2024: A Stellar Year for U.S. Financial Stocks

U.S. financial stocks have thrived in 2024, achieving their best yearly return in nearly 30 years. This remarkable growth stems from the robust strength of the American economy and increased investor enthusiasm for deregulation following Donald Trump‘s election in November.

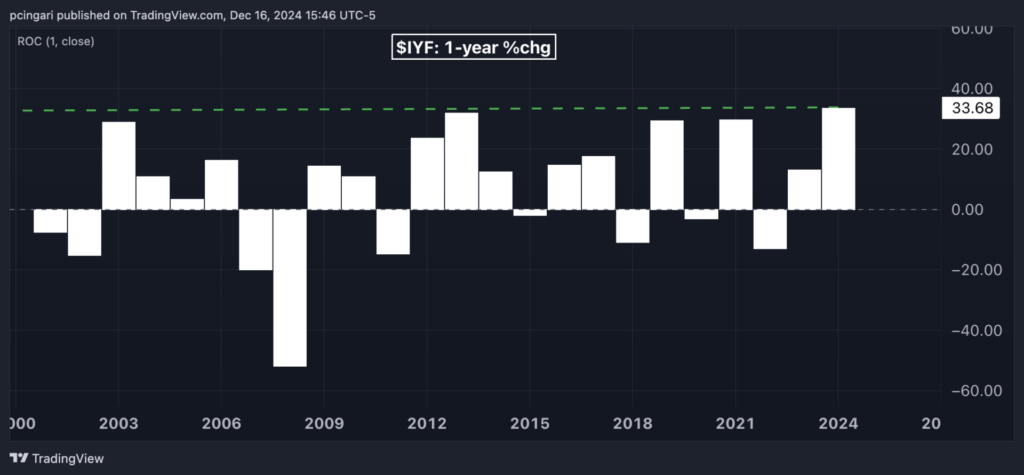

The iShares U.S. Financial ETF IYF has surged 34% year-to-date, marking its highest annual performance since its inception in 2001.

Other financial-focused ETFs also experienced considerable gains. The Financial Select Sector SPDR Fund XLF climbed 31.7%, the most substantial increase since 2013, while the Vanguard Financials ETF VFH rose 32.4%.

Chart: A Remarkable Year for Financial Stocks

Top Performers in the Financial Sector for 2024

This year has seen impressive performances from individual financial stocks. Here are the 10 best-performing financial equities of 2024 within the IYF ETF:

| Name | Price Chg. % (YTD) |

| Robinhood Markets, Inc. HOOD | 242.28% |

| Interactive Brokers Group, Inc. IBKR | 118.22% |

| Jefferies Financial Group Inc. JEF | 102.81% |

| Apollo Global Management, Inc. APO | 91.31% |

| KKR & Co. Inc. KKR | 88.71% |

| Coinbase Global, Inc. COIN | 81.72% |

| Virtu Financial, Inc. VIRT | 80.90% |

| Evercore Inc. EVR | 74.57% |

| SoFi Technologies, Inc. SOFI | 68.99% |

| Blue Owl Capital Inc. OWL | 66.88% |

Factors Driving Financial Stock Growth in 2024

The rise in financial stocks in 2024 was supported by a mix of strong economic growth, falling interest rates, and renewed interest in deregulation.

The U.S. economy showed considerable strength, with growth accelerating from 1.6% in Q1 to 3% in Q2, and stabilizing at 2.8% in Q3.

Recent surveys for December revealed private-sector activity expanding at its fastest pace since April 2022, particularly within the services sector—critical to the financial economy.

According to Bank of America’s global economics team, “Pro-growth policies like deregulation of financial services and energy, along with lower taxes, are enhancing market sentiment and asset prices.”

A significant factor was the de-inversion of the U.S. yield curve. The Federal Reserve’s lowering of interest rates, combined with steady economic growth and manageable inflation, shifted the gap between short- and long-term Treasury yields. This allowed banks to borrow at lower short-term rates while lending at higher long-term rates, enhancing their net interest margins and profitability.

For instance, although mortgage rates remain high due to connections with longer Treasury yields, there have been declines in overall interest rates.

LPL Financial noted, “Economic growth data has been better than expected lately, pushing Treasury yields higher while reducing the need for aggressive rate cuts by the Fed.”

Looking Ahead: Financial Stocks in 2025

As 2025 approaches, Wall Street anticipates continued support for the financial sector, especially from deregulation. Bank of America predicts a widespread deregulatory effort benefiting both energy and financial services. This could ease credit constraints and stabilize the banking system, particularly amidst the rapid growth of private lending, which remains largely unregulated.

Goldman Sachs analyst Richard Ramsden expresses optimism about large-cap banks, emphasizing stable consumer spending and strong corporate balance sheets as key drivers. “These factors support a positive outlook,” Ramsden mentioned recently.

Despite optimism, regional banks are cautious regarding loan growth, with many anticipating a rebound in early to mid-2025. Even though client sentiment has improved post-election, it hasn’t yet resulted in increased lending activities.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs