Exxon Mobil Posts Mixed Q3 Earnings, Surges in Production

Exxon Mobil Corporation XOM released its earnings for the third quarter of 2024, reporting earnings per share of $1.92 (excluding identified items), which slightly exceeded the Zacks Consensus Estimate of $1.91. However, this figure reflected a decline from $2.27 from the same quarter last year.

The company’s total revenues for the quarter were reported at $90 billion, falling short of the Zacks Consensus Estimate of $93.5 billion. When compared year-over-year, this figure also shows a decline from $90.8 billion.

The better-than-expected earnings were mainly a result of record liquids production in the upstream segment and improved performance in the Chemical Products sector. These gains were somewhat offset by declining commodity prices and weaker refining margins.

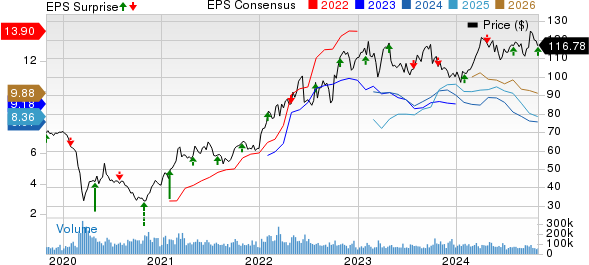

Exxon Mobil Corporation Price, Consensus and EPS Surprise

Exxon Mobil Corporation price-consensus-eps-surprise-chart | Exxon Mobil Corporation Quote

Operational Performance Overview

Upstream Segment

Earnings from the upstream segment (excluding identified items) stood at $6.2 billion, a slight increase from $6.1 billion last year, primarily fueled by production growth in Guyana and the Permian Basin, along with contributions from the company’s Pioneer acquisition and cost savings.

In the U.S., the upstream operations recorded a profit of $1.7 billion, down from $2.4 billion in the same quarter of the previous year. Non-U.S. operations showed a profit of $4.5 billion, slightly lower than the $4.6 billion reported last year.

Production Rates: ExxonMobil’s total production averaged 4,582 thousand barrels of oil equivalent per day (MBoe/d), an increase from 3,688 MBoe/d in the previous year and above our estimate of 4,499.2 MBoe/d.

Liquids production rose to 3,187 thousand barrels per day (MBbls/d), up from 2,397 MBbls/d during the same period last year, driven by increases in the U.S., Canada, and Asia.

Natural gas production reached 8,369 million cubic feet per day (Mmcf/d), compared to 7,748 Mmcf/d from the year-ago quarter, thanks to higher output from the U.S. and Europe.

Price Realization: In the U.S., ExxonMobil saw crude price realization drop to $72.94 per barrel, down from $80.45 a year ago and below our estimated $76.22. For non-U.S. operations, the crude price realization decreased to $73.07 per barrel from $77.48. The price for natural gas in the U.S. was $1.16 per thousand cubic feet (Mcf), falling from $2.30, and also missing our estimate of $1.67 per Mcf. In non-U.S. markets, the price slipped to $10.13 per Mcf from $10.50, again below our estimate of $10.88.

Energy Products: Profits in this segment (excluding identified items) were reported at $1.3 billion, down from $2.5 billion last year. This decline was primarily linked to significantly lower refining margins and scheduled maintenance activities during the quarter.

Chemical Products: This segment performed better, recording a profit of $893 million (excluding identified items), up from $249 million a year ago and surpassing our estimate of $539.7 million. The growth was driven by effective cost management and increased sales of high-value products.

Specialty Products: This unit posted a profit of $794 million (excluding identified items), increasing from $619 million in the previous year and exceeding our estimate of $638.9 million. Improvements were attributed to cost reductions and higher sales volumes.

Financial Highlights

ExxonMobil generated $17.7 billion in cash flow from operations and asset divestments during the quarter, with capital and exploration spending totaling $7.16 billion.

As of now, total cash and cash equivalents stand at $26.9 billion, while long-term debt is reported at $36.9 billion.

Current Zacks Ranking and Stock Picks

As of now, XOM holds a Zacks Rank #3 (Hold).

In the energy sector, stocks with better rankings include Archrock Inc. AROC, The Williams Companies, Inc. WMB, and FuelCell Energy FCEL. Archrock has a Zacks Rank #1 (Strong Buy), while The Williams Companies and FuelCell Energy both have a Rank #2 (Buy).

Archrock focuses on energy infrastructure, specializing in midstream natural gas compression services.

The Williams Companies, Inc. is a leader in energy infrastructure in North America, with operations involving the transportation and processing of natural gas and liquids.

FuelCell Energy creates low-carbon energy solutions using various fuel sources, aiming to reduce carbon emissions in power generation.

Zacks’ Research Chief Reveals “Top Stock to Watch”

Experts from our team have identified 5 stocks with strong potential for significant gains. Among these, Director of Research Sheraz Mian has singled out one stock as particularly promising.

This standout stock is from an innovative financial firm rapidly expanding its customer base and offering cutting-edge solutions. While not all picks pan out, this one could outperform earlier notable successes like Nano-X Imaging, which surged by +129.6% in under nine months.

Free: See Our Top Stock And 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Williams Companies, Inc. (The) (WMB) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

FuelCell Energy, Inc. (FCEL) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.