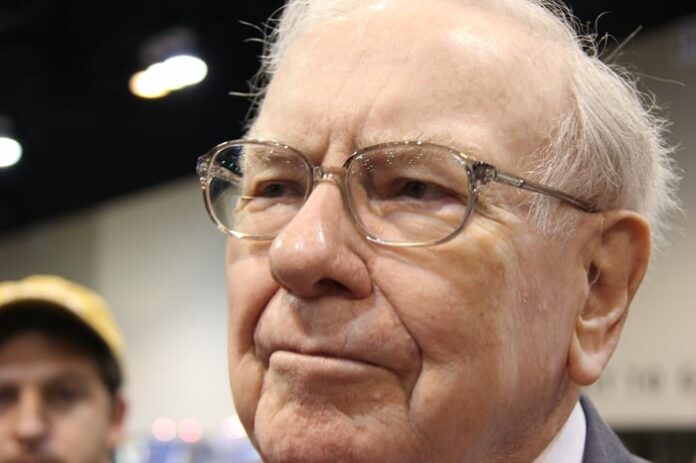

Unveiling Warren Buffett’s Hidden Assets: A Look at His Secret Portfolio

Warren Buffett’s investment strategies often spark curiosity. While the public knows about Berkshire Hathaway‘s major investments, there’s more beneath the surface.

In 1998, Berkshire Hathaway expanded its reach by acquiring General Re, a reinsurance company that also owns New England Asset Management (NEAM). This firm holds a distinct portfolio of over 100 stocks and exchange-traded funds (ETFs), with 21% designated as Buffett’s lesser-known investments in three significant ETFs.

Top Holding: SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust (NYSEMKT: SPY) claims a substantial 13.1% of NEAM’s overall holdings, establishing itself as Buffett’s primary secret investment. It’s also one of two ETFs featured in Berkshire Hathaway’s portfolio.

It may come as no surprise that the SPDR S&P 500 ETF Trust holds such a prominent position; it is the largest ETF globally by assets managed and is frequently among the most actively traded ETFs.

This ETF aims to mirror the performance of the S&P 500 index, comprising 503 stocks from leading U.S. companies such as Apple, Microsoft, Nvidia, and Amazon. The strong performance of these notable stocks—especially amid the growing interest in artificial intelligence—has contributed to a remarkable year-to-date gain of 27% for this ETF.

The second-largest holding in NEAM’s portfolio is the iShares Core MSCI EAFE ETF (NYSEMKT: IEFA), representing approximately 4.2% of total assets.

This ETF tracks the MSCI EAFE IMI Index. MSCI stands for Morgan Stanley Capital International, a leading investment research firm, while EAFE refers to Europe, Australasia, and the Far East. IMI indicates an Investable Market Index.

By focusing on stocks from these regions, the iShares Core MSCI EAFE ETF includes 2,682 stocks, with an equal weighting approach. Its largest position, Novo Nordisk, accounts for only 1.82% of the portfolio.

Third Largest Holding: Vanguard High Dividend Yield ETF

Next in line is the Vanguard High Dividend Yield ETF (NYSEMKT: VYM), which constitutes roughly 4% of NEAM’s holdings.

The fund’s mission is clear from its name: it seeks to match the performance of the FTSE High Dividend Yield Index. In total, it owns 537 stocks, offering a dividend yield of 2.49%. Major holdings include Broadcom, JPMorgan Chase, ExxonMobil, and Home Depot.

True to Vanguard’s reputation, this ETF is also a low-cost option, showcasing an attractive annual expense ratio of just 0.06%.

Outlook for 2025: Are These ETFs Worth Investing In?

The upcoming year may present challenges, making it difficult to foresee how these ETFs will perform. The potential policies of the incoming Trump administration, including steep tariffs or tax reforms, could significantly impact these investments. Particularly, the iShares Core MSCI EAFE ETF may be vulnerable to losses if trade tensions rise.

In spite of the uncertainty, all three ETFs have strong potential for long-term investment.

Opportunity Awaits: Don’t Miss Out

Consider this: Have you ever felt as though you’ve missed an opportunity to invest in top-performing stocks? If so, this is your moment.

Occasionally, our analysts identify a “Double Down” stock—an investment they believe is poised for growth. With historical returns speaking volumes:

- Nvidia: If you invested $1,000 back in 2009, your return would have been $338,103!*

- Apple: A 2008 investment of $1,000 would now be worth $48,005!*

- Netflix: Investing $1,000 in 2004 would yield an impressive $495,679!*

Currently, we’re highlighting three “Double Down” stocks, presenting a potential opportunity that may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of Motley Fool Money. Keith Speights has positions in Amazon, Apple, Berkshire Hathaway, ExxonMobil, and Microsoft. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Home Depot, JPMorgan Chase, Microsoft, Nvidia, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool recommends Broadcom and Novo Nordisk and endorses the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.