Analysts Project Growth for FCOM ETF and Key Holdings

In a detailed analysis of ETFs under our coverage at ETF Channel, we evaluated the trading prices of individual holdings and compared them to the average 12-month price targets set by analysts. For the Fidelity MSCI Communication Services Index ETF (Symbol: FCOM), the implied analyst target price stands at $66.99 per unit.

Current Trading Data and Potential Gains

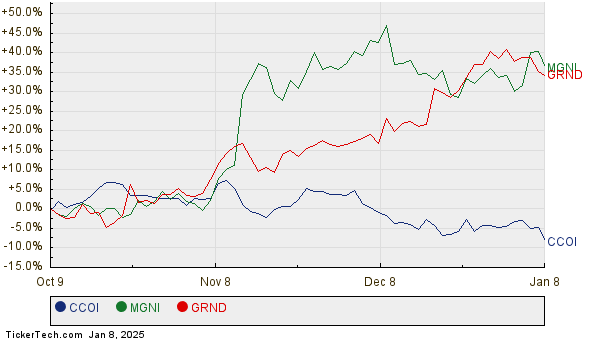

Currently, FCOM is trading around $59.96 per unit, suggesting an upside potential of 11.72% based on analysts’ forecasts for its underlying holdings. Several companies within the ETF are particularly noteworthy in terms of their optimistic analyst targets. Cogent Communications Holdings, Inc. (Symbol: CCOI) recently traded at $72.44 per share, but analysts project a target price of $82.73, indicating a 14.20% upside. Magnite Inc (Symbol: MGNI) is also in a favorable position, with an average target of $18.81, which is 13.16% above its current price of $16.62. Additionally, Grindr Inc (Symbol: GRND) has an analyst target of $19.50, 12.46% higher than its current price of $17.34. The chart below illustrates the 12-month price performance of CCOI, MGNI, and GRND:

Summary of Analyst Targets

The table below summarizes the analyst target prices and upside potential for the highlighted stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Communication Services Index ETF | FCOM | $59.96 | $66.99 | 11.72% |

| Cogent Communications Holdings, Inc. | CCOI | $72.44 | $82.73 | 14.20% |

| Magnite Inc | MGNI | $16.62 | $18.81 | 13.16% |

| Grindr Inc | GRND | $17.34 | $19.50 | 12.46% |

Evaluating Analyst Optimism

Are analysts justified in their target prices for these companies? This question invites investors to consider whether the optimism reflected in target prices is realistic, especially in light of recent developments within specific companies and the broader industry. While high price targets can signal a positive outlook, they may also lead to adjustments if expectations are not met. Investors are encouraged to conduct thorough research to form their own conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• APLS Videos

• IPOB Options Chain

• DCPH Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.