Analyzing Lumentum Holdings: A Surging Stock Amid AI Demand

Lumentum Holdings (NASDAQ: LITE) may not be a widely recognized name in the investment community, but a look at its stock price over the last four and a half months reveals a stunning upward trend. The company specializes in the production and sale of optical and photonic components, which are essential for high-speed data transfers, as well as laser products used in various industrial applications. Recent increased demand for high-speed data transmission, particularly to support artificial intelligence (AI) tasks, has significantly boosted interest in Lumentum’s offerings.

Start Your Mornings Smarter! Get the latest insights with Breakfast news delivered to your inbox every market day. Sign Up For Free »

Since releasing its fiscal 2024 results on August 14, 2024, Lumentum’s shares have soared 84%. This article explores the factors behind this remarkable stock performance and whether it can maintain its momentum into 2025.

Lumentum’s Recovery Linked to AI Growth

In August, Lumentum reported its fiscal 2024 results, revealing a 23% decline in revenue, totaling $1.36 billion. Adjusted earnings also took a hit, dropping from $4.56 per share in fiscal 2023 to $1.01 per share. This downturn can be attributed to weakened demand in the industrial sector, where revenues fell 38%, equating to $274 million.

The cloud and networking segment, which generates about 80% of Lumentum’s revenue, also showed an 18% revenue decline due to reduced telecom demand. However, the fiscal Q1 results (ended September 28, 2024) hinted at a turnaround.

Revenue for the first quarter increased 6% year over year, reaching $337 million and surpassing the company’s guidance. A key contributor to this rebound was a 23% revenue rise in the cloud and networking sector, spurred by the growing demand for AI infrastructure.

For example, Lumentum’s management highlighted in August that its externally modulated lasers (EMLs)—crucial for high-speed data transmission through fiber optics—are now being adopted by several cloud and AI clients. The company achieved record EML shipments in this quarter and indicated sufficient booking levels to support operations through fiscal 2025.

Looking ahead, Lumentum anticipates a demand increase for EMLs by 30% to 40% this fiscal year and is significantly ramping up production to meet this need. With AI adoption, the company’s addressable market in the data center photonics sector is projected to grow from $4.5 billion in 2023 to $16 billion by 2028.

Analysts predict Lumentum’s growth will continue in the current quarter. The company expects to generate $390 million in revenue for fiscal Q2, up 6% from last year, with earnings anticipated at $0.35 per share, which is higher than the previous year’s $0.32 per share.

Given the strong backlog and the expanding AI networking market, don’t be surprised if Lumentum outperforms expectations in its 2025 results.

Future Growth Potential for Lumentum

Despite significant drops in revenue and earnings in fiscal 2024, Lumentum’s outlook remains bright for the next two years.

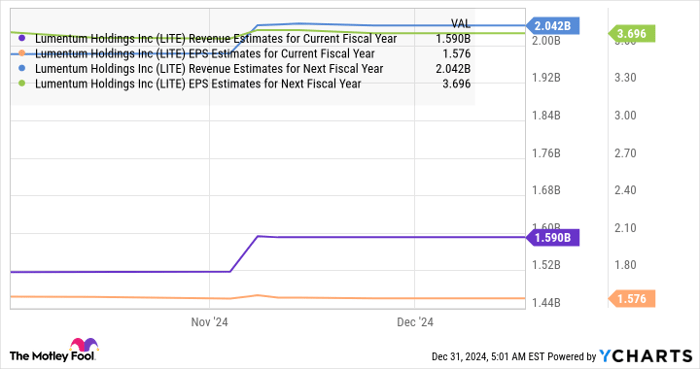

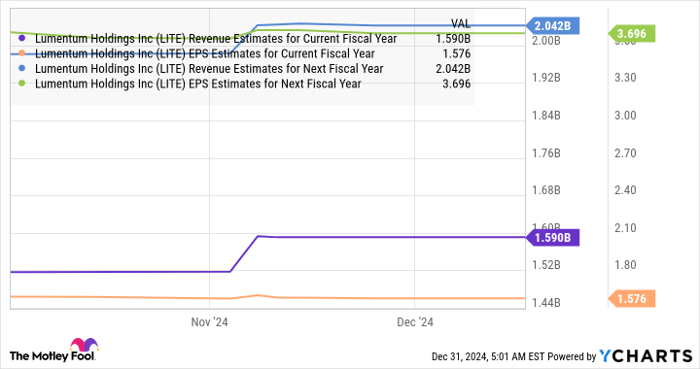

LITE Revenue Estimates for Current Fiscal Year data by YCharts.

The chart indicates that Lumentum’s earnings are expected to soar by 56% this fiscal year, followed by a dramatic 134% rise in fiscal 2026. If the company achieves $3.70 per share in earnings and trades in line with the tech-heavy Nasdaq-100 index at 33 times earnings, its stock price could reach $122, marking a 47% increase from current levels. This suggests that even investors who have missed previous gains might still consider Lumentum as a viable option for future investment.

Is It Time to Invest $1,000 in Lumentum?

Before investing in Lumentum, it is important to think critically about your options:

The Motley Fool Stock Advisor team recently highlighted what they believe are the 10 best stocks for investment right now, and Lumentum didn’t make the list. Those selected may have the potential for substantial returns in the near future.

For example, consider that when Nvidia was featured on this list on April 15, 2005, a $1,000 investment would now be worth $823,000!*

Stock Advisor offers an easy-to-follow strategy that includes guidance on portfolio building, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has delivered returns more than quadruple that of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool recommends Lumentum. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.