Mar 20 marked the latest FOMC meeting where the Fed chose to maintain the benchmark lending rate between 5.25-5.5%. This steady range has held since July 2023, hitting a remarkable 23-year peak. Speculation has been rife in 2024 on when the central bank would make its first interest rate cut of the year.

Concerns had mounted among financial experts about the potential rate cut due to persistent inflation, bolstered by a robust labor market, rising wages, and strong consumer spending trends. However, to the relief of investors, the Fed reiterated its intent to enact the number of interest rate reductions foreshadowed during the December FOMC session.

The recently published Fed’s “dot-plot,” showcasing projections from 19 anonymous FOMC officials, projects the benchmark lending rate to fall to 4.625% by the end of 2024. The current mid-point of the Fed fund rate stands at 5.375%, indicating three anticipated 25 basis points rate cuts.

Fed Chairman Jerome Powell, in his post-FOMC address, hinted at a potential policy shift. He remarked, “We believe that our policy rate is likely at its peak for this type of cycle, and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

After the March FOMC decision, the CME FedWatch tool indicated a 75% probability of the first rate cut happening during the June FOMC meeting. This probability had stood at 60% just before Powell’s post-FOMC announcement.

In the aftermath, Wall Street basked in fresh highs. The S&P 500 soared, reaching 5,224.62 and hitting an all-time high of 5,226.19. The Dow Jones notched up an all-time peak of 39,529.13 and a closing high of 39,512.13. The Nasdaq Composite surged to a new apex at 16,369.41.

Tech Sector Growth Prospects

Despite lofty valuations, the tech sector is primed for further acceleration in 2024 as lower interest rates typically fuel growth stocks like those in technology. Investing in such stocks can lead to wealth accumulation over the long haul.

A reduction in market interest rates will shrink the discount rate, thereby augmenting the net present value of investments. Additionally, many tech firms rely on credit sources for business expansion.

The tech surge since 2023’s outset was spearheaded by a robust push towards artificial intelligence (AI), notably generative AI. The widespread adoption of digital tools and the internet globally during lockdowns spurred considerable AI uptake.

The realm of AI in the U.S. and international markets is poised for further growth, promising substantial business prospects for tech firms crafting top-tier products.

Our Standout Selections

Our quest narrows down to five tech giants (with market cap exceeding $35 billion) boasting double-digit YTD returns. These firms flaunt a robust business framework, financial stability, and globally recognized brand prowess.

These chosen stocks exhibit significant growth potential for 2024 and have garnered positive earnings forecast revisions in the last 30 days. Not to mention, each pick carries a Zacks Rank #1 (Strong Buy). A comprehensive roster of all the latest Zacks #1 Rank stocks can be perused here.

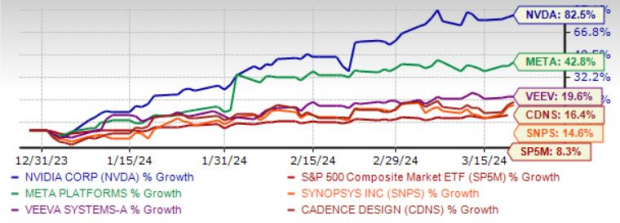

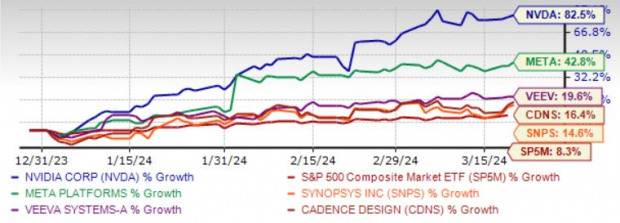

The chart below delineates the year-to-date price performance of our chosen quintet.

Image Source: Zacks Investment Research

NVIDIA Corp. is riding high on Compute & Networking revenues, buoyed by the thriving AI landscape and accelerated computing. The data center sphere stands poised for growth with the rising demand for generative AI and large language models utilizing NVIDIA’s Hopper and Ampere architectures.

Hyperscale demand spikes and increased sell-ins to partners across Gaming and ProViz end markets, post-channel inventory normalization, are bolstering NVDA. Collaborations with Mercedes-Benz and Audi are slated to bolster NVDA’s footprint in autonomous vehicles and automotive electronics.

The Rising Stars of Tech: SNPS and CDNS Shine Bright in the Digital Constellation

Riding the Wave of Innovation

The tech industry is ablaze with excitement as companies like Synopsys Inc. (SNPS) and Cadence Design Systems Inc. (CDNS) continue to carve their path through the digital landscape. With the relentless march of technology, both SNPS and CDNS have found themselves at the forefront of a revolution ushered in by cutting-edge trends like artificial intelligence, 5G, and the Internet of Things.

SNPS: Pioneering the Future

Synopsys Inc. (SNPS) is not just another tech company; it is a pioneer in the realm of design, IP, and security solutions. Boasting an expected revenue growth rate of 13.2% and an earnings growth rate of 21.2% for the current year, SNPS is boldly venturing into uncharted territory. The Zacks Consensus Estimate for earnings has seen a 0.6% uptick over the past month, signaling a bullish trajectory for the company. It’s no surprise that the stock price of SNPS has soared 14.6% year to date, a testament to its solid performance and investor confidence.

CDNS: A Beacon of Growth

Meanwhile, Cadence Design Systems Inc. (CDNS) shines brightly in the tech firmament, fueled by robust customer demand and a strategic vision for the future. With a backlog of $6 billion and remaining performance obligations of $3.2 billion, CDNS is on a steady ascent. The company’s accelerated design activity, driven by transformative trends like generative AI and autonomous driving, is propelling its growth trajectory. The momentum in 3D-IC and chipset designs further cements CDNS’ position as a leader in the industry. Not to mention, its strong partnerships with tech giants like NVIDIA, Arm, and Intel are paving the way for even greater success.

Looking Toward the Horizon

Both SNPS and CDNS are poised for a stellar year ahead. With SNPS anticipating an impressive revenue growth rate of 12.2% and an earnings growth rate of 15.2% for the current year, the company is setting itself up for a period of sustained prosperity. The Zacks Consensus Estimate has seen a 1% uptick in earnings over the past month, reflecting the market’s bullish sentiment. CDNS, on the other hand, has seen its stock price appreciate by 16.4% year to date, a clear indicator of the company’s upward trajectory.

Embracing the Digital Revolution

As the tech sector hurtles forward into uncharted territory, companies like SNPS and CDNS stand out as beacons of innovation and growth. With a firm grasp on the pulse of the industry and a commitment to pushing the boundaries of what is possible, these companies are well-positioned to thrive in the ever-evolving tech landscape. Investors looking for promising opportunities in the tech sector would do well to keep a close eye on SNPS and CDNS as they navigate the digital frontier.