Declining Stock Value: FedEx Corporation FDX is experiencing a downward trend on Tuesday, following a significant announcement last December. The company revealed plans to separate its Freight Unit right after reporting earnings.

Understanding Stock Moves: The stock’s recent performance exemplifies what traders label as “bad action.” This term highlights adverse market reactions that can often signal underlying issues. Consequently, our team of technical analysts has designated FedEx as our Stock of the Day.

Market Reactions Explained: Unlike traditional metrics, “action” in the stock market cannot be easily quantified. For instance, when a company surpasses earnings expectations but sees its stock price decline, it represents “bad action.” Conversely, a stock can rise despite missing earnings, indicating “good action.”

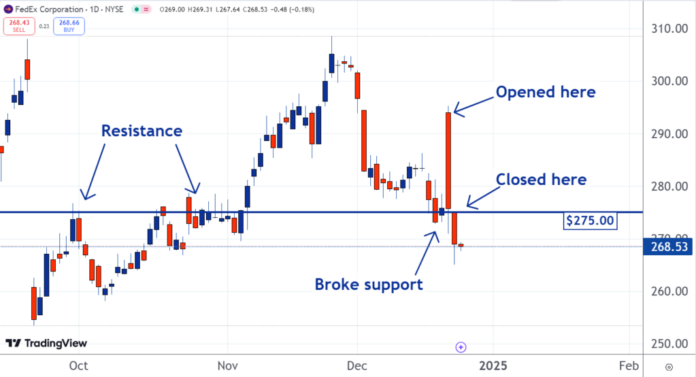

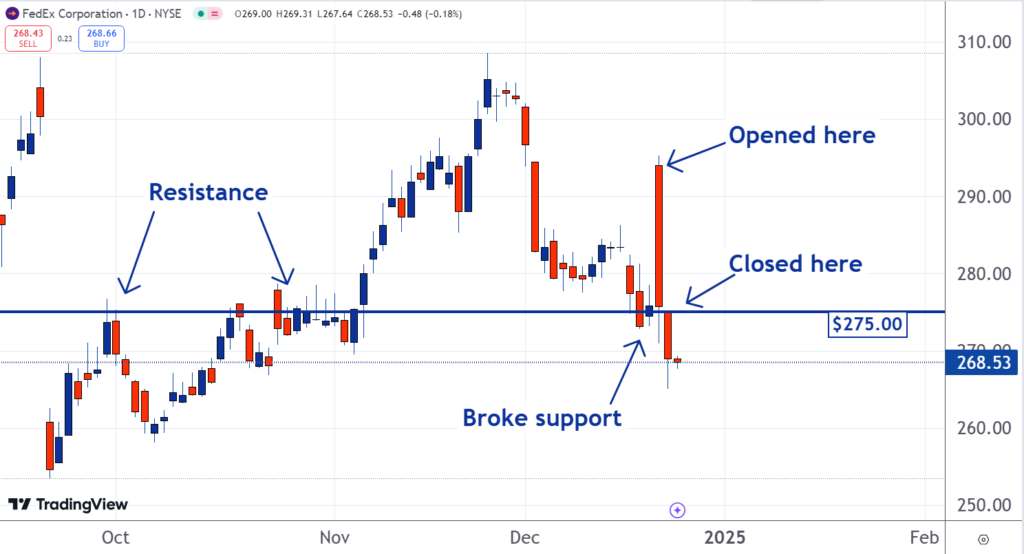

Initial Hopes Turned Sour: Following the earnings report on December 20, FedEx’s stock initially surged by about $20. Traders interpreted this as a positive signal. However, by the end of the trading day, selling pressure overtook buying momentum, leading to a complete reversal of gains, which indicated “weak action” and reinforced bearish sentiment.

Chart Analysis: The stock’s chart reveals that it breached key support at the $275 mark, further solidifying the notion of “bad action.” This breakdown reflects a significant shift in market dynamics.

Support Dynamics: Market behavior often sees support form at levels previously encountered as resistance. Investors who sold at these higher prices tend to regret their decisions once the price rebounds. Consequently, they may place buy orders upon the stock returning to those levels.

However, during the recent dip to $275, sell orders overwhelmed buy orders, causing the support level to fail and resulting in further declines.

Looking Ahead: The absence of any notable rebound reinforces the bearish outlook. Typically, significant price drops are followed by at least a minor recovery. The lack of such movement suggests that buyers are hesitant, allowing sellers to dominate the market.

Forecast: Analysts suggest FedEx may continue its downward trajectory in the near term.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs