AI Boosts Digital Advertising: The Trade Desk’s Promising Growth Story

Artificial intelligence (AI) has transformed various industries, including semiconductors, cloud computing, and workplace collaboration software. From consumers to corporations and governments, the push for improved productivity through technology is evident.

The digital advertising sector has embraced AI to help advertisers reach their target audiences with greater efficiency. A recent report by Grand View Research forecasts that spending on AI tools in digital marketing could soar from $15.8 billion in 2023 to $82 billion by 2030, marking a compound annual growth rate of 26%.

This trend has contributed to the significant growth of The Trade Desk (NASDAQ: TTD), which operates a programmatic advertising platform. The company’s stock price has appreciated by 69% in 2024, backed by strong revenue and earnings growth. A third-quarter earnings report is set for Nov. 7, and expectations are high for another positive outcome. Here’s why.

Accelerated Growth in 2024

The Trade Desk provides a sophisticated ad platform that leverages data to enable brands and advertisers to purchase ad inventory and display ads in real-time across multiple media, including video, connected TV, mobile, and social networks.

Since 2016, the platform has integrated AI to streamline ad buying and maximize returns. Last year, the company introduced Kokai, an AI-driven platform that has yielded substantial results for its users, including an average 36% decrease in cost per click and a 34% reduction in cost per action.

Kokai’s capabilities include access to over 15 million ad impressions per second, enabling advertisers to optimize their campaigns to reach potential customers at the right time and price. Clients transitioning from the previous Solimar platform, launched in 2021, have reported a remarkable 70% increase in audience reach.

The company’s strategic focus on Kokai integration appears to be driving its growth, as reflected in its revenue of $1.08 billion during the first half of 2024, up 27% year over year, compared to a 22% increase in the same timeframe last year. Earnings also rose by 29% to $0.66 per share.

For the upcoming third quarter, The Trade Desk anticipates revenue of at least $618 million, representing a 25% year-on-year increase. Adjusted EBITDA is projected to rise from $200 million in Q3 2023 to $248 million, also nearly 25% growth.

Expectations may even be surpassed; management believes the total addressable market is around $1 trillion, indicating substantial growth potential. The company’s customer retention rate has exceeded 95% over the last decade, highlighting the appeal of its platform.

With AI becoming increasingly integrated, The Trade Desk is well-poised to attract more advertisers in the evolving market.

Promising Earnings Growth Ahead

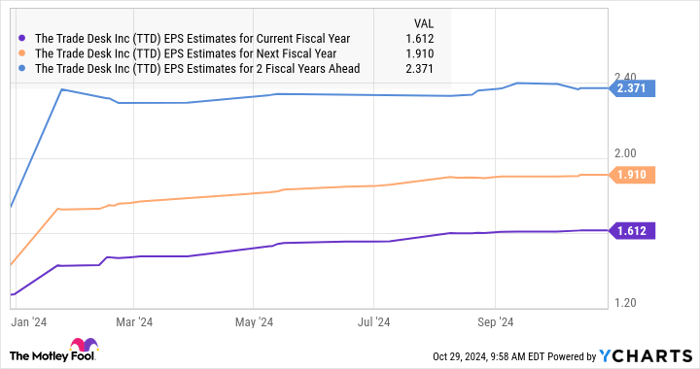

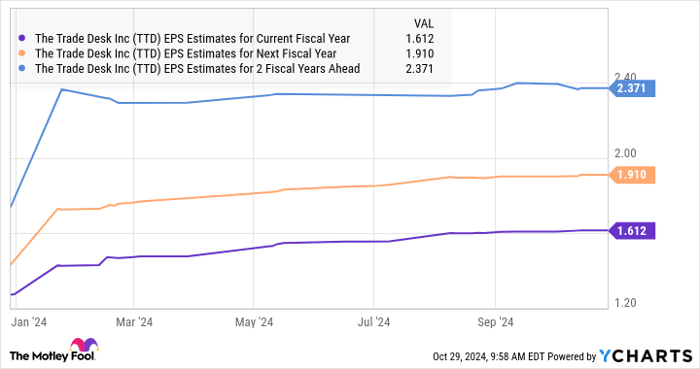

Analysts project that The Trade Desk will end 2024 with earnings per share of $1.61, a 28% increase over 2023. Growth is expected to moderate to 19% in 2025 but should rebound to 24% in 2026.

TTD EPS estimates for current fiscal year, data by YCharts.

Significantly, The Trade Desk’s earnings estimates for 2024 have risen, hinting at a potential for stronger-than-expected financial outcomes in the coming years. For those seeking promising growth stocks, The Trade Desk remains a compelling option within a large, expanding market.

A New Opportunity in the Market

Thinking you missed your chance to invest in successful stocks? You might find this interesting.

Occasionally, our expert analysts identify a “Double Down” stock recommendation, pinpointing companies poised for significant growth. If you believe you’ve missed your chance, now might be the perfect moment to invest:

- Amazon: A $1,000 investment made when we recommended it in 2010 would be worth $22,292 now!*

- Apple: A $1,000 investment from 2008 is now worth $42,169!*

- Netflix: A $1,000 investment made when we doubled down in 2004 would now be worth $407,758!*

At present, we’re issuing “Double Down” alerts for three amazing companies, and chances might not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends The Trade Desk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.