General Motors: A Remarkable Turnaround Driving Future Growth

General Motors (NYSE: GM) deserves more recognition for its impressive recovery since the financial crisis and Great Recession. In contrast, Ford Motor Company (NYSE: F) received significant praise for navigating the recession without government aid. Ford quickly adapted, launching appealing products and returning to robust profits.

Today, it appears the tide has turned, with GM showing strong momentum as 2024 unfolds. Recent projections are generating optimism among investors regarding GM’s potential for growth over the next decade.

GM’s Software Strategy

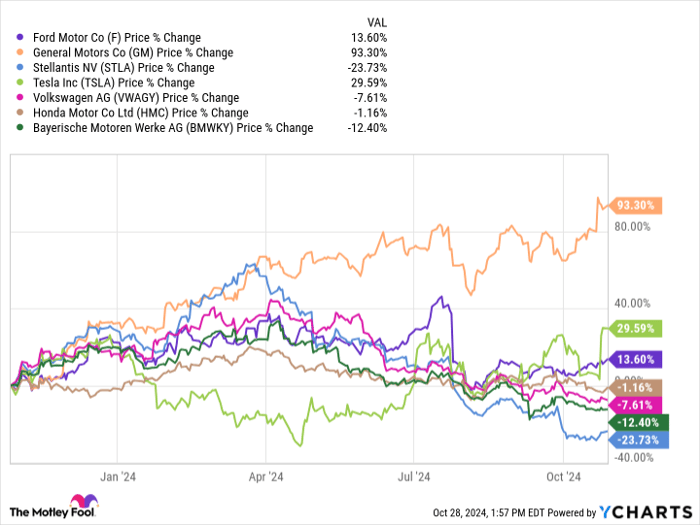

The graph below highlights GM’s impressive stock performance compared to its competitors this year.

F data by YCharts.

Despite its current success in 2024, GM’s Cruise operations—focusing on robotaxis and self-driving vehicles—have not garnered much investor interest. However, the technology behind Cruise holds significant financial promise.

A report from the Oliver Wyman Forum estimates that the global market for advanced driver-assistance systems could soar to $307 billion by 2035, an increase from just $1.7 billion in 2023. Furthermore, revenue from digital automotive services is projected to grow 25% each year for the next decade, potentially reaching $610 billion by 2035, compared to $42 billion in 2023. The report covers a range of services, including car-as-a-service and micromobility.

These optimistic projections are encouraging, but more tangible benefits await investors: improved profit margins. With the integration of advanced technologies, driver assistance software, and subscription offerings, automakers can significantly enhance their profit margins.

Andreas Nienhaus, a partner at Oliver Wyman Forum, emphasized to Automotive News that manufacturers focusing on software and subscription services can reap substantial economies of scale:

“The more people who use this will provide [automakers] with more data … and also just give [them] margin. You don’t have a lot of hardware connected to it because it is built in the vehicle already.”

Evidence of Potential

Current market trends may already illustrate this potential, particularly through Ford’s commercial business. Management has noted that commercial clients tend to embrace software upgrades and subscription services more than general consumers.

Ford Blue, its traditional segment, generated $2 billion in earnings before interest and taxes (EBIT) during the first half of 2024, achieving a 4.3% margin. In contrast, Ford Pro, focused on commercial clients, witnessed a 35% increase in subscriptions to its software during the second quarter and reported $5.6 billion in EBIT with a much healthier 15.9% margin.

While various factors contribute to Ford Pro’s impressive profits and margins, subscription services and upgrades play a critical role, especially with margins approaching 16% EBIT.

Future Outlook

So far, some investors regard Cruise as more of a distraction and an expensive venture. Nonetheless, GM has resumed its operations in the U.S. market with a limited fleet of vehicles in Arizona since April, following a temporary setback after one of its self-driving cars was involved in a pedestrian accident in San Francisco. After this incident, Cruise’s management underwent significant changes prioritizing safety.

It may seem ambitious, but there’s a chance that in 10 to 20 years, Cruise could become GM’s most valuable asset. While robotaxis may not dominate the roads, the related technology—including software and driver assistance—will likely hold considerable value.

Seize the Investment Opportunity

Have you ever felt like you missed out on investing in successful companies? You might want to pay attention now.

Our team of analysts occasionally identifies “Double Down” stock recommendations for companies poised for significant growth. If you’re worried you’ve missed your chance, this might be the perfect moment to invest. The data speaks volumes:

- Amazon: $1,000 invested in 2010 would now be worth $20,993!*

- Apple: $1,000 invested in 2008 would now be worth $42,736!*

- Netflix: $1,000 invested in 2004 would now be worth $407,720!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, with opportunities like this hard to come by.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.