CNO Financial Group, Inc. is currently positioned for success with a concoction of higher insurance policy income, new product launches, strategic acquisitions, and robust partnerships, all simmering in a pot of commendable financial strength.

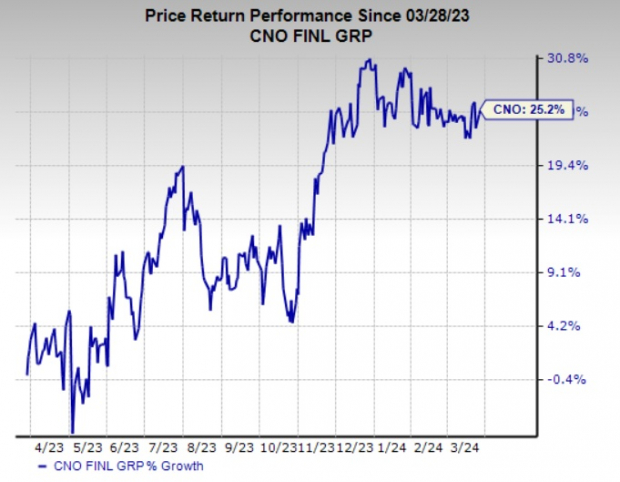

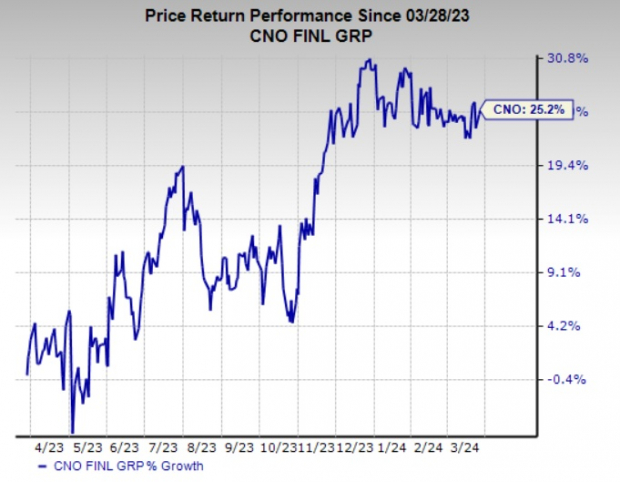

Zacks Rank & Price Performance

Bearing a Zacks Rank #1 (Strong Buy), CNO Financial has seen its stock price bloom by a significant 25.2% over the past year.

Image Source: Zacks Investment Research

Favorable Style Score

Boasting an exceptional Value Score of A, CNO Financial stands out as an undervalued gem in the market, offering investors a rare opportunity for exponential growth.

Robust Growth Prospects

Based on the Zacks Consensus Estimate, CNO Financial’s future shines bright with projected earnings of $3.17 per share for 2024, showcasing a 2.6% growth from the previous year. Looking further ahead, 2025 estimates predict earnings of $3.40 per share, reflecting a healthy 7.2% improvement.

Decent Earnings Surprise History

CNO Financial has pleasantly surprised investors, beating earnings estimates in two of the last four quarters with an average positive deviation of 3.62%.

Solid Return on Equity

With a current Return on Equity of 17.5%, surpassing the industry average of 13.3%, CNO Financial demonstrates adeptness in efficiently utilizing shareholder funds to drive profitability.

Key Business Tailwinds

CNO Financial’s forte lies in its diversified product portfolio spanning annuity, health, and life insurance products, providing a stable revenue stream akin to a well-nurtured garden yielding bountiful fruits. The company’s innovative offerings such as the “premium bonus” product have the potential to attract a growing customer base.

The insurer’s strategic initiatives involving acquisitions, partnerships, and technological advancements ensure it stays ahead in the race, expanding its footprint while enhancing customer outreach and operational efficiency.

Furthermore, the company’s robust cash reserves and cash-generating capabilities set the stage for future growth, enabling CNO Financial to reward shareholders through dividend payments and share repurchases.

Other Stocks to Consider

In the insurance realm, some notable contenders include Horace Mann Educators Corporation (HMN), Palomar Holdings, Inc. (PLMR), and HCI Group, Inc. (HCI), each carrying a Zacks Rank of 1. These companies exhibit similar growth trajectories, showcasing potential for substantial returns in the future.

For over three decades, Zacks Investment Research has been curating a list of elite stocks. These top picks, including CNO Financial, have consistently outperformed the market, offering investors a shiny pot of gold at the end of the rainbow.