Alphabet’s Ambitious Path to Growth: Exploring New Opportunities

A Deep Dive into Google’s Business Landscape

Alphabet (GOOGL) is best known for its dominance in the search engine market, commanding 94% of global market share. Although the stock has struggled to gain upward momentum due to its substantial valuation—approximately $2.4 trillion—Google remains one of the most innovative companies worldwide. Its efforts, however, extend far beyond search, as it explores new business avenues to invigorate growth.

The Drive for Innovation: Google’s Future Growth

Despite Google’s stronghold in search and its prominent YouTube platform, investors are keenly looking for emerging growth sectors that could propel earnings higher. The public knows quite well about Google’s existing businesses, and the stock’s performance reflects that. Instead of resting on its laurels, Google is actively pursuing fresh avenues for growth.

Exploring Five Key Growth Drivers for Google

This article highlights five exciting areas that could enhance Google’s earnings prospects and boost its stock value in the future:

Waymo: A Leap into Autonomous Vehicles

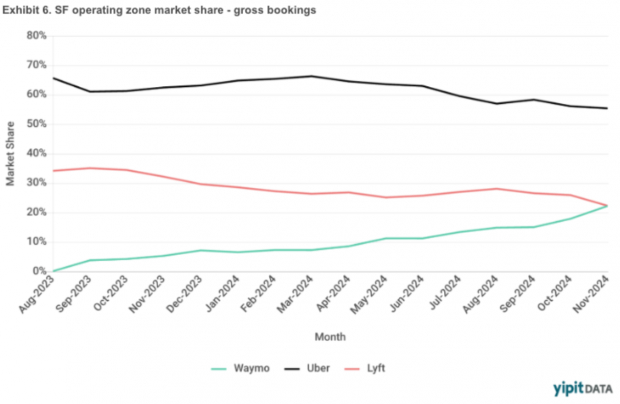

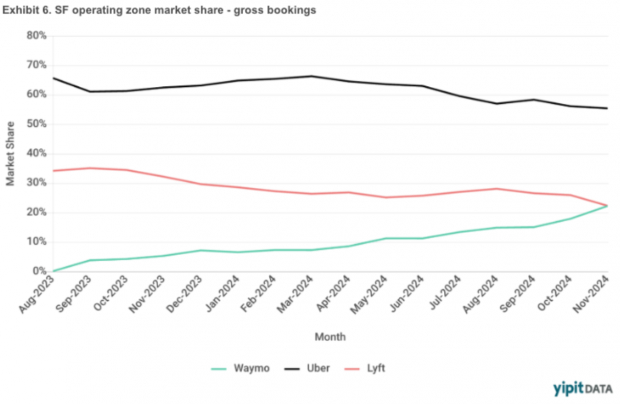

Waymo, Google’s venture into autonomous taxi services, recently expanded to several cities, including San Francisco. Since its launch in August 2023, ride-hailing giants Uber (UBER) and Lyft (LYFT) held a combined 100% market share. Fast forward a year, Waymo now holds around 22% of the rideshare market within its operating zones.

Image Source: Yipit Data

Waymo’s rapid progress alongside the declining stock prices of Lyft and Uber reveals a potential disruption to the rideshare market by both Google and Tesla (TSLA). Factors suggest such a shift could occur over the next five years.

Willow: A Breakthrough in Quantum Computing

Recently, Google introduced its innovative “Willow” quantum computing chip. In an impressive demonstration, Willow completed a computation in just five minutes that would reportedly take one of the fastest supercomputers 10 septillion years to accomplish.

To put that into perspective, that number is written out as:

10,000,000,000,000,000,000,000,000!

Gemini Generative AI: Advances in Artificial Intelligence

Alphabet’s journey into generative AI initially faced hurdles with inaccuracies in its large language model (LLM). Nevertheless, Google’s talented team has worked diligently to resolve these issues, rolling out new features like image capabilities, coding support, and app integration. While the AI market remains competitive, Google benefits from its significant cash reserves, advanced technology, and integration possibilities with its other products, such as Android.

Google Cloud: A Growing Power in Cloud Computing

Google Cloud is steadily increasing its market share, supported by strong performance from its Google Cloud and Workspace platforms. In the third quarter, Google Cloud generated revenues of $11.35 billion, reflecting a 28.8% year-over-year increase. Drawing parallels with Amazon (AMZN) Web Services (AWS), many investors may find excitement in Google Cloud’s developing contribution to overall business revenues.

Google Nest: A Smart Home Innovator

In the burgeoning smart home sector, Google is capturing market share with its Nest product line, which includes smart speakers, displays, streaming devices, thermostats, smoke detectors, routers, doorbells, and locks. Nest showcases another instance of Google’s ability to leverage existing products while adapting to new AI technologies, likely leading to increased sales as consumer interaction evolves.

Technical Outlook: GOOGL on the Rise

The trajectory of Google’s innovations is exemplified in the performance of its stock. GOOGL shares are breaking through a prolonged multi-month consolidation phase, with analysts suggesting that the stock may reach $250 by 2025, based on Fibonacci extensions.

Image Source: TradingView

Google’s Future: A Powerhouse Ready for Growth

Google remains a leader in the tech industry. While it dominates the search market, its expansion into high-growth sectors could attract significant investor interest through 2025 and beyond.

Top 7 Stocks to Watch This Month

Experts have recently identified 7 standout stocks from a pool of 220 Zacks Rank #1 Strong Buys. These companies are considered the “Most Likely for Early Price Pops.”

Since its inception in 1988, this stock list has outperformed the market, doubling expectations with an impressive average annual gain of +24.1%. Don’t miss out on these carefully selected stocks.

Looking for the latest stock recommendations? Download 5 Stocks Set to Double for free today.

- Amazon.com, Inc. (AMZN): Free Stock Analysis Report

- Tesla, Inc. (TSLA): Free Stock Analysis Report

- Alphabet Inc. (GOOGL): Free Stock Analysis Report

- Lyft, Inc. (LYFT): Free Stock Analysis Report

- Uber Technologies, Inc. (UBER): Free Stock Analysis Report

Read more about Google’s growth potential on Zacks.com.

The views expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.