“`html

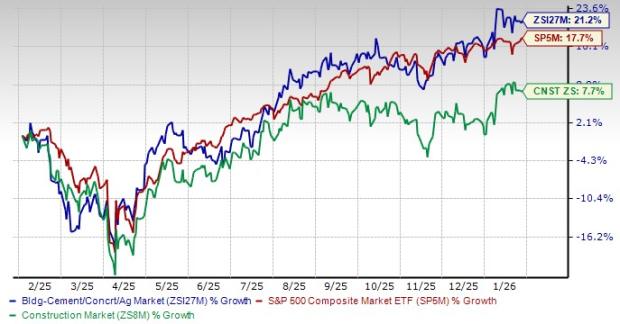

Rio Tinto’s stock has gained only 1% over the past year, significantly lagging behind the S&P 500’s 14% increase. The company, valued at over $100 billion, primarily generates revenue from iron ore, which may limit its growth potential compared to emerging sectors. A significant breakthrough in lithium production could potentially revitalize Rio’s stock performance as global demand for lithium increases with the rise of electric vehicles (EVs).

Currently, Rio Tinto trades at a trailing P/E ratio of approximately 8.5, well below its 13-year median of 10 and the 13-14 range of industry peers. If Rio successfully expands its lithium production, it could become a vital player in the clean energy market, which may lead to higher profit margins and valuation multiples.

The company’s existing capital, infrastructure, and strategic positions in regions like Serbia and Argentina position it well to capitalize on the growing lithium market. Transforming into a leading supplier of clean energy materials could significantly enhance its stock valuation.

“`