Alphabet’s Stealthy Ascent in the AI Landscape

Current hype surrounding artificial intelligence (AI) may be overstated. The stock market often reacts emotionally, swinging rapidly in response to both good and bad news. With AI stocks like Nvidia seeing prices surge tenfold over recent years, there is a potential for a market correction, especially since many of these stocks appear to be holding unrealistic expectations.

Despite this, the generative AI market is just beginning to show its potential. Analysts predict that spending on generative AI alone could soar to $356 billion by 2030, representing an annual growth rate of 46% over the next six years. This marks it as one of the fastest-growing sectors globally, up from an estimated $36 billion in spending this year. Given its high valuation, Nvidia already reflects much of this anticipated growth in its stock price.

Alphabet’s Strategic Rebound

Worries filled the air for Alphabet investors in late 2022. The explosive rise of ChatGPT and other advanced AI tools made many believe that Alphabet — the parent company of Google Search — might be trailing in AI development. As a result, its stock dropped to a price-to-earnings ratio (P/E) of nearly 15 in early 2023, its lowest earnings ratio in a decade.

However, since then, Alphabet has proven skeptics wrong. The stock has surged 90% since those early 2023 lows. Through its array of subsidiaries and research initiatives, Alphabet has either matched or surpassed every innovation from OpenAI and introduced exciting new AI products.

Among its innovative offerings is NotebookLM, a tool that summarizes documents both audibly and in writing on complex subjects. Another addition is Google Search AI summaries, which enhance the user experience of the world’s most widely used search engine. Additionally, the new Google Lens feature allows users to conduct searches using images instead of text, adding another dynamic to their suite of tools.

Alphabet has also made strides beyond generative AI. Its self-driving subsidiary, Waymo, now serves multiple cities across the United States and is on track to handle 100,000 rides each week, a tenfold increase compared to the previous year. This aspect of Alphabet’s business is often overlooked but is made possible by its AI leadership.

Capitalizing on Cloud Revenue Growth

In recent years, Alphabet has demonstrated that it is not just another tech company behind in AI innovation. Many might argue that the company has emerged as a clear frontrunner in the generative AI arena. But how will it capitalize on these advancements?

One promising avenue is through Google Cloud, Alphabet’s fastest-growing subsidiary. This cloud division harnesses all of Alphabet’s advancements in AI, computer technology, and data centers to offer solutions to other companies. Last quarter, Google Cloud reported revenue growth of 35% year over year, totaling $11.4 billion. If analyst predictions about generative AI spending hold true, this remarkable growth could continue long-term.

With expectations of reaching $100 billion in annual revenue and sustaining a 25% profit margin in the coming years, Google Cloud could generate $25 billion in operating earnings for Alphabet. This would represent a significant upgrade to its total of $105 billion in recent consolidated operating earnings.

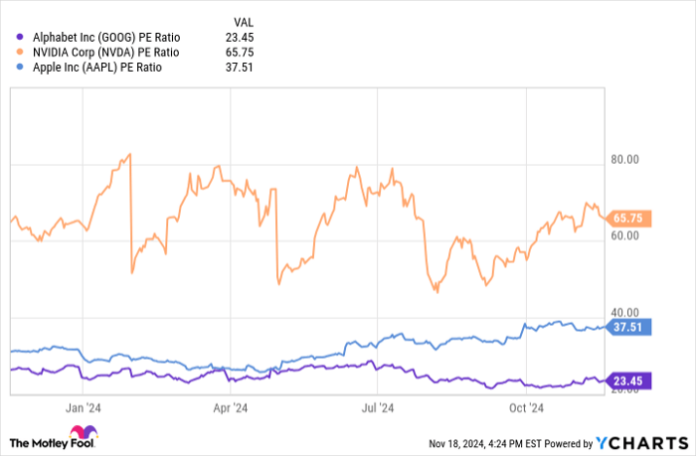

GOOG PE Ratio data by YCharts

Market Undervaluation of Alphabet

Despite Alphabet’s advancements in AI, reflected both in new products and strong financial results, its stock performance remains modest compared to other technology companies.

With a P/E of only 23, Alphabet stands out as one of the more affordably priced stocks in the AI and tech sector. In contrast, Nvidia commands a P/E of 66, while Apple — which is growing at a slower pace than Alphabet and has had limited success with AI offerings — trades at a P/E of 37.

As generative AI spending is poised for substantial increases through the decade, Alphabet is uniquely positioned to capture a significant share of this revenue through its diverse AI products and monetization strategies. Investors can currently purchase the stock at a P/E of 23, notably below the S&P 500 index average of 30. This presents an enticing opportunity for potential long-term investment gains.

Is Investing $1,000 in Alphabet a Smart Move Right Now?

Before making a purchase of Alphabet stock, take this into consideration:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks for investors to consider now… and Alphabet did not make the list. The stocks chosen for this list have the potential for impressive returns in the years ahead.

For perspective, when Nvidia was included on this list on April 15, 2005… if you had invested $1,000 at that time, it would be worth $869,885!*

Stock Advisor offers investors a simple roadmap to success, including portfolio-building strategies, ongoing analyst updates, and two new stock picks each month. Since its inception in 2002, Stock Advisor has outperformed the S&P 500 by more than four times.*

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer holds positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, and Nvidia. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.