Driving the defense against the relentless surge of automated bot attacks, Fastly has propelled its cybersecurity portfolio to new heights with the unveiling of Fastly Bot Management. This cutting-edge solution stands as a testament to Fastly’s unwavering commitment to fortify online security amidst escalating risks of fraud, DDoS assaults, and account infiltrations.

The unveiling of Fastly Bot Management represents a significant milestone in the realm of cybersecurity, extending the prowess of its next-gen Web Application Firewall (WAF) capabilities to safeguard websites, applications, and invaluable digital assets.

Operating at the Network Edge, Fastly Bot Management swiftly discerns between benign and malevolent bots, offering an array of server-side and client-side mitigation tactics. Characterized by its user-friendly interface, developer-centric design, and seamless integration with the robust Fastly Edge Cloud Platform, this solution is tailor-made for modern development teams.

Empowering Customers

Fastly Bot Management ushers in a new era of fortified digital defenses, ushering in reduced instances of fraud and resource abuse, an enhanced client experience, and streamlined bot mitigation, application security, and delivery services – all encapsulated within a singular, intuitive interface.

Fastly’s Strategic Evolution

This Prodigal Son of the cybersecurity landscape, Fastly, has taken a prodigious leap with the introduction of Fastly Bot Management, revolutionizing edge-based protection against automated bot onslaughts, aiming to fortify the security posture of organizations on a global scale.

As of the fourth quarter of 2023, FSLY witnessed a surge in demand for its cybersecurity solutions, catalyzed by the revelation of the annual global cybersecurity magnum opus, The Race to Adapt, shedding light on the predilection of 76% of surveyed enterprises to ramp up their cybersecurity budgets in the forthcoming year.

Additionally, Fastly unfurled a bouquet of novel features for its next-gen WAF solution, enhancing performance and user experience with a melange of offerings including Hashicorp Vault Integration, Agent Auto-Update, WAF Simulator, New Anomaly Signal: Out-of-Band Domain, and Simplified Attack Signal Thresholds.

In the quest for operational excellence, Fastly’s exclusive Private Network Interconnects (PNIs) and strategic alliances with tech behemoths such as Alphabet’s Google Cloud Platform and Amazon’s AWS play a pivotal role in expunging or minimizing exorbitant fees, boosting security, and ameliorating overall performance

Integration with the Google Cloud Platform paves the way for seamless streaming of real-time logs to any Google Cloud Platform big data service like Google Cloud Storage, BigQuery, and Bigtable – fostering a paradigm shift in digital operations.

Similarly, integration with Amazon’s AWS augments cloud services with enhanced delivery and security features, propelling digital transformation initiatives through cutting-edge edge cloud solutions.

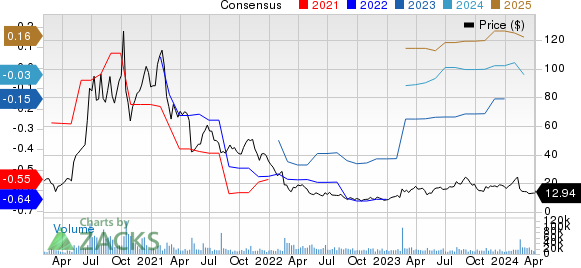

For the first quarter of 2024, Fastly anticipates revenues in the range of $131-$135 million – a trajectory signaling a 13.21% year-over-year growth, as per the Zacks Consensus Estimate.

The Zacks Consensus Estimate for earnings indicate a drop of 7 cents per share, remaining unaltered in the past 30 days.

An Outlook on Rankings and Options

Fastly currently holds a Zacks Rank #3 (Hold) in the cybersecurity domain, indicative of a poised position amidst the ever-evolving threat landscape.

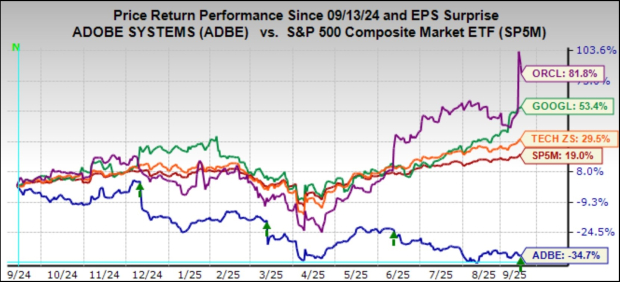

While Fastly shares have witnessed a 27.3% downturn in the year-to-date period, the broader Computer & Technology sector has experienced a noteworthy ascent of 12.2%.

In the expansive tech domain, a glimmer of hope shines upon Bill Holdings, rated Zacks Rank #1 (Strong Buy). Despite a 21.8% decline in stock value year-to-date, BILL’s long-term earnings growth rate lingers at a promising 23.64%.

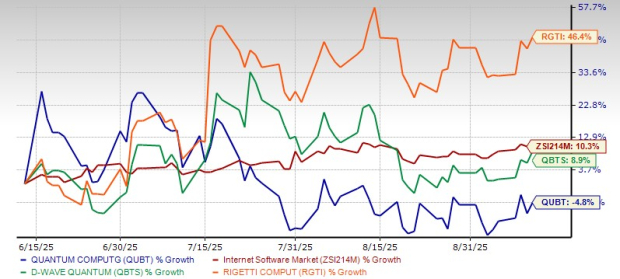

Dive Deeper into the Semiconductor Realm

Amidst a burgeoning semiconductor landscape, explore a shining star poised to outshine even the likes of NVIDIA, offering vast potential for exponential growth amidst the insatiable hunger for Artificial Intelligence, Machine Learning, and the Internet of Things.

As global semiconductor manufacturing propels from $452 billion in 2021 to a projected $803 billion by 2028, seize the opportunity to delve into this compelling domain in collaboration with top-tier experts.

Discover This Gem Now, Free of Charge >>

Uncover More at Zacks Investment Research

Opinions conveyed in this narrative are those of the author and are not necessarily a reflection of sentiments held by Nasdaq, Inc.