Market Uncertainty Brought on by AI Developments and Upcoming Earnings

The last trading week of January is shaping up to be a volatile one.

Investors faced a severe sell-off on Monday, spurred by concerns regarding Chinese startup DeepSeek that challenged confidence in US AI leadership. However, tech stocks rebounded strongly on Tuesday, nearly recovering from the decline.

While outside events can impact portfolio performance in the short term, historical trends show that investors who buy and hold strong companies usually see positive results over time. Nevertheless, it is essential to recognize that nothing is certain. Stocks can swing significantly—both up and down—within a brief timeframe. Regardless of bull or bear markets, volatility remains a constant factor that we must accept and incorporate into our investment strategies.

There is no doubt that some sectors of the market are primed for a pause. Yet, the recent bull rally largely hinges on solid fundamentals, especially rising earnings estimates, which our research indicates as the most considerable influence on stock prices. Over the long run, stock performance typically aligns with corporate earnings shifts.

Federal Reserve Keeps Rates Steady

The members of the Federal Open Market Committee (FOMC) are finalizing their two-day policy meeting on Wednesday. They are expected to keep the policy target rate unchanged, ranging between 4.25% and 4.5%. As of today, there is about a 98% likelihood that officials will retain this status quo.

Unless there is an unexpected shift in the Fed’s dot plot, the market is likely to concentrate on upcoming earnings announcements.

The Nasdaq Composite displayed strength yesterday, regaining a vital technical level ahead of a wave of key reports. With quarterly results from major tech companies leading the headlines this week, attention will center on future profit guidance, particularly for AI-related projects.

Four of the ‘Mag 7’ stocks, including Microsoft, Tesla, Meta Platforms (parent company of Facebook), and Apple, are set to announce their quarterly earnings in the next few days. Analysts predict that the Mag 7 will achieve an overall earnings growth of 20.9% from last year, paired with a 12.2% increase in revenues.

Seasonal Trends in the Stock Market

The stock market often shows seasonal trends, with specific months being more bullish than others. For instance, January lies at the midpoint of the more favorable six-month stretch, which spans from November through April.

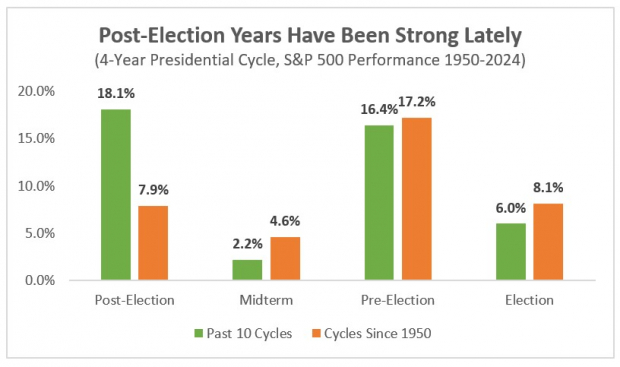

The four-year Presidential Cycle theory suggests that the stock market follows a predictable pattern linked to a president’s term. Historically, post-election years like 2025 yield modest returns, based on data since 1950.

However, an examination of more recent cycles suggests that investors should pay close attention to the first year under a new president. Remarkably, post-election years have seen a strong average return of 18.1% since 1985, succeeding in nine of the past ten occurrences:

Image Source: Zacks Investment Research. Data via Carson Group.

As always, while historical patterns provide insights, they are not guarantees. Investors must maintain adaptability and an impartial approach.

Key Stocks to Monitor During Q4 Earnings Season

The earlier sell-off indicated some sector rotation, as investors took profits in tech stocks and shifted to recently breaking-out areas like health care. This behavior is typical and may signal the sustainability of the current bull market.

Some tech firms defied the trend on Monday. Investors should watch for stocks that can withstand volatility and continue attracting buying pressure, as these are likely to be the ones that rise to new highs once market conditions stabilize.

Cybersecurity stocks have gained considerable traction recently. For instance, Cloudflare (NET) has hit 52-week highs following an upgrade from analysts at Goldman Sachs last week.

Part of the Zacks Internet – Software industry group, which ranks in the top 18% of Zacks Ranked Industries, Cloudflare has a strong history of exceeding earnings estimates and is set to report its quarterly results next week.

With a Zacks Rank #2 (Buy), NET stock has outperformed the market over the past year, boasting a nearly 75% return:

Image Source: StockCharts

Meta Platforms (META) also showed resilience, closing positively on Monday. Known for being the largest social media platform, Meta is expected to announce its fourth-quarter results tonight after the market close. Analysts forecast a profit of $6.90 per share, reflecting a growth of 29.5% compared to last year.

Having surpassed earnings estimates in each of the last eight quarters, the stock is currently rated as Zacks Rank #3 (Hold). It has surged to all-time highs as it gains traction ahead of the earnings report, accumulating over 70% in gains from the previous year:

Image Source: StockCharts

Insights from the Zacks Earnings Model

The Zacks Earnings ESP (Expected Surprise Prediction) aims to identify companies that have recently seen positive revisions in earnings estimates. This updated information typically serves as a better predictor for future earnings, providing investors with an advantage during earnings season.

This method has proved effective in spotting positive earnings surprises. In fact, when a stock combines a Zacks Rank #3 or better with a positive Earnings ESP, the likelihood of an earnings surprise is about 70%, based on our ten-year analysis.

Currently, Meta Platforms, rated Zacks Rank #3 (Hold), has a +6.74% Earnings ESP. A positive surprise may be on the horizon when the company reports its Q4 results on Wednesday evening.

Conclusion

Both historical and seasonal analysis suggest that we should remain open to better-than-expected outcomes in this post-election year.

However, navigating uncertainty is always challenging. Even the sturdiest bull markets face volatility.

Keep a close watch on leading stocks as we transition further into the fourth-quarter earnings season.

7 Best Stocks for the Next 30 Days

Our experts have narrowed down a list of 7 elite stocks from 220 Zacks Rank #1 Strong Buys, specifically identified as winners poised for early price increases.

Since 1988, this comprehensive list has outperformed the market by more than two times, achieving an average gain of +24.3% per year. Therefore, it’s crucial to pay attention to these carefully chosen stocks.

Want to keep up with the latest recommendations from Zacks Investment Research? You can download our list of the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Cloudflare, Inc. (NET): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.