Five9’s Impending Q4 2024 Earnings Report: What to Expect

Five9 (FIVN) is set to unveil its fourth-quarter 2024 earnings results this Thursday, creating anticipation among investors.

Revenue and Earnings Projections

The company forecasts fourth-quarter revenues between $267 million and $268 million. The Zacks Consensus Estimate stands at $267.49 million, reflecting an 11.89% increase from the same period last year.

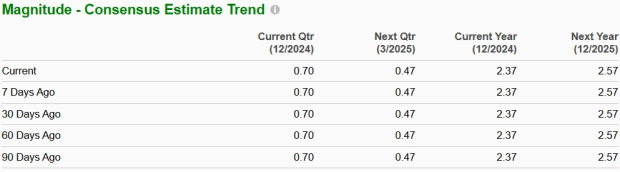

Expected non-GAAP net income per share falls within the range of 69 to 71 cents. The consensus estimate for earnings is currently 70 cents per share, which indicates a year-over-year growth of 14.75%. Notably, this figure has stayed constant over the last month.

Image Source: Zacks Investment Research

Stay updated with earnings estimates and surprises on Zacks Earnings Calendar.

Five9’s Historical Performance

Five9 has a strong reputation for earnings surprises. In its last reported quarter, the company posted an earnings surprise of 15.52%. Impressively, it has exceeded the Zacks Consensus Estimate in all of the last four quarters, with an average surprise of 22.46%.

Analyzing FIVN’s Earnings Whispers

The current data does not confidently predict an earnings beat for Five9 this time. A successful earnings outcome typically requires a positive Earnings ESP along with a Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold)—neither of which are in place at the moment. Five9 currently has an Earnings ESP of 0.00% and a Zacks Rank of 2. For a complete list of today’s top Zacks Rank stocks, you can check here.

What to Watch for in the Upcoming Report

Five9 enters this earnings report with several strengths in play. Its expanded artificial intelligence (AI) functions and solid growth in subscription revenue offer promising momentum. In the third quarter of 2024, subscription revenues surged 20% year-over-year, signaling robust business fundamentals.

The company’s initiatives in AI have gained traction, as AI products accounted for over 20% of new customer Annual Contract Value bookings in the previous quarter. Deals featuring AI components were approximately five times larger than those without, and AI was a defining element in all contracts exceeding $1 million in Annual Recurring Revenue (ARR). This trend is likely to persist due to new AI offerings and increased enterprise adoption.

Additionally, Five9’s acquisition of Acqueon, which had minimal impact in the last quarter, is expected to influence the upcoming results positively as integration advances. This acquisition enhances Five9’s omnichannel capabilities and broadens its market presence, especially in healthcare thanks to Epic integration. Enterprise customer gains remain strong, with record new logo turn-ups in the last quarter. The segment of customers with over $1 million in ARR, which constitutes about 56% of subscription revenues, increased by 29% year-over-year—a trend likely to continue.

In the previous quarter, Five9 achieved an adjusted EBITDA margin of 20%, and managers anticipate further margin improvements. A solid operating cash flow of $41 million (16% of revenue) highlights the company’s growing efficiency, a trend expected to see continuity.

Nonetheless, competition within the Contact Center as a Service (CCaaS) space is intensifying, with established players like Twilio (TWLO), RingCentral (RNG), and Zoom (ZM) investing heavily in AI technologies. This fierce competition could pose challenges to growth rates and margins ahead of the earnings report.

Despite these considerations, Five9’s strategic focus in the evolving contact center landscape, bolstered by its AI capabilities and improving profitability indicators, offers an appealing investment case as it approaches its fourth-quarter earnings announcement.

Stock Valuation and Performance Analysis

Five9’s stock has dropped 44.8% over the last year, trailing behind the broader Zacks Computer and Technology sector, and underperforming against the S&P 500 index’s gains of 26.2% and 23.3%, respectively.

Performance Snapshot of FIVN Stock

Image Source: Zacks Investment Research

The trailing 12-month EV/EBITDA ratio for Five9 stands at 34.63x, which seems high compared to the Zacks Internet – Software industry average of 8.41x. However, several factors justify this premium valuation and support a buy recommendation, reflecting Five9’s strong positioning in a rapidly expanding cloud contact center market and its effective monetization of AI solutions.

Valuation Metrics for FIVN: An Overview

Image Source: Zacks Investment Research

Five9: A Strategic Investment Ahead of Q4 2024 Results

Why Five9 is Worth Considering

Five9 offers a strong investment potential as it approaches its fourth-quarter 2024 earnings report. The company operates in the fast-growing contact center-as-a-service (CCaaS) sector and has seen significant success with its artificial intelligence (AI) initiatives. Notably, more than 20% of new enterprise bookings incorporate AI products, with deals that feature AI components being five times larger than others. This underscores Five9’s technological advantages in a competitive market.

The company is also experiencing strong subscription revenue growth, boasting an impressive 20% increase year-over-year. Additionally, its EBITDA margins have expanded to 20%, highlighting robust financial health. The recent acquisition of Acqueon is anticipated to enhance Five9’s omnichannel capabilities, positioning the company favorably as the industry shifts toward cloud-based solutions.

Final Thoughts

As Five9 approaches its fourth-quarter earnings announcement, the company appears to be a solid investment option due to its growing subscription revenue, increased adoption of AI technologies, and strong enterprise engagement. With improving margins and seamless integration of its Acqueon acquisition, Five9 is well-prepared for future growth. Investors may want to consider adding FIVN to their portfolios at this time.

Unlock Insights for Just $1

Seriously!

In a surprising move several years ago, we offered our members a 30-day access to all our stock picks for only $1. There were no hidden fees or obligations afterwards.

Many took us up on this opportunity, while others were hesitant, thinking there was a catch. The truth is, we want you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which recorded 256 positions with double- and triple-digit gains in 2024 alone.

Ringcentral, Inc. (RNG): Free Stock Analysis Report

Five9, Inc. (FIVN): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

Zoom Communications, Inc. (ZM): Free Stock Analysis Report

To view the full article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.