Buffett’s Apple Strategy: A Closer Look at Recent Moves

Many strategies promise wealth on Wall Street, yet few are as consistent as the approaches taken by Warren Buffett. Since taking control of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) in 1965, Buffett has led the company to achieve a remarkable 19.6% average annual stock gain over the last sixty years.

Buffett’s success contains no mysteries. Berkshire Hathaway holds an annual shareholder meeting that draws thousands of investors and submits its trading activity to the U.S. Securities and Exchange Commission every three months.

Start Your Mornings Smarter! Subscribe to Breakfast news for daily market updates. Sign Up For Free »

Recent disclosures showed Berkshire ended September with 300 million shares of Apple (NASDAQ: AAPL). Valued at $69.9 billion, Apple’s shares represented 26% of Berkshire’s equity portfolio.

While Apple is still Berkshire Hathaway’s largest holding, Buffett has been reducing this stake significantly. As of the third quarter of 2024, the company slashed its Apple shares by 25%, totaling a 66.5% decrease since the end of 2022.

Understanding Buffett’s Decision to Sell Apple Stock

Buffett would not keep Apple in his portfolio without confidence in the company’s growth potential. However, selling off more than half of its shares raises some eyebrows regarding his outlook.

The recent reduction in Apple stock primarily relates to its high market valuation, not concerns over the company’s fundamentals. Presently, Apple trades at approximately 31.7 times its trailing free cash flow, a valuation aligned with businesses showing consistent growth in profits. Given Apple’s recent performance, this does not accurately describe its current situation.

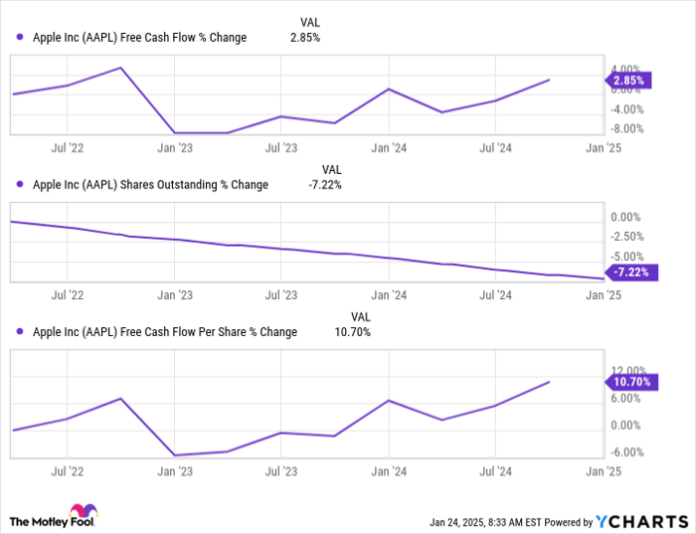

AAPL Free Cash Flow data by YCharts.

In the past three years, Apple’s revenue has only increased by 1.3%. Meanwhile, free cash flow per share has seen a 10.7% rise, bolstered primarily by the company’s stock buyback efforts. Altogether, free cash flow has merely grown by 2.9% during this timeframe.

Such a disparity between Apple’s high valuation and its subdued performance causes concern. A negative market reaction could lead to a significant drop in the stock price.

Free cash flow signifies the money a company can utilize for various purposes, such as paying dividends, reinvesting, reducing debt, or buying back shares. Apple amassed $108.8 billion in free cash flow over the past year, providing it with several options to maintain its earning per share growth.

Although sales of Apple devices are not rapidly increasing, the company is expanding its services for its vast customer base. Last year, Apple reported having over 2.2 billion active devices globally, with service sales to these users growing. In the fiscal fourth quarter alone, service sales climbed 12% from the previous year, now contributing 26% of total revenue.

The market for Apple’s services remains ripe for development, especially since many existing device owners have yet to subscribe to offerings like iCloud Storage, Apple Music, or Apple TV+. This focus on high-margin service sales suggests that earnings could continue to grow, albeit at a single-digit rate for the foreseeable future.

While there is a risk of Apple’s stock price dropping during broader market declines, its dividend payments are expected to keep rising. Currently, the stock provides a minimal 0.4% dividend yield, but the company could significantly increase this amount. In the past year, Apple has covered its dividend commitments with only 14% of the free cash flow it generated.

Is Now the Right Time to Buy Apple Stock?

Despite being Berkshire’s largest equity holding, purchasing Apple stock may not be wise for most investors at this time. While there are reasons to maintain some shares of Apple in a diversified portfolio, buying in at elevated valuations during a period of stagnant sales and profits poses risks.

Should you invest $1,000 in Apple right now?

Before making a decision on investing in Apple, consider this:

The Motley Fool Stock Advisor recently spotlighted the 10 best stocks for current investment… and Apple did not make the cut. The stocks chosen possess the potential for substantial returns in the upcoming years.

For instance, consider how Nvidia was featured on this list on April 15, 2005. If you had invested $1,000 at that time, you would now have $874,051!!

Stock Advisor offers investors a straightforward roadmap for success, with guidance on portfolio building, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.*

Learn more »

*Stock Advisor returns as of January 21, 2025

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends both Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.