, its stock value could rise to $860. This would represent a potential increase of 53%, ultimately pushing Meta towards a $2 trillion valuation within three years.

Currently trading at 27 times earnings, Meta offers an appealing opportunity for investors. These figures underscore the potential for substantial returns in the foreseeable future.

Don’t Miss this Opportunity

If you’re worried about missing out on strong investment prospects, this might be the time to act. The expert team regularly identifies companies poised for significant growth—often referred to as a “Double Down” recommendation.

- Amazon: A $1,000 investment in 2010 would be worth $23,446!*

- Apple: A $1,000 investment in 2008 would be worth $42,982!*

- Netflix: A $1,000 investment in 2004 would be worth $428,758!*

At this moment, three new “Double Down” alerts have been issued, creating an exciting investment opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.