Salesforce’s Q3 Earnings: A Surge Fueled by AI Innovations

In its fiscal Q3 report released on Tuesday, Salesforce (CRM) showcased mixed results, yet investor excitement remained high. While earnings slightly missed analyst predictions, the company surpassed revenue expectations with a solid $9.44 billion, representing an 8% increase from the previous year. Operating cash flow jumped 29% year-over-year to $1.98 billion, while free cash flow rose 30% to reach $1.78 billion. The company also returned $1.6 billion to shareholders through buybacks and dividends during the quarter.

A key factor behind the stock’s impressive 11% rise following the earnings announcement was not only these figures but also the introduction of Agentforce, Salesforce’s new autonomous AI agents. This development reinforces Salesforce’s dedication to integrating artificial intelligence into its offerings, solidifying its position as a frontrunner in enterprise AI solutions.

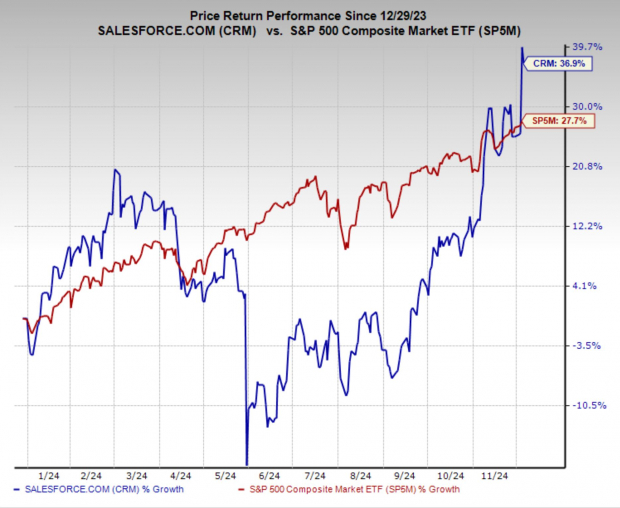

After facing challenges earlier this year, Salesforce has seen significant improvement, now outpacing the market in year-to-date performance. With innovations like Agentforce and broader AI initiatives, the company seems well-placed for continued growth and strong performance in the coming year. The role of AI is likely to be pivotal in shaping Salesforce’s trajectory.

Image Source: Zacks Investment Research

Understanding Agentforce: A Game Changer for Businesses

At the forefront of Salesforce’s AI transformation is Agentforce, a feature set to change how businesses engage with their data and clients. This allows companies to design customizable AI “agents”—virtual assistants that can manage specific tasks, such as sales coaching, customer service, and lead generation. These AI agents utilize generative AI and Salesforce’s Large Language Models (LLMs) to understand natural language requests. For instance, they can interpret customer inquiries and effectively respond with relevant actions.

Agentforce is engineered for versatility and scalability. It can manage simple support tasks, escalate issues to human staff when necessary, or resolve complex problems. Notably, users can create an AI agent without any coding skills—just by using natural language within an easy-to-use interface. For those seeking more tailored solutions, the platform permits advanced customizations through prompts, data flows, or API integrations, ensuring a personalized experience.

With Agentforce, Salesforce strengthens its position as a leader in enterprise AI, offering tools that enhance efficiency and enable businesses to tap into their data more effectively. As this technology develops, AI is set to be a crucial element in Salesforce’s ongoing growth and innovation.

Salesforce Earnings Analysis and Market Position

Salesforce currently holds a Zacks Rank #3 (Hold) rating, which indicates mixed earnings revisions among analysts. However, the recent platform advancements may lead to positive ratings, suggesting that now might be a good opportunity for potential investors. Regardless of any imminent earnings revisions, Salesforce remains an attractive investment option.

Earnings growth projections stand at an impressive 14.8% annually over the next three to five years, and during the earnings call, it was noted that free cash flow is anticipated to increase by 30% next year.

Currently, Salesforce’s valuation appears favorable, especially when considering its Free Cash Flow yield, which stands at 3.3%. This is notably above the overall market average and outpaces its 10-year median of 2.6%, with further increases expected in cash flow soon.

Image Source: Zacks Investment Research

Is It Time to Invest in CRM?

With its renewed emphasis on AI and strong earnings growth, Salesforce presents an appealing opportunity for investors. The launch of Agentforce reinforces its role as a leader in enterprise AI, making it likely that AI advancements will further propel innovation and revenue growth.

In this arena, Salesforce stands alongside tech titans like Microsoft (MSFT) and Alphabet (GOOGL), which are also heavily investing in AI technologies to maintain their competitive advantages. Microsoft’s incorporation of AI in its tools, such as Copilot within Microsoft 365, and Alphabet’s Vertex AI Agents highlight the rising significance of AI-driven solutions in revolutionizing business practices.

Moreover, Salesforce benefits from strong buying interest, having rebounded from prior underperformance to surpass market averages thus far in the year. For investors looking to engage with the AI wave, Salesforce proves to be a noteworthy option.

7 Stocks Poised for Growth in the Coming Month

New insights: Experts have identified 7 leading stocks from a pool of 220 Zacks Rank #1 Strong Buys, predicting these tickers to be “Most Likely for Early Price Pops.”

This selective list has historically outperformed the market by more than double since 1988, averaging gains of +24.1% per year. Don’t miss these top 7 stocks, which deserve your immediate attention.

See them now >>

Looking for the latest stock recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce Inc. (CRM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.